Abu Dhabi Real Estate Smart Investment Guide

- Credence & Co

- Dec 18, 2025

- 12 min read

Abu Dhabi’s property market has evolved into a fascinating maze of beachfront neighbourhoods and planned communities. Supply remains tight, while purpose-built developments continue to spring up along the coast. As a result, both home-seekers and investors find themselves drawn to an ever-shifting landscape.

Explore Abu Dhabi Real Estate Journey

Picture yourself cruising down Saadiyat Island’s winding road. Suddenly, you spot a brand-new waterfront villa—and learn it sold out within days of launch. That moment perfectly captures Abu Dhabi’s magnetic pull.

This guide lays out a clear path from market fundamentals to hands-on due diligence. Each chapter unfolds with concrete examples, expert commentary and practical tools:

Progressive concept building backed by recent market data

Real-world stories that bring individual neighbourhoods to life

Blockquotes spotlighting essential takeaways

Step-by-step checklists for valuation and transaction success

Abu Dhabi’s long-term vision has shaped premium districts across the emirate. A commitment to culture, leisure and infrastructure sustains rising rental yields year after year.

Check out our guide on property valuation in Abu Dhabi to see how precise analysis boosts investment confidence.

Coastal Maze Meets Strategic Growth

Think of Abu Dhabi’s coastline as a living labyrinth. Limited parcels meet ambitious masterplans—and that dynamic keeps prices on an upward trajectory.

For instance, government and industry sources both point to solid momentum for 2025. The Abu Dhabi Real Estate Centre’s H1 2025 report recorded a record AED 54 billion in transactions alongside 38% growth in residential sales. Meanwhile, leading brokers noted double-digit gains in volume and pricing. Read more on the ADREC site.

Key Insight: Strategic planning and supply constraints are a driving force behind current price growth.

From sleek high-rises to secluded villas, every asset class tells its own story. Let’s start our journey by unpacking the fundamentals of Abu Dhabi real estate.

Roadmap For This Guide

Market Fundamentals And Transaction Essentials

Neighbourhood Insights With Price Comparisons

Due Diligence Checklist Complete With Valuation Tools

Expert Tips From Credence & Co.-Accredited Specialists

Risk Scenarios And Mitigation Strategies

Prepare to navigate Abu Dhabi’s real estate scene with clarity, confidence and actionable insights.

Understanding Market Fundamentals

Imagine stepping onto Al Reem Island and finding a vacant, fully finished flat ready in weeks, not years. This eager buyer is emblematic of how Abu Dhabi real estate is shifting towards immediate occupancy rather than off-plan promises.

Ready Properties Vs Off-Plan Trends

Some investors now chase immediate rental yield instead of waiting on construction schedules.They avoid delivery uncertainties by choosing ready units with lower risk of delay.An occupied home tends to change hands faster thanks to clear titles and proven occupancy.

This pattern drives demand and fuels price momentum across both apartments and villas.

Price Growth Ratio Apartment prices surged 14.4% while villas climbed 11.1% year-on-year in H1 2025.

Here’s a quick snapshot comparing early-2025 gains with Q3 figures.

Key Market Metrics H1 2025 vs Q3 2025

Metric | H1 2025 | Q3 2025 |

|---|---|---|

Sales Transactions | 3,300 | 1,900 |

Total Sales Value (AED Billion) | 8.9 | 6.2 |

Apartment Price Growth | 14.4% | 12.5% |

Villa Price Growth | 11.1% | 10.8% |

For deeper insights, refer to H1 2025 residential market performance on cavendishmaxwell.com. By Q3, we see a modest cooling in both volume and value, signalling the market’s natural ebb and flow.

Supply And Demand Tides

Scarce coastal parcels have pushed prices higher as occupancy levels hit new highs. New launches on Yas Island and Saadiyat Island should add relief, but completion timelines remain staggered.

Saadiyat Grove Residences will introduce over 800 units in mid-2025.

Yas Link Townhouses bring 150 luxury villas into the ready market.

Al Raha Lofts contributes 500 mid-rise apartments by the marina.

Effective due diligence means watching handover dates and tracking developer track records. For tailored analysis, explore how Credence & Co. shapes investment confidence in our guide on smart investment guidance for real estate consulting firms

This clear snapshot of market health sets up our exploration of regulatory details and transaction best practices.

Project Pipeline Overview

Looking ahead, several masterplans are seeding new off-plan stock across the emirate. A phased release strategy—such as monthly drops of 200 apartments on Al Maryah Island—helps smooth absorption.

Shams Abu Dhabi aims to deliver 1,200 waterfront apartments by Q4 2025.

Maryah Central Residences plans 900 mixed-use units with integrated retail.

Yas Bay Marina launch offers 600 luxury villas in early 2026.

Backlog Units Over 2,700 off-plan units are slated for delivery across flagship projects in 2025.

As this pipeline unfolds, price growth may temper in the latter half of the year. Understanding these cycles informs more accurate valuation models and negotiation tactics.

Transaction Velocity And Buyer Profiles

In Q3 2025, investor-driven deals rose to 35%, with many targeting rental income. End-users still made up 65% of transactions, underlining steady residential demand.

Young families seeking ready villas near schools and community centres.

Gulf expatriates attracted to off-plan apartments with flexible payment terms.

Institutional funds acquiring clusters of flats for long-term leasing.

Turnover Rate Average days on market fell from 75 to 60 days between H1 and Q3 2025.

These dynamics highlight the diverse forces shaping Abu Dhabi real estate, preparing investors for timing and pricing strategies. This fundamental overview primes you for the detailed regulatory and transaction chapters to follow.

Regulatory Framework And Transaction Process

Exploring Abu Dhabi’s property regulations can feel like navigating a maze. Every rule serves as a shield—protecting both investors and residents.

By breaking down each step—freehold versus leasehold rights, ADDED registration, title deed formalities and escrow safeguards—you’ll move forward with confidence whether you’re buying, selling or leasing.

Ownership Rules

Deciding on freehold or leasehold is the first fork in the road. Your choice shapes everything from your control over the property to how easily you can resell.

Freehold grants permanent ownership in zones such as Saadiyat Island and Yas Island.

Leasehold offers tenures up to 99 years in areas outside the freehold map.

Mixed structures also exist—blending immediate usage rights with long-term tenure.

For a quick comparison:

Ownership Type | Term | Typical Locations |

|---|---|---|

Freehold | Indefinite | Saadiyat Island, Yas Island |

Leasehold | Up to 99 years | Areas outside freehold zones |

One developer recounts a first-time buyer who overlooked a mortgage clause under leasehold conditions. Always confirm your tenure before you sign on the dotted line.

Registration And Title

Registering with the Abu Dhabi Department of Economic Development (ADDED) locks in your legal standing. In return, you receive a unique title deed—proof that the property now belongs to you.

Submit the sales agreement, passport copies and AJD application form.

Pay registration fees—usually 2% of the purchase price.

Receive a provisional title deed number while the escrow account is set up.

Once ADDED verifies everything, you’ll be handed the official title deed certificate. This document is your strongest evidence of ownership.

“Escrow accounts ensure funds release aligns with project milestones,” says a DMT-accredited expert.

Escrow Account Setup

For off-plan purchases, escrow protection is non-negotiable. It keeps your investment safe if construction drags or the developer hits a snag.

Open an escrow account with an ADGM- or DED-recognised bank.

Tie payment instalments to quarterly progress reports.

Check statements regularly to make sure fund release matches construction stages.

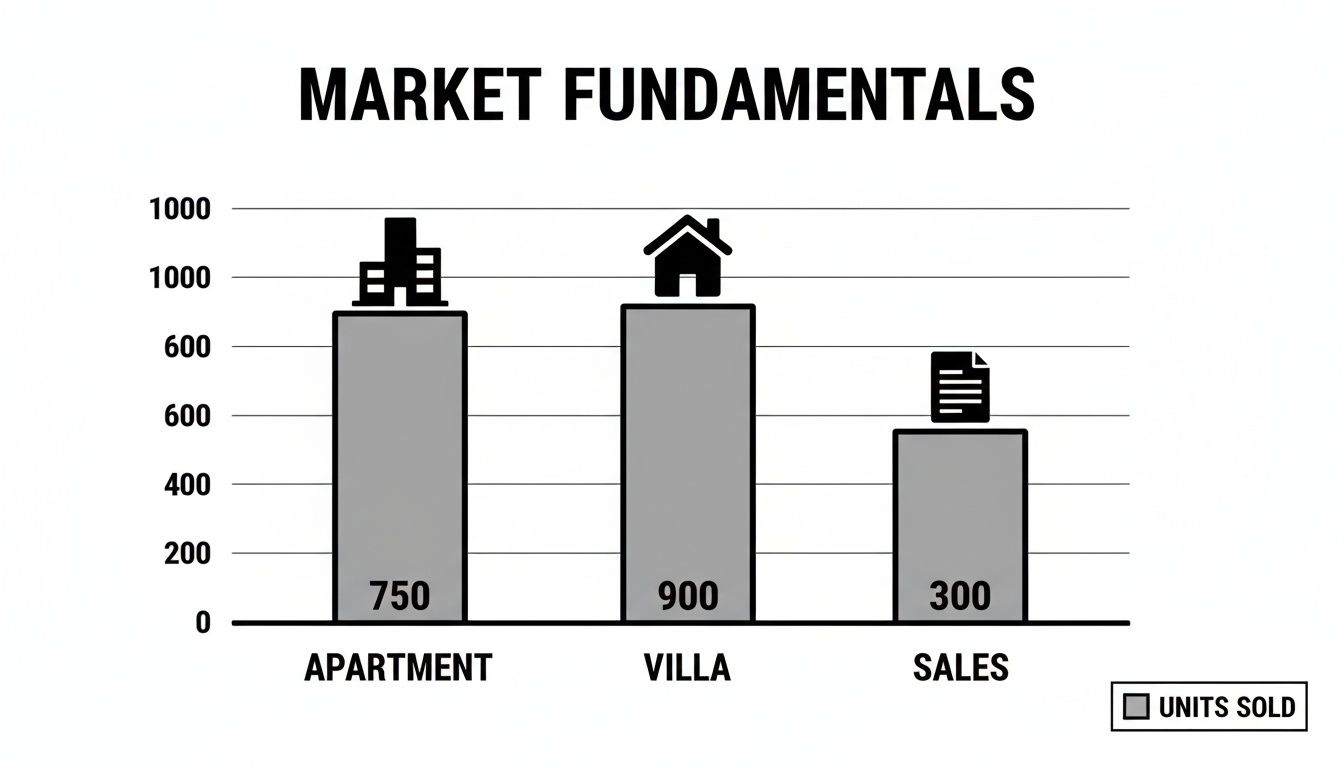

This infographic breaks down the transaction phases at a glance. It shows how ready properties lead the market in sales volumes—apartments, villas and overall deals.

Here’s a quick checklist of the documents and fees you’ll need:

Sales agreement draft with the developer

Passport and Emirates ID copies

Mortgage approval letter (if applicable)

Registration fee payment receipt

Title deed issuance fee (AED 200)

Escrow account opening charges

Common Pitfalls And Tips

Skipping mortgage clause reviews before activating escrow can cost you.

Don’t assume escrow covers every late-delivery penalty.

Always verify the developer’s licence and milestone schedule with DMT’s portal.

Engage an independent escrow audit to flag hidden risks.

Buyers should also review tenancy rules and watch for buried clauses. Learn more in our article on Abu Dhabi tenancy law guide.

With crystal-clear steps and thorough checklists, you’ll navigate the process smoothly. Credence & Co. offers accredited guidance and precise valuation services at every turn—helping developers, lenders, investors and advisers de-risk their deals.

Timelines typically range from two to four weeks. Contact us today.

Exploring Neighborhoods And Asset Classes

Abu Dhabi’s districts feel like threads in a vibrant tapestry. Each neighbourhood—whether a cultural island, a bustling leisure hub or an up-and-coming inland zone—adds its own colour and texture.

From the art galleries of Saadiyat Island to the high-energy pulse of Yas Island, every corner has a tale waiting to be discovered. Follow that thread and you’ll find where lifestyle and long-term value intersect.

Connectivity Highlights

Saadiyat Island sits just minutes from Abu Dhabi International Airport, linked by tram services that weave through cultural landmarks.

Yas precinct enjoys multi-lane highways, an expanding metro line and shuttle pods that ferry visitors to entertainment venues.

Inland communities like Al Shamkha benefit from fresh highway connections and a reliable suburban bus network.

In real estate, access often equals appeal. Areas with solid transport networks tend to hold their value and attract steady demand.

Average Price Bands And Buyer Profiles

Prices span a wide spectrum—from AED 1.2 million entry-level flats to AED 40 million ultra-luxury villas. Each segment draws a unique buyer group:

Asset Class | Price Range (AED) | Typical Buyer |

|---|---|---|

Villas | 8m–40m | HNWIs and families |

Apartments | 1.5m–5m | Professionals and expats |

Mid-tier Flats | 1.2m–2.5m | Value-conscious investors |

Luxury villas often appeal to those seeking legacy assets and spacious living.

High-rise apartments attract young professionals and expat families chasing rental returns.

Mid-tier flats draw investors focused on cost efficiency and flexible payment schemes.

Asset Class Real-World Examples

On Saadiyat Grove, waterfront villas begin at AED 10 million, blending museum-adjacent glamour with serene sea views.At Al Maryah Central, modern high-rises start from AED 2.3 million, offering sleek finishes and enviable city vistas.Meanwhile, Bay Central delivers budget-friendly apartments around AED 1.4 million, ideal for families new to the market.

Sara, a first-time buyer, tapped into an emerging inland suburb and snapped up a mid-tier flat for AED 1.15 million. Within weeks, her property was generating positive rental cash flow.

“Emerging suburbs deliver higher yields if you understand infrastructure timing,” notes a Credence & Co. analyst.

Official figures report 7,154 transactions and AED 25.3 billion in sales for Q3 2025, driven by both mid-tier and luxury segments. Read the full research about Abu Dhabi’s Q3 2025 market activity on Property Finder.

Emerging inland pockets can match coastal returns at a fraction of the price. Check out our guide on Industrial Land and Commercial Building Valuation in Abu Dhabi for more specialised insights.

Each district moves to its own pace—some with steady yields, others with rapid growth. Together, they form a dynamic Abu Dhabi real estate landscape.

Choosing Your Ideal Asset

Your choice hinges on goals and horizons. Short-term income investors often target mid-tier flats, where yields can exceed 7%. Long-term capital seekers gravitate towards coastal villas, banking on premium appreciation.

When comparing options, remember to:

Evaluate local amenities, such as schools and clinics, that underpin rental demand.

Check the developer’s track record for quality finishes and on-time handovers.

Align your plans with upcoming infrastructure milestones to anticipate value spikes.

Credence & Co.’s accredited valuations and data-driven reports can highlight hidden costs and validate your strategy.

Next Steps For Investors

Begin with a neighbourhood audit—map out schools, hospitals, price trends and future projects. Then apply our specialised metrics, like cap-rate comparisons and supply-demand indices, to benchmark your targets.

Request a detailed valuation report to confirm market value and upside potential.

Structure financing to match project timelines and safeguard cash flow.

With a clear roadmap and expert backing, you can weave the perfect investment thread. That hands-on approach turns ambition into achievement in the fast-moving Abu Dhabi real estate arena.

Start your neighbourhood exploration today and find your ideal thread in Abu Dhabi’s property tapestry.

Assessing Risks and Opportunities

Navigating Abu Dhabi’s property market often feels like reading shifting desert skies. Some days bring bright prospects; other times, dark clouds gather on the horizon.

When masterplan communities flood the market, vacancy starts to climb and yields slip. Delays in project handovers can push financing bills higher and stretch holding periods. Meanwhile, global economic gusts and changes in lending rates can whip up sudden downturns.

Oversupply Drives Up Vacancies

Delivery Delays Inflate Carrying Costs

Economic Headwinds Dampen Foreign Demand

Yet every storm eventually passes. When tourism booms around cultural hotspots, short-stay rentals surge. Fresh road and metro links spark renewed buyer interest. And a growing focus on green building draws sustainability-minded capital.

Tourism Growth Peaks During Major Events

Metro Expansions Open Up New Districts

Sustainability Standards Bolster Asset Resilience

Real Investor Examples

One family office snapped up mid-tier flats at AED 1.2 million and celebrated +15% capital gains in just twelve months.

Another fund timed its entry ahead of a new metro launch, locking in a 12% rental yield from day one.

“Understanding local timing and spreading your bets across different areas are key to managing volatility in Abu Dhabi,” explains a Credence & Co. analyst.

Risk Mitigation Tactics

Every investor needs a clear plan to weather unexpected market shifts. Balancing coastal and inland holdings smooths overall returns. Aligning exit strategies and payment schedules with construction milestones reduces financing strain. Hedging currency exposure shields portfolios from AED-pegged fluctuations.

Diversify Across Districts and Asset Types

Use Escrow-Linked Payment Schedules

Set Defined Exit Horizons and Review Points

Track Oil Prices and Visitor Arrivals as Early Indicators

Risk Driver | Mitigation Method | Expected Outcome |

|---|---|---|

Oversupply | Geographic Diversification | Lower Vacancy Pressure |

Delivery Delays | Escrow-Linked Payment Terms | Steadier Cash Flow |

Economic Headwinds | Dynamic Exit Timing Strategy | Improved Liquidity Access |

Market Volatility Insight

Sentiment can shift as unexpectedly as a sandstorm. In 2026, a new mortgage-cap announcement sparked a swift 5% correction in select neighbourhoods.

Opportunity Outlook

Several emerging hubs are set to redefine rental peaks:

Louvre Abu Dhabi welcomed 1.2 million visitors in 2025.

Masdar City’s latest phase has reignited green-tech developments.

Aldar Capital’s new platform paves the way for GCC cross-border investments.

Combining high-yield rentals with core, income-stable assets creates a balanced portfolio positioned for lasting growth.

Service Advantage

Credence & Co’s scenario-planning and modelling tools uncover hidden risks and quantify upside potential. Their DMT accreditation and RERA approval inspire confidence among developers, lenders, and investors alike.

Review Scenario Analyses Quarterly and Adjust Strategy Proactively.

Due Diligence And Valuation Checklist

Before you put pen to paper, a meticulous due diligence routine acts like a safety harness for your Abu Dhabi real estate investment. It shines a spotlight on any legal tangles or financial surprises that could surface at the closing table.

Think of this as a step-by-step roadmap—from verifying ownership to crunching valuation data. Each phase breaks down into clear, actionable tasks:

Title and Covenant Review: Match the title deeds against developer records, flag any encumbrances.

Regulatory Approval: Verify planning permissions, DMT registrations, and zoning compliance.

Site Inspection: Bring in qualified surveyors to assess structure, MEP, and finish quality.

Valuation Metrics: Use rental yield and IRR formulas alongside a comparables analysis.

Once you’ve secured the legal groundwork, it’s time to turn numbers into insights. Here are three essential formulas:

Rental Yield (%) = (Annual Rental Income / Purchase Price) × 100 Example: AED 120,000 / AED 2,000,000 × 100 = 6%

IRR uses net cash flows and time periods. Example: Achieving an IRR of 12% on a AED 1,000,000 investment over five years (assumes uniform cash flows).

Comparables-Based Valuation = Average Price per Sqft × Property Size Example: AED 2,000/sqft × 1,500 sqft = AED 3,000,000

Key Roles And Responsibilities

A diverse, multi-disciplinary team is the engine behind a smooth due diligence and valuation process. Each specialist brings vital expertise:

Surveyors perform site assessments, structural checks and quantity surveys.

Legal Advisors review title deeds, covenants, and ensure adherence to Abu Dhabi regulations.

Market Specialists analyse supply-demand dynamics, transaction data, and local comparables.

Financial Analysts build cash flow models, IRR calculations and sensitivity scenarios.

Sample Due Diligence Checklist1. Verify title deed authenticity2. Check developer covenant records3. Inspect structural and mechanical systems4. Confirm planning and zoning approvals5. Calculate rental yield and IRR metrics

This annotated list serves as a hands-on template for your next property evaluation. Keep it current—regular updates capture project changes and new regulations.

Document every site visit and centralise your records for lenders, investors and advisers. Digital tools can track completion dates and highlight outstanding tasks.

Task | Responsible Party | Key Document |

|---|---|---|

Title Verification | Legal Advisor | Title Deed Certificate |

Site Inspection | Surveyor | Inspection Report |

Rental Yield Analysis | Financial Analyst | Rental Market Report |

This breakdown clarifies ownership of each due diligence step and the documents you need on hand.

Credence & Co.’s DMT accreditation and RERA approval guarantee you stay compliant every step of the way.

Start using this checklist today to turn tasks into a reliable process. Document and review after each inspection for continuous improvement.

Template Library: Pre-filled due diligence checklists.

Workflow Guide: Step-by-step process maps.

Your clear due diligence path starts here.

You might be interested in our property valuation service at Credence & Co.

Confidently close deals with full clarity.

Begin now.

Frequently Asked Questions

When diving into Abu Dhabi real estate, investors often circle back to the same core questions. This FAQ distils years of practical experience into clear, actionable guidance—no guesswork required.

What Are Ownership Rules for Foreign Buyers

In Abu Dhabi’s key districts, non-residents enjoy full freehold rights. Outside these areas, leaseholds stretch up to 99 years, giving you long-term security while respecting local regulations. Always cross-check with the Department of Municipalities and Transport to be absolutely certain.

Saadiyat Island: Freehold

Yas Island: Freehold

Designated freehold zones across Abu Dhabi

Leasehold up to 99 years elsewhere

How Do I Assess Financing and Mortgage Options

Securing the right loan starts with comparing interest rates and loan-to-value ratios at different banks. Early conversations also help you line up the papers you’ll need, from pay slips to proof of residency.

Assessing Financing Options

Survey competitive mortgage rates and conversion fees

Map out repayment schedules and stress-test scenarios

Prepare income statements, bank statements and any salary transfer details

Seek pre-approval meetings to lock in favourable terms

Which Neighborhoods Offer the Best Rental Yields

High-growth suburbs can deliver yields north of 7%, while island communities settle around 5–6%. Your final figure depends on local amenities, occupancy trends and lifestyle appeal.

Al Reef: 7.5% average yield

Al Raha Beach: 7.2% average yield

Yas Island: 5.8% average yield

What Due Diligence Steps Protect Against Title Issues

A thorough title search with the Land Department is your first line of defence. Layer on a legal review of developer covenants to spot any hidden charges before you sign.

Always confirm title deed authenticity and developer records to avoid unexpected liens.

Due Diligence Safeguards

Validate deeds directly with the Land Department

Review all developer agreements for encumbrances

Engage a seasoned legal advisor to vet every clause

Each answer here is a building block from our wider guide, giving you rapid clarity. Bookmark these FAQs and approach your next Abu Dhabi deal with confidence.

Interested in accredited valuations, expert guidance and advisory services? Contact us for market analysis. Reach out to Credence & Co. today.