How to Purchase Property in Dubai A Practical Guide

- Credence & Co

- Dec 20, 2025

- 17 min read

So, you’re thinking about buying a property in Dubai. Fantastic choice. It's a journey that thousands have taken, and while it might seem complex at first, the process is actually incredibly clear and well-regulated. Think of it as a well-trodden path designed to protect everyone involved, turning the dream of owning a piece of this global hub into a tangible reality.

This guide is here to walk you through it, step by step.

Your Dream of Dubai Property Starts Here

Picture it: owning a slice of one of the world's most dynamic cities. Buying property in Dubai isn't just a transaction; it's your ticket to an incredible, cosmopolitan lifestyle. But with so much information out there, where do you even begin?

Consider this your personal roadmap. We're going to cut through the jargon and demystify the entire process, from figuring out your eligibility as a foreign buyer to navigating the fast-paced market. Let’s treat this like a conversation with an experienced advisor—someone who can give you the clarity and confidence to make smart, informed decisions.

A Market That’s More Than Just Booming

To say Dubai's real estate market is active would be an understatement. It's not just growing; it's setting new benchmarks. The city's magnetic appeal is pulling in investors and new residents from every corner of the globe, fuelling a remarkable expansion and creating some truly compelling opportunities for sharp buyers. This isn't just a fleeting trend; it’s a testament to the city's rock-solid economy and visionary leadership.

The numbers alone paint a powerful picture of confidence and demand. In a recent year, Dubai clocked over 197,000 property transactions, smashing previous records with values topping AED 500 billion. What’s behind this surge? A rapidly growing population and a huge appetite from investors, which has seen prime property prices jump by as much as 198% in just five years. For more on these trends, the Global Property Guide offers some fantastic historical data.

Dubai offers a unique combination of tax efficiency, high rental yields, and a world-class lifestyle. For investors, this translates into a powerful formula for wealth creation and portfolio diversification.

What to Expect on Your Journey

The path to getting those keys in your hand is structured and transparent, meticulously managed by authorities like the Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA). To help you visualise the road ahead, let’s break down the key phases.

The Dubai Property Buying Journey at a Glance

This table provides a quick overview of the essential phases you will navigate in the property acquisition process.

Phase | Key Action | Primary Goal |

|---|---|---|

Preparation & Planning | Define budget, arrange financing, set investment goals | To establish a clear financial and strategic foundation |

Search & Selection | Explore neighbourhoods, compare properties, hire an agent | To find the perfect property that meets your criteria |

Due Diligence & Legalities | Verify documents, sign initial contracts (MOU) | To ensure the property is legally sound and secure the deal |

Transaction & Transfer | Complete payment, obtain NOC, register the title deed | To finalise the purchase and officially become the owner |

Understanding these stages empowers you to move forward with certainty and control.

Each step is a move closer to your goal. The system is built to guide you, and with the right preparation, it's a journey you can navigate smoothly. For a deeper dive into what makes this market so compelling, you might find our article on why you should invest in Dubai real estate an interesting read.

Now, let's explore the critical first steps together and set you on the path to owning your perfect Dubai home.

Getting to Grips with the Dubai Real Estate Landscape

Before you even think about scrolling through listings, it’s crucial to get a feel for the unique rhythm of Dubai's property market. Your first big decision isn't about the view or the number of bedrooms; it's about which path you want to take. Are you drawn to the promise of a brand-new, off-plan property bought straight from a developer, or does the security of a ready home on the secondary market appeal more?

Each route offers a completely different journey, with its own set of challenges and rewards. The key is to align your choice with your own financial reality and what you want to achieve in the long run.

Off-Plan Dreams vs. Ready-Made Reality

The choice between a property that exists only on a blueprint and one you can walk into today will shape your entire investment experience. Buying off-plan feels like you're getting in on the ground floor. Developers often roll out attractive payment plans, and there's a real chance for your property's value to climb significantly by the time it's built. You’re essentially buying a piece of the future at today’s price.

Of course, this path demands a bit of patience and a comfort with uncertainty. Construction schedules can slip, and the market can shift between the time you sign the papers and the day you finally get the keys.

On the other hand, a ready property is all about certainty. What you see is exactly what you get. You can walk through the rooms, check the finishes, and get a real sense of the space. Best of all, you can move in or start earning rental income almost immediately. While you'll need more cash upfront, the instant gratification and near-elimination of construction risk are huge draws. For any ready property, it's absolutely vital to understand how to determine home value accurately so you know you’re making a smart buy on the secondary market.

What Does "Owning" Really Mean in Dubai?

Beyond the property type, you need to be crystal clear on your ownership structure, especially as an international buyer. Dubai has two main categories of property ownership, and the difference between them is massive.

Freehold: This is the gold standard. When you buy a freehold property in a designated area—think Dubai Marina, Downtown, or Palm Jumeirah—you own it all: the apartment or villa and the land it’s built on. It's yours, outright. You have the full right to sell it, lease it, or pass it down to your family.

Leasehold: This option gives you the right to the property for a fixed, long-term period, which can be up to 99 years. While you don't own the land itself, you can still treat the property as your own for the duration of the lease—living in it, renting it out, or selling the lease to someone else.

For most foreign investors, freehold is the ultimate prize. It offers total control and a tangible, lasting asset in one of the world's most dynamic cities.

The landmark 2002 law allowing foreigners to buy freehold property was a complete game-changer. It single-handedly transformed Dubai into the global real estate powerhouse it is today by giving international investors the security and full ownership rights they needed.

Thinking Like an Investor

So, how do you choose? It all comes down to your personal strategy. Are you playing the long game, hunting for capital growth and happy to wait for it? Or do you need that rental income to start flowing as soon as possible?

To help you decide, let's break it down side-by-side:

Feature | Off-Plan Property | Ready Property |

|---|---|---|

Initial Cost | Lower down payment, spread over time | Larger upfront cost, usually involving a mortgage |

Capital Growth | High potential for a value jump on completion | More gradual, stable appreciation over time |

Rental Income | Zero until the property is handed over | Can start earning rent right away |

Risk Factor | Market shifts, potential construction delays | Much lower risk; the property is already built |

Customisation | You might get to choose finishes and layouts | What you see is what you get; changes require renovation |

Really thinking through these points is your first piece of homework. As you weigh the pros and cons, it pays to stay on top of what the experts are predicting. Getting a sense of the Dubai real estate outlook for 2024 can give you invaluable insight into where the market is headed and what you can expect from your investment.

Getting Your Money and Your Team in Order

Alright, this is where the dream of owning a home in Dubai starts to feel real. You've got the lay of the land, and now it’s time to build the solid financial and legal foundation for your purchase. Think of this less as paperwork and more as gearing up—getting the right people and the right financial backing so you can move with total confidence.

Sorting out your finances is, without a doubt, the most powerful move you can make right now. It instantly shifts you from someone just browsing online listings to a serious, ready-to-act buyer.

First Things First: Get Your Mortgage Pre-Approval

For most expats, the journey kicks off with getting a mortgage pre-approval from a UAE bank. This isn't just a piece of paper; it's your golden ticket. It tells you exactly what your budget is, down to the last dirham.

Once you have that number, you gain incredible leverage when it's time to negotiate.

UAE banks are very familiar with lending to foreign nationals, but they do have a clear set of criteria you’ll need to tick off. The whole point is for them to get a crystal-clear picture of your financial health and decide how much they're comfortable lending you.

They'll typically ask for a few key documents:

Proof of Income: Get your salary certificates and at least six months of bank statements ready.

Identification: This is the standard stuff—copies of your passport, visa, and Emirates ID.

Employment Details: You'll likely need a letter from your employer confirming your role and salary.

The Loan-to-Value (LTV) ratio is also a big deal here. If this is your first property, you can generally expect to borrow up to 80% of its value. That means you need to have a down payment of at least 20% ready to go, plus extra for the associated fees. For a deep dive into this, our guide to mortgages in Dubai is a must-read. Broadening your knowledge on how to secure funding for real estate can also give you a strategic edge.

Here's a pro tip I share with every client: Get your pre-approval before you even start scheduling viewings. It’s non-negotiable. It signals to sellers and agents that you're a serious contender, and your offers will land with real weight.

This financial readiness is even more critical in a market that's moving as fast as Dubai's. Just recently, the city's real estate sector saw sales transactions hit around Dh64.4 billion in a single month—a massive 49% jump from the previous year. A huge part of that surge came from off-plan sales, which shot up by 72%, showing just how intense the demand is in prime areas.

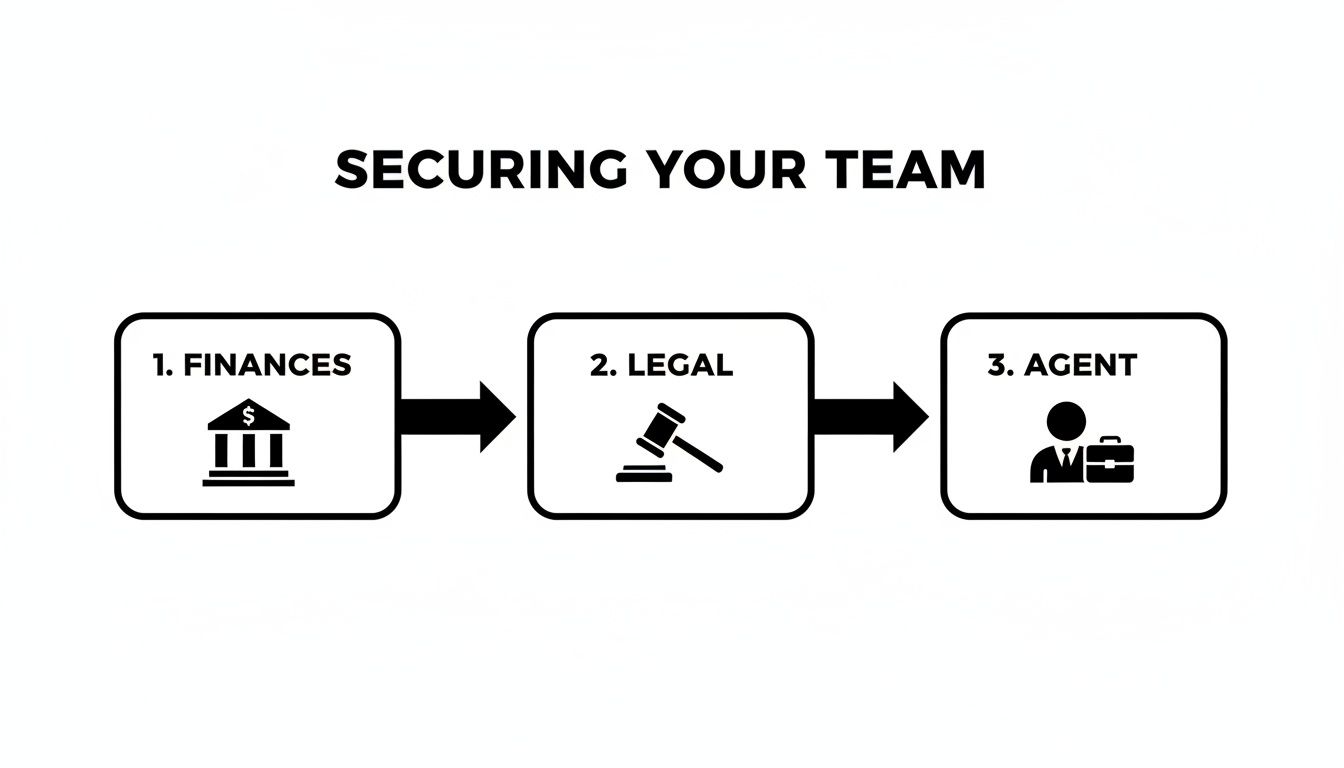

Build Your A-Team

While the bank is working on your pre-approval, it’s the perfect time to assemble your professional support team. You wouldn't climb a mountain without an experienced guide, right? The same logic applies here. These experts are your advocates, completely dedicated to protecting your interests.

Your essential team members should be:

A RERA-Certified Real Estate Agent: This person is your guide to the market. A great agent doesn't just find you listings; they give you the inside scoop on neighbourhood values, handle the back-and-forth of negotiations, and guide you through the process. Make sure they are officially registered with the Real Estate Regulatory Agency (RERA)—it's your guarantee they're held to a high professional standard.

A Conveyancer or Property Lawyer: Consider this your legal guardian. Their job is to dive deep into the due diligence, go over the Sale and Purchase Agreement (SPA) with a fine-tooth comb, and make sure every legal document is perfect. They’ll confirm the seller actually has the right to sell and check that the property is free of any messy legal claims or debts.

The Power of Proper Legal Due Diligence

Your legal team's first job is a deep dive into due diligence. If you’re buying a ready property, they'll start by verifying the Title Deed with the Dubai Land Department (DLD). This confirms the seller is the true owner. They'll also hunt for any mortgages or legal holds (known as encumbrances) that could throw a wrench in the works.

For an off-plan property, the focus shifts to a document called the Oqood. This is the initial contract registered with the DLD that spells out the property details and your payment schedule. Your lawyer will verify the Oqood, confirm the developer’s project is properly registered, and most importantly, ensure your payments are going into a secure escrow account. This is a crucial protection that keeps your money safe until the project is completed.

With your finances locked in and your expert team by your side, you're not just ready to find a property—you're ready to make a smart, confident, and successful investment.

Making It Happen: The Purchase Process

You've got your mortgage pre-approval in hand and a solid team by your side. This is where the real excitement begins—turning your Dubai property dream into a tangible reality. The path to ownership here is refreshingly clear and well-regulated, designed to give both buyers and sellers peace of mind every step of the way.

It all starts with your offer. Once the seller says "yes," things move quickly. The deal is cemented with a Memorandum of Understanding (MOU), which the Dubai Land Department (DLD) officially calls Form F. Think of this as the definitive contract that locks in the price and all the terms. At this stage, you'll put down a security deposit, typically 10% of the property's value, which your real estate agent will hold in trust until the final transfer.

Off-Plan vs. Ready: Two Paths to Your Keys

From here, the journey looks a little different depending on whether you're buying a brand-new, off-plan property or a home that's already built. It's crucial to understand these distinctions so you know exactly what to expect.

If you’ve set your heart on an off-plan property, your financial protection is the top priority. The Real Estate Regulatory Agency (RERA) has a fantastic system in place for this. All your payments must go into a government-approved escrow account. This is non-negotiable. The developer only gets to dip into those funds as they hit very specific, verified construction milestones, which gives you a powerful safety net. Your money is protected and used exactly as intended—to build your future home.

For a ready property, the critical document you're waiting for is the No Objection Certificate (NOC) from the developer. This is the golden ticket. It confirms the seller has cleared all their service charges and has no outstanding debts tied to the unit. The developer won't issue the NOC without a final inspection, which is why a professional snagging report is so valuable. To get a better sense of this, check out our guide to what a professional property inspection in Dubai and its costs involves.

As you can see, having your financial, legal, and real estate advisors lined up isn't just a suggestion—it's the foundation of a smooth and secure purchase.

The Grand Finale: Transfer Day at the DLD

The final, most rewarding moment of this whole process happens at the Dubai Land Department (DLD). This is transfer day, where ownership officially passes to you. You, the seller, both agents, and your bank’s representative (if you have a mortgage) will all meet at a DLD trustee office to finalise everything.

Here, the final payments are exchanged—usually via manager's cheques for security—and the last documents are signed. Once the DLD gives everything the final stamp of approval, they issue a brand new Title Deed with your name on it. Congratulations, you are now officially a property owner in Dubai!

I’ve seen this process countless times, and it never gets old. The DLD's efficiency is truly remarkable. Thanks to their digital systems, a transfer that could have taken weeks in other parts of the world is often wrapped up in a single day. It’s a real testament to Dubai’s commitment to making things easy and secure for investors.

Getting Real About the Costs

The purchase price is the headline number, but it’s not the whole story. To avoid any unwelcome surprises at the finish line, you need to budget for the associated fees. Getting this right from the start makes the entire closing process feel seamless and stress-free.

Here’s a clear breakdown of the costs you'll need to account for:

DLD Transfer Fee: The big one. This is 4% of the purchase price.

DLD Administrative Fees: A smaller, but necessary, charge of around AED 4,200.

Real Estate Agency Commission: This is typically 2% of the property value, plus VAT.

Mortgage Registration Fee: For those with financing, the DLD charges 0.25% of your loan amount to register the mortgage.

NOC Fee: Payable to the developer, this can be anywhere from AED 500 to AED 5,000.

Title Deed Issuance Fee: A small fee of about AED 520 to get your new title deed printed.

All in, these additional costs usually add up to an extra 7-8% on top of the property price. Factoring this into your budget from day one means you can walk into the final stages with total confidence, ready to collect your keys.

How to Avoid Common Property Buying Pitfalls

Every major investment has its potential tripwires, and buying a property in Dubai is certainly no exception. But the good news is that with a little inside knowledge, you can navigate the process like a seasoned pro and sidestep the common hurdles that catch so many others out.

Let’s be honest, it’s easy to get caught up in the excitement of the hunt. You find a place that feels right, and your imagination takes over. This is exactly when the most frequent mistake happens: underestimating the total cost of the purchase.

Most people budget for the sticker price, but the reality is you need to have an extra 7-8% of the property’s value set aside for all the associated closing costs. Forgetting to account for the 4% Dubai Land Department (DLD) transfer fee, agent commissions, and other administrative charges can lead to a serious financial shock right at the finish line.

Don't Skip Your Homework: The Power of Due Diligence

Another trap I see buyers fall into is taking everything they're told at face value. This is where your professional team—your agent, your lawyer, your valuer—becomes your most important asset. It's not about distrust; it's about smart verification.

A classic example? Relying on the seller's asking price without getting your own independent property valuation. A seller’s price is just their starting point. Without an objective assessment from a RERA-approved valuation firm, you’re flying blind. Are you paying fair market value, or are you overpaying from day one? This one simple check can save you a fortune and give you incredible leverage during negotiations.

We often see buyers, especially from overseas, who are so impressed by a property’s presentation that they overlook the fundamentals. An independent valuation isn't a formality; it's your financial shield against overpaying in a competitive market.

This is particularly crucial for ready properties on the secondary market. A professional valuer digs into recent comparable sales, the building's condition, and even future market trends to give you the true picture.

The Sale and Purchase Agreement: Your Most Important Document

The Sale and Purchase Agreement (SPA) is the legal heart of your transaction. Rushing through it or failing to have a lawyer comb through every single clause is a risk you just can't afford to take. This document locks in everything from payment schedules and handover conditions to the penalties for any delays.

Think about this real-world scenario: an off-plan buyer signs an SPA, completely missing a clause that gives the developer a huge grace period for project completion. When the handover is delayed by a year, they discover they have almost no legal recourse because they’d already agreed to the terms. A sharp lawyer would have flagged that instantly, giving them the chance to negotiate or walk away.

Here are a few critical areas your legal expert must dissect:

Payment Milestones: For off-plan deals, are payments clearly tied to tangible, verifiable construction progress?

Hidden Charges: Are there vague clauses about "community fees" or "service charges" that could balloon into massive annual bills?

Default Clauses: What are the exact consequences for both you and the seller if someone fails to hold up their end of the bargain?

Your lawyer isn't just proofreading; they are safeguarding your entire investment.

Your Pre-Purchase Due Diligence Checklist

To help you stay organised and sidestep these common mistakes, I’ve put together this practical checklist. Think of it as your final safety net before you commit to one of the biggest investments of your life. Running through these points is a non-negotiable part of how you should purchase property in Dubai.

Checklist Item | Why It's Important | Expert Tip |

|---|---|---|

Verify Title Deed/Oqood | This confirms the seller legally owns the property and that the project is officially registered with the authorities. | Have your conveyancer perform this check directly through the DLD's portal. This ensures the documents are authentic and current. |

Obtain Independent Valuation | It guarantees you're paying a fair price based on hard data, not just what the seller is asking for. | Always use a firm accredited by RERA. This ensures an unbiased and professionally sound assessment. |

Review Service Charges | This uncovers the true annual cost of maintaining the property and its common areas. High fees can seriously impact your returns. | Ask the seller or owner's association for at least two years of service charge history. Look for any sudden spikes or special assessments. |

Conduct a Snagging Inspection | This identifies any defects or shoddy workmanship in a new or off-plan property before you officially take ownership. | Don't do this yourself. Hire a professional snagging company. Their detailed report is powerful leverage to get the developer to fix everything before you accept the keys. |

When you take these proactive steps, you shift from being a hopeful buyer to a savvy, informed investor. You’ll be fully prepared for a successful and rewarding purchase.

Your Dubai Property Questions Answered

Taking the leap into Dubai property ownership is exciting, but it's natural to have questions. It’s a huge milestone, and getting clear, straightforward answers is what turns a complex process into a confident and rewarding journey.

Let's walk through some of the most common questions I hear from clients, cutting through the jargon to give you the practical insights you need.

Can Foreigners Buy Property Anywhere in Dubai?

This is usually the first question on everyone's mind, and the short answer is: in designated areas, yes, absolutely.

The UAE government brilliantly opened the market to global investors by creating specific freehold zones. In these areas, foreign nationals can purchase property with outright ownership, meaning the property and the land it sits on are yours.

Popular Freehold Areas: You’ll recognise the names instantly—Dubai Marina, Downtown Dubai, Palm Jumeirah, and Jumeirah Beach Residence (JBR), plus sprawling new communities like Dubai Hills Estate.

Outside of these zones, ownership is typically reserved for UAE and GCC nationals. However, foreigners can sometimes acquire property on a leasehold basis. This gives you the right to use the property for a long time, often up to 99 years, but the land itself isn't yours. Before you get your heart set on a place, always double-check its status with the Dubai Land Department (DLD).

What Is the Main Difference Between Off Plan and Ready Properties?

This is a classic head-scratcher for new buyers. Choosing between a home that’s still on the drawing board (off-plan) and one you can walk into today (ready) comes down to your goals, timeline, and appetite for risk.

An off-plan property often dangles the carrot of a lower price and flexible payment plans spread over the construction period. You're buying the promise of a brand-new home, hoping for a nice bump in value by the time you get the keys. The flip side? You have to wait, and there's always a small risk of delays or market changes.

On the other hand, a ready property is all about certainty. What you see is what you get. You can move in immediately or start collecting rent from day one. This route usually requires a bigger chunk of cash upfront for the down payment, but it completely removes any construction-related headaches.

Your personal strategy is everything here. If you’re playing the long game and hunting for capital growth, off-plan can be a fantastic option. But if you need an immediate home or want that rental income to start flowing right away, a ready property is your best bet.

What Residency Benefits Come with Owning Property?

For many, this is the real prize. Owning property in Dubai can be your ticket to long-term residency in the UAE through the highly sought-after Golden Visa programme.

The rules can evolve, but the current setup is incredibly appealing. An investment of AED 2 million (around USD 545,000) in property can qualify you for a 10-year renewable visa.

This isn't just for you; it extends to your spouse and children, giving your family the stability to live, and often work and study, in the UAE without needing a separate sponsor. For anyone looking to put down roots in Dubai, this benefit is an absolute game-changer. It's always a good idea to check the latest government regulations to make sure you tick all the boxes.

What Are the Typical Closing Costs I Should Budget For?

This is the one people often forget, and it can cause a real headache if you're not prepared. Never just focus on the property's price tag.

As a solid rule of thumb, set aside an extra 7-8% of the purchase price to cover all the fees and taxes. Trust me, budgeting for this from the start makes the final stages so much smoother.

Here’s a quick rundown of where that money goes:

Dubai Land Department (DLD) Transfer Fee: This is the big one, at 4% of the property’s value.

Real Estate Agent Commission: Usually 2% of the purchase price, plus 5% VAT.

Mortgage Registration Fee: If you're getting a mortgage, the DLD will charge 0.25% of the loan amount.

Developer's No Objection Certificate (NOC) Fee: For ready properties, this fee (from AED 500 to AED 5,000) confirms all service charges are paid up.

Administrative and Trustee Fees: A few smaller fees for things like title deed issuance, typically adding up to a few thousand dirhams.

Factoring these costs into your initial budget means no nasty surprises when you’re ready to close the deal. We dive into even more specific situations in our complete property buying FAQ section, so feel free to explore for more answers.

At Credence & Co., we provide RERA-accredited, independent property valuations that give you the clarity and confidence to make informed purchasing decisions. Ensure you're paying fair market value and protect your investment from day one. https://www.cnco.ae

Comments