Choosing Property Valuation Companies in Dubai

- Credence & Co

- Nov 6, 2025

- 14 min read

Picking the right property valuation company in Dubai is a crucial step for any major real estate move, whether you're getting a mortgage, finalising a sale, or simply want to know what your asset is truly worth. These firms are the ones who provide a critical, impartial assessment of a property's current market value, and they operate under some pretty strict regulatory standards.

Navigating the Dubai Property Valuation Market

Before you even start Googling for firms, it pays to understand the unique world they operate in. Dubai’s real estate scene isn't just active; it's a dynamic, fast-moving ecosystem. It's defined by constant new developments and a high volume of transactions.

For anyone involved—be it an investor, a homeowner, or a bank—a professional valuation is far more than a simple box-ticking exercise. It's a foundational piece of the puzzle, offering clarity and security in a market that can shift on a dime.

This entire process is overseen by a clear regulatory framework from the Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA). These organisations make sure every valuation is transparent and aligns with international standards. For any legitimate valuation firm, compliance isn't just a suggestion; it's mandatory.

Understanding What Moves the Market

The price tag on a Dubai property is a moving target, influenced by a whole host of factors. Getting a grip on these forces gives you the context you need to have a meaningful conversation with a valuer.

Here’s what really drives property values here:

New Infrastructure: Think about the impact of a new metro line, a bridge, or a major community park. These projects can instantly boost the appeal and value of nearby properties.

Off-Plan Launches: When a big-name developer unveils a new tower or villa community, it doesn't just add new homes; it can reset pricing benchmarks for the entire area.

Economic Policies: Government decisions, like changes to visa rules such as the Golden Visa, have a direct line to buyer demand and overall market confidence.

Global Economic Trends: As a global hub, Dubai's property market feels the ripples from broader economic shifts that influence the flow of foreign investment.

For a deeper dive into what influences property prices, you can explore the https://www.cnco.ae/post/property-value-dubai-key-drivers-of-dubai-real-estate in our detailed guide.

A valuation report isn't just a number on paper. It's a snapshot of your asset's place in a living, breathing market. It reflects everything from a new school opening down the road to a shift in international investor sentiment.

The sheer scale of this market is what makes expert guidance so necessary. The Dubai property valuation sector supports a real estate market that saw transactions worth over AED 400 billion by the end of Q3 2025. That’s a 15% jump from the same period in 2024, spread across more than 120,500 transactions.

With this level of activity, the insights from professional property valuation companies are absolutely essential for anyone looking for accurate pricing and solid market analysis. For a broader understanding of companies that specialise in various types of estimates, you may wish to visit the Microestimates Homepage.

Digging into Credentials and Finding the Right Specialisation

Alright, you've got a shortlist of potential firms. Now comes the real work: making sure they're not just talk. This part is more than just a box-ticking exercise; it's about confirming that the valuation report you get will actually hold water with banks, courts, and buyers. Let's be clear, not all property valuation companies in Dubai are built the same, and their official accreditations are where the differences really start to show.

First things first, any company you even consider must be registered with Dubai’s Real Estate Regulatory Agency (RERA). This is the absolute minimum requirement. A RERA-certified valuer is recognised by the Dubai Land Department (DLD), which means their report is legitimate for official business, whether you're securing a mortgage or settling a legal dispute. No RERA, no deal.

Why RICS Qualification Is a Big Deal

Once you've confirmed they're RERA-registered, the next thing to look for is valuers who are members of the Royal Institution of Chartered Surveyors (RICS). This is a global gold standard. Think of it as an international stamp of approval that holds its members to incredibly high ethical and professional benchmarks, all laid out in their famous 'Red Book' Global Standards.

When you hire a firm with RICS-qualified valuers, you're buying an extra layer of peace of mind. It tells you their team is serious about:

Doing things by the book: They operate with total impartiality and transparency.

Knowing their stuff: They have the right skills and are always updating their knowledge.

Looking after you: They're committed to great service and have proper procedures if things go wrong.

This international qualification is a powerful sign that a company is dedicated to quality work here in the Dubai market.

A valuation report is only as credible as the company that produces it. RERA registration makes it official, but a RICS qualification makes it world-class, assuring you that the valuation is backed by rigorous international standards.

To help you keep track, here’s a quick checklist to use when you're vetting potential firms.

Key Accreditation and Specialisation Checklist

This table is a quick-reference guide to help you verify the qualifications and expertise of potential property valuation companies.

Credential/Factor | What to Look For | Why It Matters |

|---|---|---|

RERA Registration | A valid registration number on the company's website and official documents. You can cross-reference this on the DLD website. | This is the legal minimum to operate in Dubai. Without it, the valuation is not officially recognised for mortgages, sales, or legal matters. |

RICS Qualification | Valuers listed as MRICS (Member) or FRICS (Fellow). The firm may be designated as 'Regulated by RICS'. | This signifies adherence to global best practices ('Red Book' standards), ensuring ethical conduct, competence, and reliability. |

Property Type Specialisation | A portfolio or track record of valuing properties similar to yours (e.g., residential villas, commercial offices, industrial warehouses). | The valuation methodology for a luxury villa differs hugely from that of an industrial plot. Relevant experience ensures accuracy. |

Geographic Focus | Deep experience in the specific community or area your property is in (e.g., Downtown Dubai, Jafza, Palm Jumeirah). | Hyper-local market knowledge is crucial for a nuanced and contextually aware valuation that reflects true market value. |

Using this checklist will give you a clear, structured way to compare firms and ensure you’re choosing one that is both qualified and has the specific expertise you need.

Does Their Expertise Match Your Property?

Credentials are one thing, but specialised expertise is what separates a generic valuation from a truly insightful one. The market dynamics of a beachfront villa on Palm Jumeirah are worlds away from a high-rise flat in Downtown Dubai or a massive warehouse in Jebel Ali Free Zone (Jafza).

You need a firm that genuinely understands your slice of the market. Some companies, for instance, have built their reputation on deep local knowledge, while others, like the global giants Asteco, CBRE, and Cushman & Wakefield, bring international methodologies to the table. An established player like Asteco, which has been around since 1985, offers incredible regional insight, while a global firm like CBRE often sets the benchmark for accuracy by applying worldwide standards. You can read more about top firms influencing the Dubai market on providentestate.com.

Don't be shy about asking direct questions. Ask about their recent experience with properties just like yours. A great way to see their work in action is by checking out case studies from valuation experts, which can show you their process for different types of assets. This is how you confirm their specialisation truly aligns with your needs, making sure the final report is not just a number, but an accurate, context-aware assessment of your property's value.

Evaluating Their Valuation Methods and Reports

The final number on a valuation certificate is just the tip of the iceberg. What really matters is how the company got to that figure. This is where the methodology comes in, and it's what separates a reliable, defensible report from a risky guess. Honestly, not all property valuation companies in Dubai apply the same level of rigour, so you need to know what you’re looking for.

At the end of the day, valuers here in Dubai lean on three internationally recognised approaches. The right one for the job really just depends on the property itself.

The Three Core Valuation Approaches

A seasoned valuer will know exactly which method to use based on the property’s type, age, and whether it’s generating income.

The Sales Comparison Approach: This is your bread and butter for residential properties. Think of it like this: if you have a two-bedroom apartment in Dubai Marina, the valuer will dig into recent sales of similar apartments in the same tower or nearby buildings. From there, they’ll make smart adjustments for things like a better view, a higher floor, or a brand-new kitchen to nail down the value.

The Cost Approach: This one comes into play for unique properties where you can't just find easy comparisons—like a custom-built villa on the Palm, a school, or a freshly completed building. The logic is simple: what would it cost to build this exact property from the ground up today? They calculate that replacement cost and then subtract depreciation for any wear and tear.

The Income Approach: If you’re looking at a commercial or income-generating property, like a tenanted office building or a block of rental apartments, this is the go-to method. It’s all about the money it brings in. The valuer assesses the property’s worth based on the net income it generates from rent. The higher and more reliable that rental income is, the higher the valuation.

If you want to dive deeper into these techniques, our guide on property valuation methods and their applications breaks it all down.

What a High-Quality Report Looks Like

Beyond the method, the report itself speaks volumes about a company’s professionalism. If you get a flimsy, one-page summary, that’s a massive red flag. A proper report should be a comprehensive document that tells the full story of your property's value.

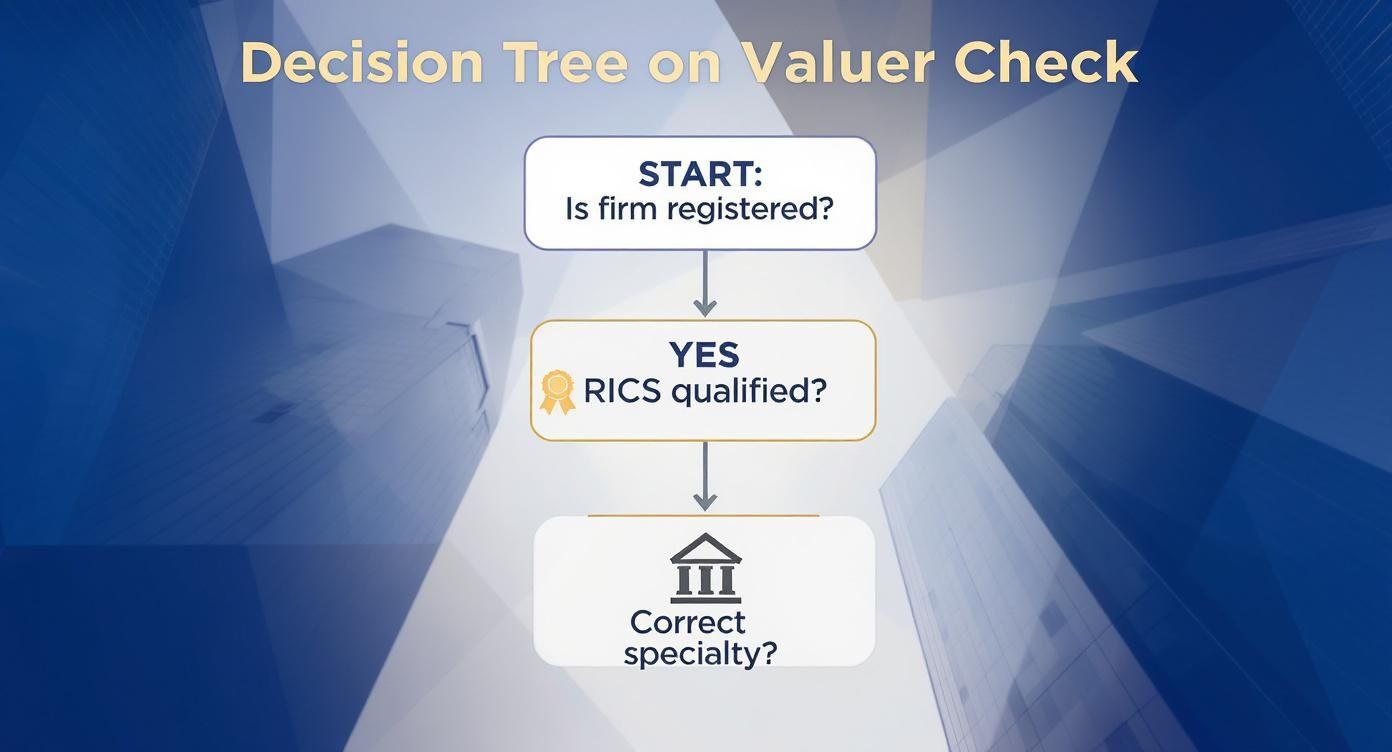

This infographic gives you a quick visual guide to make sure you're starting off on the right foot with a qualified firm.

As you can see, fundamental checks like RERA registration and RICS qualification are the absolute first things to confirm before you even consider a firm's specific expertise.

A great valuation report doesn't just give you a number; it gives you the evidence. It should walk you through the logic, data, and market context so clearly that you can understand precisely how the final value was determined.

So, what should you be looking for in the report? Make sure it includes these key elements:

Detailed Market Analysis: The report should talk about current market conditions, recent trends, and the outlook for that specific neighbourhood or community.

Strong Comparable Data: If they used the sales comparison approach, the report must list the exact properties they compared yours to, complete with photos, addresses, and sale dates. No hiding the evidence.

Clear Justifications for Adjustments: Every tweak they make needs to be explained. If they add value for a premium view or subtract it for a poor layout, they need to show their work and justify the amount.

A shallow report is almost always the result of a shallow process. When you get a thorough, well-documented report from one of Dubai's top property valuation companies, you’re not just getting a number—you’re getting the confidence to make a major financial decision.

Weighing Up the Costs, Speed, and Service

Once you've shortlisted a few firms based on their credentials, it's time to dig into the practical side of things. How much will it cost, how quickly can you get the report, and what's the service actually like? These factors can make a huge difference, especially when you’re on a tight deadline for a mortgage or trying to close a deal.

What Should You Expect to Pay?

First up, let's talk about fees. In Dubai, most valuers will either charge a fixed fee, especially for standard residential properties, or a fee that’s a small percentage of the property's final value. A fixed fee is great because you know exactly what you're paying upfront, which is perfect for a common property type, like a two-bedroom apartment in Dubai Marina or a villa in The Springs.

A word of caution, though: don't just jump at the lowest price. A quote that seems too good to be true probably is. It could mean they're cutting corners, using old data, or have junior valuers on the job. The aim isn't to find the cheapest valuation, but one that offers fair market value for a genuinely accurate report. Skimping here could cost you a lot more down the line.

How Quickly Will You Get the Report?

Time is almost always a critical factor. For a standard apartment or villa, a good firm should have the full valuation report back to you within 3 to 5 business days following the physical inspection. Of course, more complex assets—think commercial buildings or an entire portfolio of properties—will naturally take longer.

It’s smart to get a clear timeline from the very beginning and ask what might slow things down. Common culprits include:

Trouble getting in: Sometimes, scheduling the inspection with a tenant or building manager can be tricky.

Paperwork delays: The valuer can't start without key documents like the title deed or floor plans.

Unique properties: A one-of-a-kind property will always require more digging and analysis.

A truly professional company will be upfront about these possibilities and manage your expectations from the get-go.

Think of your first phone call or email exchange as a test run. If the team is responsive, knowledgeable, and professional from that initial contact, it's a strong sign you'll get a high-quality report without any headaches.

Don't Overlook the Importance of Good Service

Finally, never underestimate the value of good old-fashioned customer service. The way a firm communicates with you often reflects the care and attention they put into their actual valuation work.

When you make that first enquiry, take note of how they handle it. Do they answer your questions thoroughly? Do they sound like they know what they’re talking about? A good team will walk you through the entire process, tell you exactly what documents they need, and keep you in the loop. That kind of communication doesn't just make for a pleasant experience; it gives you the confidence that your property is in the right hands.

Doing Your Homework: Asking the Right Questions

Alright, you've shortlisted a few firms that look good on paper. Now it’s time to dig a little deeper. This is where you go beyond their polished websites and brochures to get a real feel for how they operate. Proper due diligence is about more than just ticking boxes; it's about asking pointed questions that reveal a company's true expertise.

First, hunt for real client feedback. I don't mean the glowing testimonials on their homepage. Look them up on Google Reviews, professional forums, or even LinkedIn to see what past clients are really saying. You’re looking for patterns in their performance, accuracy, and professionalism.

A property valuation isn’t a product you just buy off the shelf. It’s a professional service built on trust and communication. While it’s a different field, the principles in this guide on how to choose an agency that won't waste your budget are surprisingly relevant here—it’s all about finding a reliable partner.

Can They Talk the Talk? Probing Market Expertise

The right questions will quickly separate a seasoned valuer from someone just plugging numbers into a template. You need to test their understanding of the specific micro-market where your property sits. Are they just pulling data, or are they actively interpreting it based on on-the-ground experience? A top-tier valuer can discuss hyper-local trends with genuine confidence.

Think about it: the difference between a valuation for a villa in Arabian Ranches and one in Jumeirah Islands isn't just about square footage. It's about school catchments, new road access, community fees, and upcoming retail developments.

Getting a Feel for Their Process

Beyond market knowledge, you need to understand their internal process. What happens if there's a disagreement? How do they handle unique situations? A professional outfit will have clear, structured procedures and won't be flustered by these questions. This is your chance to see how they operate under pressure and what your options are if things don't go as planned.

A confident valuer will welcome tough questions. They see it not as a challenge, but as a chance to demonstrate their expertise and transparent process, building your trust before the engagement even begins.

This diligence is more critical than ever. In Q1 2025, residential mortgage transactions in Dubai jumped by 24% year-on-year, with a total value of AED 20.4 billion. With this much activity, banks and buyers need valuations they can absolutely trust.

To help you get the answers you need, I’ve put together a list of essential questions.

Essential Questions to Ask Your Valuer

Asking direct questions is the best way to gauge a firm’s suitability. This table covers the key areas you need to explore to ensure you're making an informed choice.

Question Category | Specific Question to Ask |

|---|---|

Market Knowledge | "What are the key value drivers you're seeing for properties like mine in this specific community?" |

Recent Activity | "How have recent infrastructure projects or policy changes in Dubai affected values in this area over the last six months?" |

Comparable Sales | "Which comparable properties did you recently value nearby, and what key differences influenced their final figures?" |

Dispute Resolution | "What is your standard procedure if I disagree with the final valuation figure?" |

Unique Features | "How do you account for unique or unpermitted property upgrades that may add value?" |

Communication | "Who will be my direct point of contact, and what is your protocol for updates during the valuation process?" |

By asking these smart questions upfront, you're not just hiring a company; you're partnering with an expert you can depend on. It’s the final, crucial step to ensure you’re working with one of the best property valuation companies in Dubai.

Common Questions About Property Valuations

Even after you've done your homework and shortlisted a few firms, you'll probably still have some questions floating around. That's completely normal. Choosing from the many property valuation companies in Dubai is a big deal, and getting answers is key to feeling confident about your financial decisions. Let's tackle some of the most common questions we hear all the time.

How Often Should I Get My Dubai Property Valued?

For your own records, just to keep an eye on how your asset is performing, getting a valuation done every two or three years is a pretty good rule of thumb. It helps you stay in touch with your investment's growth.

However, the second you need it for any official reason—think refinancing a mortgage, getting ready to sell, or even just updating your home insurance—you'll need a fresh, up-to-date report. It's not optional at that point.

And for serious investors managing a portfolio in a market as dynamic as Dubai's? Many find it pays to get an annual valuation. It gives them the hard data they need to track performance accurately and make sharp, timely decisions.

Can I Challenge a Valuation Report I Disagree With?

Yes, you absolutely can, and you should if you feel the number is off.

Your first move should be to pick up the phone and have a calm, professional conversation with the valuer. Ask them to walk you through their process. This is your chance to point out anything they might have missed—maybe you just finished a high-end kitchen renovation or have data on a recent private sale next door that wasn't public.

If that conversation doesn't resolve things and you still believe the valuation is inaccurate, you have a couple of solid options. You can ask for an internal review, where a more senior valuer at the same company takes a second look. Or, you can bring in another RERA-registered and RICS-certified firm to conduct a completely new, independent valuation. This gives you a fresh set of eyes and a valuable point of comparison.

A good valuer will never be defensive about their work. They should be able to stand by their report and clearly explain the 'why' behind their final figure, backing it up with market evidence and comparable sales data.

What Is the Difference Between a Bank and Independent Valuation?

The real difference comes down to who they're working for and why.

A bank valuation is done for one reason: to protect the bank's money. It’s all about assessing their risk before they lend you hundreds of thousands, or even millions, of dirhams. Because of this, they often lean towards a more conservative figure. It’s their safety net.

An independent valuation, which you commission yourself, serves your interests. You might need it for a potential sale, a private purchase agreement, sorting out inheritance, or just for smart asset management. The valuer takes a much broader view of the market, free from the tight constraints of a lender's risk department.

Do All Renovations Increase My Property Value?

Not always, and almost never on a one-to-one dirham basis.

Upgrades that add real function and have wide appeal, like a modern kitchen or a beautifully renovated bathroom, usually give you the best bang for your buck. Buyers see immediate value in these. They're practical, desirable improvements.

On the flip side, highly personal renovations can be a gamble. That custom-built home cinema you love might not add much to the valuation because the average buyer might just see it as a bedroom they have to convert back. A valuer has to look at it through the eyes of the general market, focusing on the quality of the work, its functionality, and whether it’s something most people would actually want.

For an accredited, technically robust valuation that provides clarity for your next major decision, trust the experts at Credence & Co.. Our RICS-qualified team delivers precise, RERA-compliant reports for all property types. Learn more about our valuation services.

Comments