A Guide to Commercial Property to Buy in Dubai

- Credence & Co

- Nov 12, 2025

- 17 min read

Updated: Nov 13, 2025

Commercial property Dubai

Finding the right commercial property to buy in Dubai is more than just a transaction; it's a strategic move that taps into one of the world's most dynamic economies. With investor-friendly policies and a constant influx of global businesses, key areas like Business Bay and Jumeirah Lake Towers have become magnets for smart capital seeking impressive returns.

Understanding Dubai's Commercial Real Estate Market

Before you even start looking at listings, you need to get a feel for the real-world forces shaping Dubai's commercial property scene. This isn't just about concrete and glass. It’s a living, breathing ecosystem powered by multinational giants setting up regional headquarters, local businesses scaling up, and a steady stream of global talent.

This creates a marketplace that’s both vibrant and fiercely competitive. A prime location here isn't just an address; it’s a strategic advantage. The first real step is figuring out why certain areas are in such high demand. Once you understand that, you’re on the right track. For a closer look at the latest trends, it's worth exploring the dynamic property market growth in Dubai.

What Fuels Market Demand

The desire for commercial property in Dubai isn't accidental. It's built on a foundation of powerful economic drivers. Think pro-business government policies, a tax-friendly structure, and infrastructure that’s second to none. Together, these create a powerful draw for companies and entrepreneurs worldwide.

This influx has a direct impact on the types of commercial assets in demand. For instance, as tech and finance firms flock to the city, we’ve seen a real crunch for Grade A office spaces in the main business hubs. At the same time, the e-commerce explosion has sent demand for modern warehouses and logistics hubs through the roof.

Here’s what’s really pushing the market:

Global Business Hub Status: Dubai’s position as a bridge between East and West makes it a non-negotiable base for firms with eyes on the Middle East, Africa, and Asia.

Government Initiatives: Programmes like the Golden Visa aren't just about residency; they encourage long-term investment and bring in skilled professionals who fuel business growth.

Sector-Specific Growth: Industries like tourism, technology, and logistics are booming, and each one needs specialised commercial spaces to operate.

Identifying Prime and Emerging Hotspots

Some districts in Dubai are already household names in the commercial world. Business Bay is the classic central business district, packed with high-end office towers and incredible connectivity. Jumeirah Lake Towers (JLT) offers a similar vibe but with a more mixed-use, community feel that attracts a wide variety of businesses.

The real secret is to look past the popular names and understand why a location works. It's about more than the address. It's about the supporting infrastructure, the access to a skilled workforce, and how well it connects to other business centres.

But don't just focus on the established giants. Emerging industrial areas like Dubai Industrial City are quickly becoming hot property. These zones are purpose-built for logistics and manufacturing, providing the kind of specialised infrastructure that modern supply chains depend on. A smart investor knows how to balance their portfolio between the proven prime locations and these high-potential developing zones.

If you really want to get under the hood of these market forces, this article offers an in-depth Dubai real estate market analysis for investors.

To give you a clearer picture, here's a quick snapshot of the current market performance.

Dubai Commercial Property Market at a Glance

The table below summarises the key performance indicators for Dubai's commercial real estate market, highlighting growth and dominant areas.

Metric | Value/Trend | Key Areas |

|---|---|---|

Total Transactions (H1) | AED 58.6 billion | Business Bay, JLT, DIFC |

Year-on-Year Growth | 38.4% increase | Across all major commercial zones |

Prime Office Demand | High demand for Grade A spaces | Downtown Dubai, Business Bay |

Industrial/Logistics | Surging demand for modern warehouses | Dubai Industrial City, JAFZA |

These numbers aren't just statistics; they paint a picture of a market with incredible momentum. A 38.4% year-on-year jump in transaction value to AED 58.6 billion in just the first half of the year shows a market brimming with confidence and opportunity.

Getting to Grips with the Legal Side of Things for Foreign Investors

Knowing the rules of the game is hands-down the most critical part of your investment journey. When you start looking for commercial property to buy in Dubai, you’re entering a market that’s very well-regulated, and that’s a good thing—it’s designed to protect everyone involved.

The legal landscape here is actually quite straightforward, but you have to know a few key distinctions to make a secure and profitable purchase. One of the biggest hurdles for newcomers is understanding the difference between freehold and leasehold zones. It’s not just legal jargon; it fundamentally defines your rights as an owner. Getting this right from the very beginning will save you from costly mistakes down the road.

Freehold vs. Leasehold: What You Actually Own

For most international investors, freehold zones are where the action is. When a property is in a designated freehold area, you own it—and the land it sits on—outright. Your name goes on the title deed, and you have 100% ownership. Simple as that. This gives you the total freedom to sell it, lease it out, or pass it on to your heirs.

You’ll find some of the best commercial freehold opportunities in places like:

Business Bay: The corporate heart of the city, packed with premium office towers.

Jumeirah Lake Towers (JLT): A vibrant community that’s a magnet for businesses, with a huge concentration of commercial buildings.

Downtown Dubai: Home to Dubai’s biggest landmarks, offering high-end retail and office spaces that command top dollar.

On the flip side, leasehold ownership means you’re buying the right to use a property for a very long time, typically up to 99 years. You own the building or unit for that period, but the land itself still belongs to the landlord. While it’s less common for new commercial investors, you might come across it in some of the older, more established parts of the city. Before you get too far down the road with any property, you must verify its designation.

The first question you should ask about any property is, "Is this in a freehold zone?" The answer completely changes your ownership rights and what you can do with your investment in the long term.

The Key Players Protecting Your Investment

Dubai’s property market doesn’t just run on its own. It’s overseen by some very powerful government bodies that ensure everything is transparent and fair. Getting to know who they are and what they do will give you a lot more confidence as you go through the buying process.

The two main organisations you'll deal with are the Dubai Land Department (DLD) and its regulatory arm, the Real Estate Regulatory Agency (RERA). Think of the DLD as the official record-keeper. It’s the government body responsible for registering all real estate transactions and legal documents. Every single step, from signing the initial agreement to the final title deed transfer, gets logged with the DLD.

RERA, meanwhile, is the market regulator. It sets the rules for how developers, brokers, and property managers must operate. RERA’s job is to protect investors by making sure every professional in the industry sticks to strict ethical and operational standards. Their oversight adds a crucial layer of security, especially if you’re new to the Dubai market.

Must-Know Legal Documents

As you get closer to making a deal, you'll start seeing some important legal paperwork. Knowing what these documents are for is essential to keep the process moving smoothly.

Sale and Purchase Agreement (SPA): This is the big one—the main, legally binding contract between you and the seller. It lays out every single detail of the sale: the price, the payment plan, the handover date, and the exact property specifications. It is absolutely crucial that you have a legal professional look over the SPA before you even think about signing it.

No Objection Certificate (NOC): This is a formal letter from the property developer confirming that they're okay with the sale. More importantly, it certifies that all the service charges and any other outstanding fees on the property have been paid in full. You cannot transfer ownership at the DLD without a valid NOC from the developer.

Choosing the Right Ownership Structure

Finally, you need to think about how you’re going to own the property legally. You can certainly buy it in your own name as an individual, but many savvy commercial investors set up a corporate structure instead.

One of the most popular and effective strategies is to own the property through a free zone company. This can give you some great advantages, like protecting you from personal liability and offering potential tax benefits. By setting up a company in a free zone like the Dubai Multi Commodities Centre (DMCC) or Jebel Ali Free Zone (JAFZA), the company itself owns the property. This creates a firewall between your personal assets and your business investment, which is a smart move for long-term financial security. It's always a good idea to chat with a legal advisor to figure out the best structure for your specific situation before you finalise the purchase.

How to Identify and Evaluate Prime Investment Opportunities

Once you're comfortable with the legal framework, the exciting part begins: finding the right asset. Spotting a prime commercial property to buy in Dubai is both an art and a science. It’s about having a feel for the market, backed by a sharp eye for detail. The real goal isn’t just to find a property that’s for sale; it's to uncover an opportunity with genuine, long-term potential.

This means you need to look past the glossy brochures and get into the weeds of what makes a particular property a sound investment. Different sectors tell different stories. For instance, premium office spaces in hubs like DIFC or Business Bay thrive on consistent corporate demand. Meanwhile, the city's e-commerce explosion is creating an almost insatiable need for modern warehouses in logistics zones like Dubai Industrial City.

Matching Property Type to Investment Goals

Before you even start browsing listings, you need to align your investment strategy with a specific property type. Each commercial category caters to a distinct market and carries its own set of risks and rewards. Getting this right from the outset will bring focus to your search and save you from chasing assets that don't match your goals.

To help you decide, here's a quick look at how different commercial property types in Dubai stack up.

Comparison of Commercial Property Types in Dubai

Property Type | Typical Locations | Key Demand Drivers | Investment Potential |

|---|---|---|---|

Office Space | Business Bay, DIFC, JLT | Corporate expansion, new business setups, demand for Grade A facilities. | Stable, long-term rental income from corporate tenants. High capital appreciation in prime districts. |

Retail Units | Dubai Mall, high-streets in Jumeirah, City Walk | High footfall, tourism, consumer spending, proximity to residential communities. | Potentially high rental yields, but success is heavily tied to location and economic conditions. |

Industrial/Logistics | Dubai Industrial City, Jebel Ali Free Zone (JAFZA) | E-commerce growth, import/export activity, manufacturing sector expansion. | Booming sector with strong, consistent demand for warehouses and light industrial units. |

Hospitality | Downtown Dubai, Dubai Marina, Palm Jumeirah | Tourism trends, major events (like exhibitions and conferences), luxury travel. | High-income potential, but sensitive to global travel trends and requires significant management. |

Thinking through these options helps you pinpoint where to focus your energy and capital for the best results. The market is showing incredible momentum right now. In the second quarter alone, commercial property sales soared to AED 31 billion, a massive 50% jump year-on-year. The office sector was a huge part of that story, with sales rocketing up by 93%.

Conducting a Practical Market Analysis

After you've settled on a sector, it's time to zoom in on specific locations. A proper market analysis is much more than just picking a "popular" area. It's about digging into the micro-factors that will ultimately dictate a property's future value and rental appeal.

Sure, location is everything, but what a "good location" means is completely different for a warehouse than for a retail shop. For an office, it's all about being near metro stations and major highways. For a warehouse, it’s about seamless access to ports and arterial roads. You should also be looking at what’s happening around your potential property. Is new infrastructure being built? Are big-name companies moving into the neighbourhood? These are powerful signals of future growth.

A property's true value is often hidden in its surroundings. The quality of neighbouring tenants, upcoming transport links, and local zoning plans can tell you more about its long-term potential than the building itself.

Your Essential Property Evaluation Checklist

When you've found a property that looks promising on paper, it's time to put it under the microscope. This is where you move beyond the asking price and really understand the asset’s operational and financial health. A detailed financial model is your best friend here; for a solid framework, you can learn more about applying an income-based valuation to accurately project your returns.

Here’s a practical checklist to guide you through the nitty-gritty:

Tenant Quality and Lease Structure: Who's in the building right now? You're looking for reputable companies locked into long-term leases. A stable, high-quality tenant roster is the bedrock of a secure commercial investment.

Occupancy History: Pull the records for the property's occupancy rates over the last few years. Consistent high occupancy is a great sign of strong demand, whereas frequent vacancies could be a serious red flag.

Physical Condition and Maintenance: Get a good look at the building itself. Are there any looming structural issues? Will you need to budget for major capital expenses soon, like replacing the HVAC systems or the roof?

Potential for Future Growth: Is there an angle to add value? Maybe you could renovate the common areas, upgrade the facilities, or even reposition the property to attract a more premium class of tenants.

By methodically working through these points, you shift from being a passive buyer to a proactive investor. To really sharpen your process for vetting deals, it’s worth exploring a comprehensive guide on how to evaluate investment opportunities. This disciplined approach is what truly separates a good investment from a great one.

Sorting Out Your Finances and The True Cost of Buying

So, you've found a promising commercial property. Great. Now comes the real work: lining up the money. Getting your financing sorted for a commercial property to buy in Dubai isn't just a box-ticking exercise; it's what gives you the power to negotiate seriously. This phase is about more than just securing a loan—it's about getting a crystal-clear picture of every single cost involved.

Nailing your budget at this stage means no nasty surprises when it's time to sign the final papers. It's the step that turns a good idea into a viable investment and gives you the confidence to push forward.

Getting to Grips with Commercial Mortgages in Dubai

Yes, non-residents can absolutely get a commercial mortgage here, but you need to know what the banks are looking for. They'll scrutinise your financial background and want to see a solid business plan for the property.

Unlike a home loan, a commercial mortgage is less about you and more about the asset's ability to make money. Lenders need to be convinced that the potential rental income will easily cover the mortgage repayments.

Here’s what you’ll typically be up against:

Loan-to-Value (LTV) Ratios: Don't expect the same LTV you'd get for a residential villa. For non-residents, banks usually cap commercial property loans at around 50% to 60%. This means you need a hefty down payment.

Down Payment: Be ready to put down at least 40% of the property’s value in cash. It's a significant chunk of change and reflects the higher perceived risk of commercial investments.

Proof of Income: You’ll need to lay your finances bare. Think detailed salary certificates, several months of bank statements, and any other documentation that proves you have a stable income stream to handle the loan.

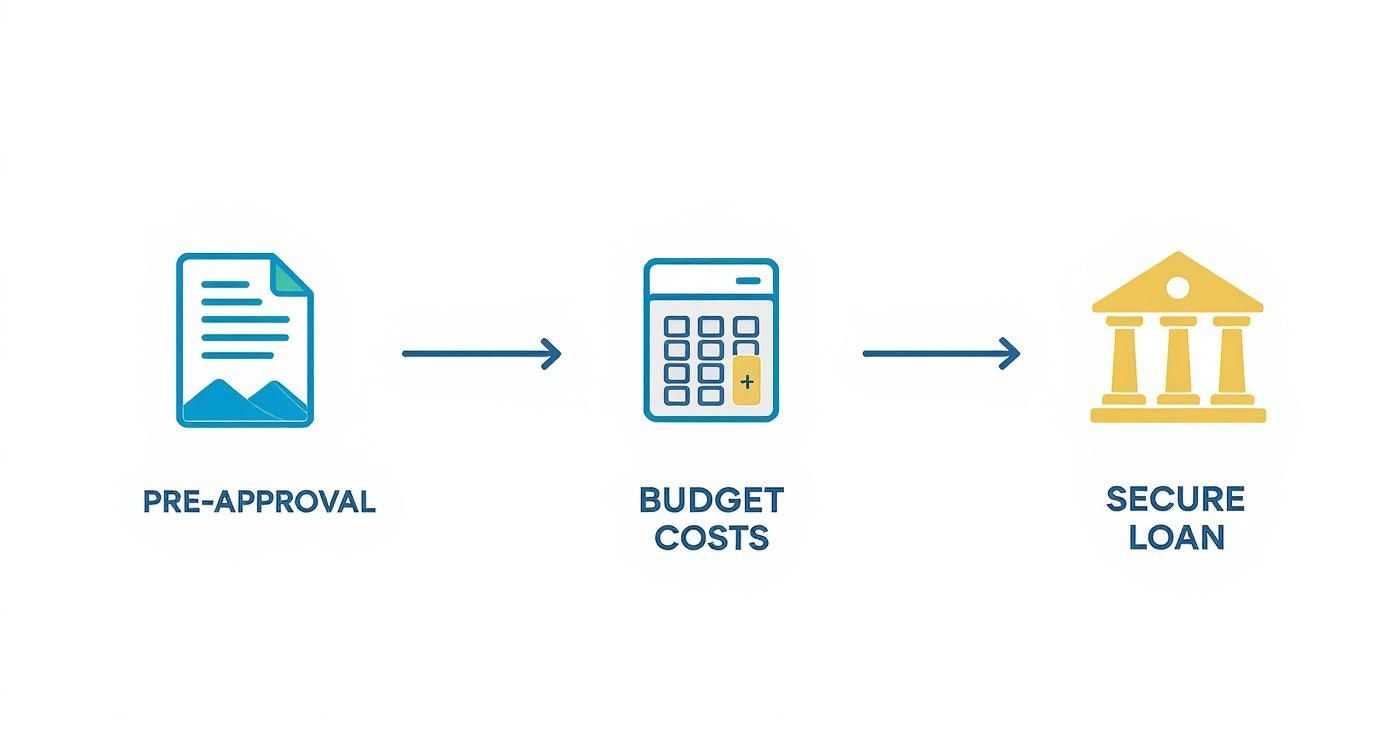

The Secret Weapon: Loan Pre-Approval

Here’s a piece of advice I give every serious buyer: get pre-approved for your mortgage before you even think about making an offer. Walking into a negotiation with a pre-approval letter from a bank changes the entire conversation. It instantly tells the seller you’re not a time-waster; you’re a qualified buyer ready to close.

This one move can put you ahead of other potential buyers, especially when a good property hits the market. Sellers are always more inclined to negotiate with someone who has their financing in place because it dramatically lowers the risk of the deal collapsing later on.

Getting pre-approved isn’t just about the money. It's a strategic play that strengthens your hand at the negotiating table and speeds up the whole purchase process.

Budgeting for Everything (Not Just the Price Tag)

The advertised price is just the start. I’ve seen too many first-time investors get caught out by underestimating the closing costs, which can add up surprisingly fast. A realistic budget has to account for every mandatory fee.

These aren't optional extras; they're required payments to finalise the transfer. A good rule of thumb is to set aside an extra 7-8% of the property's purchase price to cover all these expenses. This way, you avoid any last-minute scramble for funds.

Here's a quick rundown of the main fees you need to build into your budget:

Fee Type | Typical Cost | Who It's Paid To |

|---|---|---|

DLD Transfer Fee | 4% of the property value | Dubai Land Department |

Mortgage Registration Fee | 0.25% of the loan amount | Dubai Land Department |

Real Estate Agent Commission | 2% of the property value (+ VAT) | Real Estate Agency |

Registration Trustee Fee | Approx. AED 4,000 | DLD Trustee Office |

No Objection Certificate (NOC) Fee | AED 500 - AED 5,000 | Property Developer |

Let's put that into perspective. If you're buying a AED 5 million office space, you should plan for an additional AED 350,000 to AED 400,000 on top, just for these costs. Factoring this in from day one makes for a smooth, predictable closing and lets you focus on what really matters—the future success of your new asset.

The Due Diligence and Property Transfer Process

You’ve found the perfect property and your financing is sorted. Now comes the most critical part of the journey: the due diligence and transfer. When you’re looking to secure a commercial property to buy in Dubai, this isn't a stage you can afford to rush. It's all about verifying every detail and legally cementing your investment.

The first move is to formalise the agreement by signing a Memorandum of Understanding (MOU), which you’ll often hear referred to as Form F. This document lays out all the agreed-upon terms, acting as a firm commitment between you and the seller. At this point, you'll hand over a security deposit, usually 10% of the property's price, which a registered broker holds securely in escrow until the transfer is complete.

Locking in the Deal and Starting Your Checks

With the MOU signed and the deposit paid, the due diligence clock officially starts ticking. Think of this as your opportunity to get under the hood of the property and make sure everything is exactly as it seems. A thorough investigation here is what protects you from nasty surprises and hidden liabilities that could sour an otherwise great deal.

I always advise clients to break their due diligence into three distinct areas: legal, financial, and physical. Each one gives you a piece of the puzzle, and together they create a complete picture of the asset you're buying.

Legal Verification: First and foremost, you need to confirm the seller actually has the legal right to sell. This means a trip to the Dubai Land Department (DLD) to verify the original Title Deed. You also need to check for any outstanding liens, mortgages, or legal claims tied to the property.

Financial Scrutiny: This is where you hunt for hidden costs. Insist on getting a formal statement from the developer confirming that all service charges are paid in full. If they aren't, those unpaid fees will become your problem after the sale, so this is non-negotiable.

Physical Inspection: Never, ever skip a professional inspection. This is far more than a casual walkthrough. A proper assessment will look at the building's structural integrity, plumbing, and electrical systems. A detailed report can reveal issues that might demand costly repairs down the road. To really grasp what's involved, it's worth understanding the significance of conducting a building structural inspection.

This infographic gives a clear view of how securing your financing sets the stage before you even get to this transfer process.

Getting that pre-approval for a loan early on gives you a solid footing before you commit to the purchase and dive deep into due diligence.

Completing the Transfer at the DLD

Once your checks are complete and you're fully satisfied with what you’ve found, it’s time for the final step: the transfer appointment. This takes place at a DLD-approved Registration Trustee office, where you, the seller, and your respective agents will all meet.

This is where the final payments happen. You’ll need to have manager's cheques ready for the seller to cover the remaining balance, as well as separate cheques for the DLD transfer fee and agent commissions.

This final meeting is the culmination of your entire buying journey. Make sure all your documents are organised and your payments are prepared in the correct format (manager’s cheques) to avoid any last-minute delays.

As soon as the payments are verified, the trustee gets to work processing the transaction. The seller officially signs over the property, and the DLD issues a brand new Title Deed with your name on it. Just like that, you are the official owner of a commercial property in Dubai. The entire process is designed for security and transparency, giving you total peace of mind in your new asset.

Answering Your Key Questions About Buying Commercial Property

Stepping into a new market always brings up questions. When clients start looking for a commercial property to buy in Dubai, they often have the same initial concerns about ownership, hidden costs, and realistic returns. Getting solid answers to these questions is the first step toward making a smart, confident investment.

Let's dive into some of the most common queries we get from investors, breaking down the answers with the practical insights you actually need.

Can Foreigners Really Own 100% of Commercial Property in Dubai?

Yes, they can. Foreign investors are legally permitted to have 100% ownership of a commercial property in Dubai, but there's a crucial detail: this right only applies within specific, government-approved areas known as 'freehold zones'.

These zones were established to draw in foreign capital and now include many of the city's most prestigious business hubs—think Business Bay, Downtown Dubai, and Jumeirah Lake Towers (JLT). When you buy in a freehold area, your ownership is total. Your name goes on the Title Deed, giving you the full right to sell, lease, or pass on the asset.

Outside of these designated zones, you'll likely find 'leasehold' properties. In that scenario, you're not buying the land but rather the right to use the property for a long, fixed period, often up to 99 years. Before you get serious about any deal, your very first move should be to verify the property's status with the Dubai Land Department (DLD) to make sure it matches your investment goals.

What Are the Main Costs Beyond the Purchase Price?

The sticker price is just the beginning. One of the biggest mistakes new buyers make is underestimating the closing costs, which can add up quickly. A good rule of thumb is to budget an extra 7-8% of the property’s value to cover all the associated fees.

The largest single expense you’ll face is the DLD transfer fee, a standard 4% of the property's final sale price. This is non-negotiable.

But there are other mandatory payments to plan for:

Real Estate Agent's Commission: This is typically 2% of the purchase price, plus VAT.

Registration Trustee Fees: These are administrative charges for processing the title transfer, usually around AED 4,000.

No Objection Certificate (NOC) Fee: You pay this to the developer to confirm there are no outstanding service charges. The cost varies, ranging from AED 500 to AED 5,000.

Mortgage Registration Fee: If you're financing the purchase, the DLD charges 0.25% of the loan amount to register the mortgage against the property.

Building these costs into your budget from the very start is essential for a smooth transaction without any last-minute financial surprises.

What's the Difference Between Off-Plan and Ready Commercial Properties?

Choosing between off-plan and ready property really boils down to your investment strategy and how much risk you're comfortable with.

An off-plan property is one you buy directly from a developer before it’s even built. The appeal here is clear: you often get a lower price point and flexible payment plans that are spread out over the construction timeline. But this path has its own risks, like project delays or market shifts that could happen before the property is handed over.

A ready property, as the name suggests, is a finished unit you can walk through and inspect before you commit. The big wins here are security and speed. You see exactly what you’re getting, and more importantly, you can put a tenant in place and start generating rental income almost immediately.

In Dubai's commercial market, the smart money overwhelmingly favours ready properties. Investors here value immediate cash flow and tangible assets, which is why completed units consistently dominate transaction volumes. The choice is yours: are you hunting for potential capital growth down the line (off-plan), or do you need stable, immediate returns (ready)?

How Do I Calculate the Potential Rental Yield?

Working out your potential return on investment is non-negotiable when evaluating a commercial property. It all comes down to two key figures: gross yield and net yield.

The gross rental yield is your quick, back-of-the-napkin calculation. Simply take the total annual rental income, divide it by the property's total purchase cost (including all your fees), and multiply by 100.

But for a true picture of profitability, you need to calculate the net rental yield. This is where you factor in your annual running costs. Start with your annual rent and subtract all yearly expenses—things like service charges, maintenance, and property management fees. Take this new, lower figure and divide it by your total purchase cost.

In Dubai's prime business districts, a well-chosen commercial property can deliver attractive net yields ranging from 6% to 9%, depending on the asset type and location.

At Credence & Co., we provide RERA-accredited, technically robust valuations that give you a clear and unbiased understanding of your potential investment. Our RICS-qualified experts deliver precise analyses to help you de-risk your decisions and achieve optimal outcomes. Discover how our advisory services can support your next acquisition by visiting us at https://www.cnco.ae.

Comments