Business Advisory: A Commanding Guide to Growth and Strategy

- Credence & Co

- Dec 17, 2025

- 17 min read

Think of business advisory as having a strategic co-pilot for your organisation. It’s about getting expert guidance to navigate the often-complex market conditions we see here in the UAE and the wider GCC, helping you turn ambitious goals into real, measurable achievements.

Charting Your Course with a Strategic Partner

Picture your business as a ship sailing through the demanding waters of the GCC market. You know your destination – sustained growth and leadership in your field – but the journey is rarely a straight line. The seas can be unpredictable, full of regulatory crosscurrents, competitive storms, and sudden economic shifts that can knock anyone off course.

In this kind of environment, a map just isn’t enough. You need an expert navigator by your side, someone who can read the instruments, anticipate the weather, and plot the safest, most efficient route to where you want to go. That, in a nutshell, is the essence of business advisory. It’s far more than just a service; it’s a genuine strategic partnership built on trust and a shared vision for success.

More Than a Map, a Partnership in Direction

A great advisory firm doesn’t just hand you a report and walk away. They become part of your strategic team, working shoulder-to-shoulder with your leadership to bring clarity and direction right when you need it most. To truly steer your business forward, it helps to start adopting a financial advisor mindset, which provides a practical framework for getting tangible results. This mindset helps turn abstract goals into a clear, actionable flight plan for success.

A dedicated partner brings a lot to the table:

Objective Foresight: They offer an unbiased, outside-in perspective, challenging assumptions and spotting blind spots that internal teams can sometimes overlook.

Specialised Expertise: You get access to deep industry knowledge and technical skills for complex challenges, whether it's a merger, a business valuation, or financial due diligence.

A Strategic Sounding Board: An advisor acts as a confidential counsel for senior leadership, helping you weigh those make-or-break decisions with data-driven confidence.

Support with Execution: They make sure that brilliant strategies don’t just stay on paper but are actually implemented effectively, delivering a real, measurable impact.

At its heart, business advisory is an investment in certainty. It gives you the clarity to make bold decisions, the confidence to grab hold of new opportunities, and the resilience to navigate the obstacles that will inevitably pop up on your path to growth.

An Essential Investment in Your Vision

Ultimately, bringing in a business advisory firm is a forward-thinking move to secure your company’s future. For any organisation in the UAE, Oman, or the GCC aiming to lead its market, this kind of partnership is truly indispensable. The team at Credence & Co. has a deep understanding of the local market, as you can see when you explore who we are and what drives our mission.

It’s about building a solid foundation for sustainable success, ensuring your business doesn’t just survive the journey but actually thrives, reaching its destination stronger and more capable than ever before.

What's Under the Bonnet of Business Advisory?

To really get what business advisory can do, you need to look under the bonnet at the high-performance engines that drive great decisions. These core services aren't just abstract concepts; they are powerful, practical tools. Each one delivers the specific clarity you need to navigate critical moments with confidence.

Think of it like a specialised toolkit for your company’s journey. A pilot relies on different instruments for takeoff, cruising, and landing. In the same way, a business leader needs specific advisory functions for different stages of growth, change, and opportunity.

Let’s unpack the essentials.

The All-Important Pre-Flight Check: Financial Due Diligence

Imagine you’re about to make a huge corporate move—a merger, an acquisition, a major investment. You wouldn't dream of committing without an exhaustive inspection of what you're getting into. That's exactly what Financial Due Diligence is.

It’s a deep, meticulous investigation into the financial reality of a target company, going far beyond the glossy numbers on a balance sheet. Your advisors will dig in to verify revenues, assess liabilities, scrutinise cash flows, and uncover any potential risks that could cause serious turbulence later on.

The goal is simple but absolutely vital: to make sure the opportunity is everything it seems to be and to find any hidden problems before you sign on the dotted line. It’s the ultimate risk-mitigation tool, confirming the value of the deal and giving you the all-clear for a smooth flight forward.

Defining Your True Worth: Business Valuation

What is your business really worth? It’s one of the most fundamental questions you can ask, and the answer is rarely simple. A Business Valuation is the disciplined process of determining that precise economic value.

This isn’t just adding up the assets you can see and touch. A proper valuation looks at future earning potential, your position in the market, intellectual property, and even intangible assets like brand reputation. The result is a credible, defensible figure that becomes critical for several key moments:

Securing Investment: A robust valuation gives potential funders the confidence they need to back your vision.

Planning a Strategic Exit: It sets a realistic benchmark for selling your business, ensuring you get fair market value.

Shareholder Agreements: It provides a clear, objective basis for buy-sell agreements and succession planning.

To get a better handle on the different ways this is done, you might find our guide on business valuation methods and techniques helpful.

Cataloguing Your Arsenal: Asset Appraisals

Every business runs on its assets—from heavy machinery and vehicle fleets to sophisticated software. An Asset Appraisal is the official process of cataloguing and valuing these crucial components. It’s about knowing exactly what your most important tools are worth at any given time.

This is often a requirement for securing financing, as banks need appraisals for asset-backed loans. It's also indispensable for insurance, risk management, and accurate financial reporting. A precise, up-to-date appraisal provides rock-solid clarity and strengthens your entire financial foundation.

To put it all together, here’s a quick look at how these services function and why they are so important for your strategic planning.

Core Business Advisory Services and Their Strategic Impact

Advisory Service | Core Function (What It Does) | Strategic Outcome (Why It Matters) |

|---|---|---|

Financial Due Diligence | A deep-dive investigation into a target company's financial health, verifying assets, liabilities, and cash flow. | Protects your investment by uncovering hidden risks and validating the deal's true value before you commit. |

Business Valuation | A disciplined process to determine the economic worth of an entire business, including intangible assets and future earnings. | Empowers you for negotiations, fundraising, and exit planning with a credible, defensible value. |

Asset Appraisals | A detailed inventory and valuation of a company's physical and intangible assets, from property to patents. | Strengthens your financial position for loans, insurance, and compliance, giving you a clear picture of your asset base. |

Purchase Price Allocation | The accounting process of assigning the purchase price to all acquired assets and liabilities at their fair market value post-acquisition. | Ensures regulatory compliance and financial transparency, setting the stage for a smooth integration and accurate reporting. |

Each service provides a distinct piece of the puzzle, coming together to give you a complete, strategic view of your business landscape.

A great advisory firm doesn’t just give you answers; it inspires you to ask better questions. It helps you turn data from a rear-view mirror into a high-powered lens focused on the road ahead.

The need for these specialised services is climbing across the region. The management consulting market in the Middle East and Africa—a close cousin to business advisory—is projected to hit USD 10.75 billion in 2025 and grow to USD 13.30 billion by 2030. This surge is powered by rising M&A and private equity activity, which naturally increases the demand for expert due diligence and valuation.

This trend makes one thing clear: businesses now see expert advisory not as a cost, but as a crucial driver of success.

Ensuring a Smooth Landing: Purchase Price Allocation

After you've successfully closed a deal, the work isn't over. Purchase Price Allocation (PPA) is the critical accounting step that comes next. It involves assigning the total purchase price to the various assets and liabilities of the company you just acquired.

Think of it as carefully unpacking and organising everything you've brought on board. PPA ensures that assets like property, equipment, patents, and even customer relationships are all recorded at their fair market value on the new balance sheet. This isn't just a bookkeeping chore; it's a non-negotiable regulatory requirement for transparent financial reporting.

A well-executed PPA gives you an accurate financial picture from day one, setting you up for a seamless integration and a powerful start to your new chapter.

When Do You Call in an Advisor? The Tipping Points for Growth

Knowing the right moment to bring in a business advisor can be the difference between hitting a plateau and launching into your next phase of growth. Too many leaders think of advisors as an emergency service for when things go wrong. But the smartest companies? They use advisory as rocket fuel for their most critical moments. It's about being proactive, not just reactive.

Think of it like this: a world-class athlete doesn't wait for an injury to see a specialist. They work with coaches and experts constantly to fine-tune their performance and push their limits. Your business deserves that same level of strategic attention. The signs that you need this kind of expert guidance are usually there, if you know what you’re looking for.

These triggers aren’t signs of weakness; they're signs of ambition. They signal that you're ready to take on a bigger challenge, whether that's expanding your footprint, securing a major investment, or navigating a complex deal.

Key Moments That Demand a Strategic Partner

In a market as dynamic as the GCC, certain situations practically cry out for an objective, expert eye. These are the crossroads where having a seasoned guide can help you see the path forward with absolute confidence.

You might be at one of these crossroads right now:

You're Preparing for a High-Stakes Deal: Is a merger or acquisition on the horizon? This is where every detail matters. A business advisor brings the sharp-eyed analysis needed to make sure you're getting the best possible value while sidestepping hidden risks.

You're Seeking Major Investment: When you need capital to really scale, you need more than a good idea; you need an airtight, data-driven story. An advisor helps you polish your financial models and valuation until your pitch is simply too compelling for investors to ignore.

You're Navigating a Regulatory Maze: The rules of the game in the UAE and Oman are always shifting. An advisor with their finger on the pulse of local regulations ensures you stay compliant, all while structuring your business for maximum efficiency.

You're Planning a Smooth Leadership Handover: Whether it's a family succession or a change in the C-suite, a seamless transition is vital to protect the company's value. Expert guidance provides the framework to manage this delicate process without a hitch.

An advisor isn’t there to repeat what you already know. They’re there to show you what you’ve been missing, providing the strategic foresight to turn a daunting challenge into a defining opportunity.

The Two Sides of the Coin: Rapid Growth and Frustrating Plateaus

Interestingly, the need for an advisor often stems from two completely opposite scenarios: the thrill of explosive growth or the frustration of hitting a wall. Each comes with its own set of dangers that can derail your vision if you don't address them head-on.

When your business is taking off, your internal systems and processes can start to buckle under the pressure. Even your leadership team can get stretched thin. It's a great problem to have, but it’s still a problem. An advisor helps you build the solid operational backbone you need to support that growth for the long haul.

On the other hand, what if your growth has flatlined? When your old strategies just aren't moving the needle anymore, it’s a clear signal that you need a fresh perspective. An advisor can come in, diagnose the root issues, and inject the new thinking required to get things moving again.

No matter the trigger, the goal is always the same: to unlock your company’s true potential. Before you jump into any deal, it's crucial to understand the road ahead. Our guide on what to expect from a financial due diligence engagement is a great place to start.

This demand for sophisticated, hands-on support is a global trend. Across Africa, which shares many economic ties with the AE region, clients are looking for a new kind of business advisory. They want firms that blend deep local insight with a global perspective—partners who can provide not just a report, but genuine strategic foresight for initiatives like Nigeria's booming fintech sector. You can read more about these consulting trends in Africa on consultingquest.com. It's clear that leaders everywhere see the value in a partner who can help them master those pivotal moments and drive real, sustainable growth.

The Advisory Journey: From Challenge to Concrete Solution

Engaging a business advisory firm isn’t just about getting a report; it’s about embarking on a collaborative journey that transforms uncertainty into absolute clarity. Think of it as a structured partnership, designed to take a complex business challenge and methodically turn it into a concrete, actionable solution. Every step is built on open communication and is designed to add tangible value.

This isn't about us telling you what to do. It's about co-creating a strategy that's not only brilliant on paper but genuinely powerful and practical for your specific reality, whether you're operating in the UAE, Oman, or anywhere across the GCC.

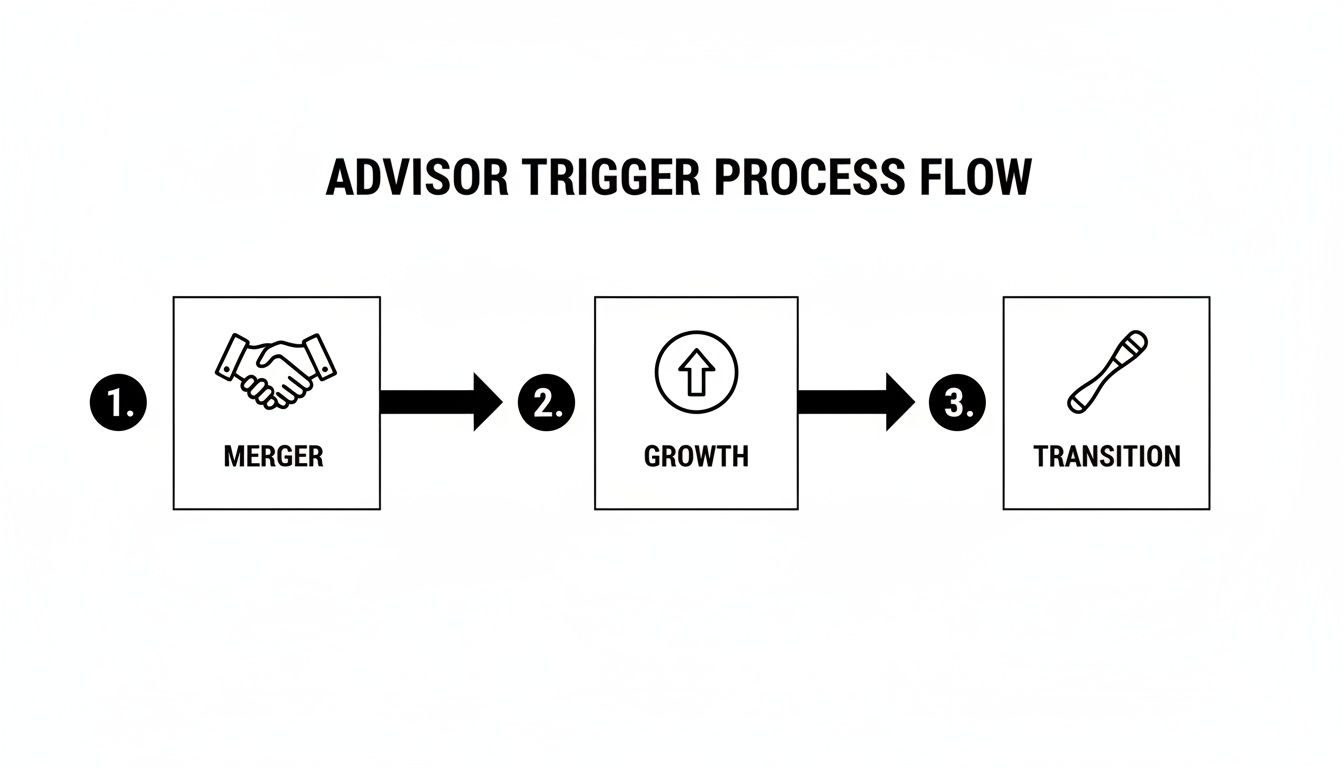

The journey often begins at a critical crossroads for a company—a potential merger, a push for significant growth, or a major transition.

These inflection points are precisely where the right guidance can fundamentally change the outcome for the better.

Discovery and Diagnosis

The first step is always Discovery and Diagnosis. This is an immersive, hands-on deep-dive where our advisors work shoulder-to-shoulder with your leadership team. The real goal here isn't just to skim the surface of the problem but to pinpoint the root cause that's holding your business back.

Consider it a strategic health check. We'll ask the tough questions, listen intently to your team, and analyse your current situation to get to the heart of the matter. Together, we’ll define what success truly looks like, setting clear and measurable objectives for the entire engagement.

Deep Dive Analysis

With our shared objectives locked in, we move into the Deep Dive Analysis. This is where our team fully immerses itself in the mechanics of your business. We gather and scrutinise data from every corner of your organisation—from financial statements and operational workflows to your market position and the competitive landscape.

But this is far more than just number-crunching. It's about uncovering the story the data is trying to tell. By connecting the dots, we can identify hidden patterns, untapped opportunities, and potential risks that are often missed from an internal perspective. This analytical rigour is the foundation of the entire strategy.

A top-tier business advisory firm doesn't just present data; it translates that data into insight. This phase is about finding the 'why' behind the numbers, which is the key to unlocking meaningful change.

Strategy and Roadmap Development

Armed with these deep insights, we enter the Strategy and Roadmap stage. This is where we forge all those analytical findings into a clear, actionable plan. It’s a creative process where our expertise meets your unique business needs, resulting in a bespoke strategy designed to hit your specific goals.

A truly great roadmap does more than just point to a destination. It details the specific steps, timelines, and resources required to get there. It’s a practical guide your team can follow with confidence, providing direction for every move. For many clients, this involves navigating complex deals, a process we break down in our guide to mergers and acquisitions in Dubai.

Implementation and Impact

Finally, the journey reaches its most critical phase: Implementation and Impact. The best advisory firms don't just hand over a plan and walk away. We remain your dedicated partners during execution, helping you navigate the inevitable obstacles that come with any significant change.

This final stage is all about turning strategy into action and action into results. We'll help you manage the transition, monitor progress against key performance indicators, and make real-time adjustments as needed. This ongoing support ensures the strategy is implemented effectively, delivering the measurable impact and lasting value you set out to achieve from day one.

Real-World Wins: What Advisory Looks Like on the Ground in the GCC

Talk is cheap. Frameworks and theories are great on paper, but the real test of business advisory is what happens when the advice hits the ground. It’s about turning a strategic plan into a tangible win that shows up on the balance sheet and secures a company’s future.

The most compelling success stories aren't found in textbooks; they're unfolding every single day in the fiercely competitive markets of the UAE, Oman, and Saudi Arabia. Let's look at what this actually looks like in practice. These aren't just anecdotes—they're proof of the incredible return you get when you find the right advisory partner.

From Dubai Hospitality Gem to Regional Powerhouse

Picture a respected hospitality group in Dubai. They had big dreams of expanding across the region, but to do that, they needed to bring a major international partner to the table. The problem? They were struggling to communicate the true, long-term value of their brand and prime properties in a language that would resonate with global investors.

This is where a pinpoint-accurate business valuation changed everything. An advisory firm was brought in to do a deep dive, looking far beyond the simple book value of their hotels. They quantified the brand's reputation, its loyal customer base, and its massive growth potential.

The Goal: Lock in a strategic partnership to supercharge regional expansion.

The Advisory Play: A comprehensive enterprise valuation that told the full story, blending the value of physical assets with the power of their brand to create an irresistible investment case.

The Result: Armed with objective, defensible data, the group closed the deal. They successfully secured a partnership that fuelled a 40% increase in their regional footprint, cementing their status as a dominant player. To see more on this, check out our in-depth hospitality consultancy guide for the UAE and GCC.

Unsnarling the Supply Chain in Oman

An Omani logistics company was a victim of its own success. Demand was booming, but their internal operations were creaking under the strain. Small inefficiencies were snowballing into major delays, driving up costs and threatening the reputation they had worked so hard to build.

They needed a fresh pair of eyes—an objective, outside perspective to spot the bottlenecks the internal team was simply too close to see. This was a classic case for operational advisory.

Advisors came in and mapped the entire supply chain from start to finish. Using data analytics, they identified the exact points of friction. From there, they created a practical roadmap for improvement, bringing in smarter workflows and technology to optimise everything from warehouse management to delivery routes. The impact was immediate and powerful.

The greatest victories are often won not by grand gestures, but by the relentless pursuit of operational excellence. The right advisory partner helps you find and fix the small inefficiencies that unlock massive gains.

Fuelling a Saudi Fintech Fireball

Over in Saudi Arabia's vibrant tech scene, a brilliant fintech startup had a game-changing product. But they were having a tough time telling their financial story to venture capital firms. They desperately needed to secure a Series B funding round to scale, but their financial models just weren't robust enough to win over serious investors.

A business advisory team with real-world tech experience stepped in. They rolled up their sleeves and worked side-by-side with the founders to rebuild their financial projections, sharpen their valuation, and polish their investment pitch until it shone. This preparation was the launchpad they needed.

The Goal: Secure a critical Series B funding round in a cut-throat market.

The Advisory Play: Intensive financial modelling, strategic pitch refinement, and hands-on investor readiness support.

The Result: The startup walked into investor meetings with unshakeable confidence, backed by a data-driven, compelling narrative. They not only closed their Series B round but exceeded their initial target by 25%, securing the capital to hit the accelerator on growth.

These stories underscore a bigger trend. The Middle East and North Africa (MENA) is rapidly becoming a global nexus for business, which in turn is driving the demand for world-class advisory. In fact, business travel bookings in MENA shot up by 40% in early 2025, and the sector is projected to grow another 6.1% this year alone. Find out more about this regional business travel boom on arabnews.com. In an environment this dynamic, having a strategic expert in your corner isn't just an advantage—it's essential.

Finding Your Co-Pilot: How to Choose the Right Advisory Partner

Choosing a business advisory firm is one of the biggest decisions you'll make. This isn't just about hiring another vendor; it's about bringing a strategic co-pilot into the cockpit. Get it right, and you can unlock incredible growth. Get it wrong, and you could face some costly mistakes down the line.

Your real mission here is to find a partner that feels like a genuine extension of your own team—someone who gets your vision and is as invested in your success as you are. To do that, you need to look past the slick presentations and focus on what truly matters.

Go Beyond the Firm, Look at the Team

Any firm can boast about its broad experience, but the success of your project will hinge on the specific people working on it day-to-day. It’s their expertise, their dedication, and their insights that will make all the difference. Don't be afraid to dig deep into the credentials of the team members who will actually be in the trenches with you.

Get direct and ask the tough questions about their hands-on experience:

Sector-Specific Knowledge: Have they actually worked with businesses in your industry right here in the GCC? The challenges of a real estate project in Dubai are a world away from those of a logistics firm in Muscat.

Stage-Specific Track Record: Do they have a proven history of helping companies at your specific growth stage? A firm that typically advises massive corporations might not grasp the nimble, fast-paced needs of a startup.

Direct Access: Will you be working directly with senior partners and key experts, or will your project be handed off to a more junior team? You need to know who you'll be calling.

Assess Verifiable Track Records and Regional Expertise

A firm’s history in the UAE, Oman, and the broader GCC is not just a "nice to have"—it's essential. The business culture, regulatory maze, and market dynamics in this region are completely unique. A partner with deep local roots brings an immediate advantage because they understand the unwritten rules of business that can make or break a venture.

When you're looking for outside help, knowing how to choose the right advisory partner is key. For those focusing on this region, checking out the best business setup consultants in Dubai can offer some great context. It gives you a valuable lens to see how firms are judged based on their local success and market knowledge.

The ultimate test of an advisory partner isn’t what they say they can do, but what they have already done. Ask for case studies and references from companies that faced challenges similar to yours, and then follow up.

Prioritise Cultural Fit and a Partnership Mindset

This might be the most crucial factor of all: cultural fit. Are you just hiring a consultant who will drop a report on your desk and walk away, or are you bringing on a committed strategic ally? The very best advisory relationships are built on a solid foundation of mutual trust, open communication, and a shared vision for the future.

As you meet with potential firms, pay close attention to the chemistry in the room. Do they listen more than they talk? Do they challenge your assumptions in a constructive way? A real partner isn't afraid to ask difficult questions or give you honest feedback, even when it's not what you want to hear.

Ultimately, you’re searching for an advisor who is as passionate about your company's future as you are. They should be a source of not just answers, but of inspiration—pushing you to see bigger opportunities and tackle challenges with renewed confidence. That level of commitment is what separates a good consultant from a truly great partner.

Your Questions on Business Advisory, Answered

Stepping into the world of business advisory for the first time? It’s natural to have questions. Whether you're at the helm of a major corporation or steering a growing SME in the UAE, clarity is key. Let's tackle some of the most common queries we hear.

Is Business Advisory Just for Big Companies?

Not at all. That’s an old myth that no longer holds true. While large enterprises are frequent clients, some of the most exciting work we do is with small and medium-sized enterprises (SMEs).

Today’s best advisory firms understand that SMEs are the engine of our economy and face their own unique set of hurdles. We create solutions that scale, whether it's helping a tech startup nail its first funding round or guiding a family business as it expands across the region. Think of it as giving SMEs the strategic firepower they need to punch well above their weight.

What's the Real Difference Between Consulting and Advisory?

It’s a great question, as the two terms are often mixed up. The simplest way to think about it is the difference in relationship and scope.

Traditional consulting is often project-based. A consultant comes in to solve a specific, defined problem and then leaves once the job is done. They're like a specialist mechanic you hire to fix a particular issue with your car's engine.

An advisor, on the other hand, is in it for the long haul. They become a strategic partner who works alongside your leadership team continuously, offering guidance, challenging assumptions, and helping you see around corners. They aren't just there to fix one problem; they’re the chief engineer obsessed with keeping your entire vehicle at peak performance, year after year.

How Can We Actually Measure the ROI?

This is one of the most important questions, and the answer should be clear from day one. Any good advisory firm will sit down with you before an engagement begins to define what success looks like and establish clear Key Performance Indicators (KPIs).

The returns you'll see are both tangible and intangible:

Hard Numbers: These are the straightforward financial wins. We’re talking about increased revenue, significant cost reductions, a higher business valuation, or the total amount of capital raised.

Strategic Value: These benefits are just as powerful, even if they don't always fit neatly on a spreadsheet. This includes things like having a crystal-clear strategic path forward, making smarter decisions faster, or running a much smoother, more efficient operation.

By setting these benchmarks upfront, we create a transparent partnership. You'll know exactly how our work is delivering real, measurable value that drives your business towards its biggest goals.

At Credence & Co., we build partnerships, not just projects. Our team is here to provide the strategic clarity and expert guidance your business needs to truly thrive in the GCC. To discover more about our accredited valuation and advisory services, please visit us at https://www.cnco.ae.

Comments