Find the Best Property Valuation Company in Dubai

- Credence & Co

- Dec 4, 2025

- 16 min read

Updated: Dec 5, 2025

Choosing the right property valuation company in Dubai is one of the most critical steps you'll take in your real estate journey. It’s the foundation for a smart investment, a fair sale, or a smooth mortgage approval. In a market as fast-paced as Dubai's, an accurate appraisal isn't just a number—it's your most powerful tool, turning uncertainty into confident, strategic action.

Your Guide to Smart Real Estate Decisions in Dubai

In Dubai’s vibrant property scene, a valuation report is so much more than a formality. It’s a strategic asset that gives you clarity and, frankly, leverage. Stop thinking of it as a box to tick for the bank. Instead, see it as the bedrock upon which you build solid financial decisions. A sloppy or inaccurate valuation can cost you dearly, whether you end up overpaying for a new villa, selling your apartment for less than it's worth, or having a lender pull the plug on your financing.

I want to cut through the industry jargon and show you the real-world impact of a precise appraisal. My goal is to give you a practical framework for picking a firm that genuinely gets the unique rhythm of Dubai's property market.

The Power of an Accurate Valuation

Let me share a quick story. An investor was eyeing a portfolio of apartments in Downtown Dubai. On the surface, the seller’s price looked fair. But to be sure, the investor hired an independent property valuation company in Dubai. Their deep-dive report uncovered subtle market shifts and recent sales the seller had conveniently ignored. The verdict? The portfolio was overvalued by nearly 8%.

Armed with that concrete, data-driven report, the investor walked into negotiations with total confidence and secured a much, much better price. This is what I mean when I say knowledge is power. A meticulous valuation delivers that knowledge, transforming a risky gamble into a calculated win. You have to see this service not as an expense, but as an essential investment in your financial success.

A professional valuation isn’t just about confirming a price. It's about revealing the complete story of a property's true worth, right here, right now. It's the difference between guessing and knowing.

Navigating Your Selection Process

Finding the right valuation partner doesn't have to be complicated if you have a clear plan. I'll walk you through a structured way to assess potential firms, looking at their credentials, their specific areas of expertise, and the quality of their reports. A great place to start is by understanding what actually drives property values here, which you can learn more about in our article on the https://www.cnco.ae/post/property-value-dubai-key-drivers-of-dubai-real-estate.

And if you're looking at new developments, visualising the final product is everything. It's worth exploring the tools for creating stunning architectural designs that bring these projects to life. By the time we're done, you'll be ready to choose a firm that delivers more than just a figure—they’ll give you confidence and clarity.

Decoding the Credentials That Truly Matter

When you start looking for a property valuation company in Dubai, you'll be flooded with websites promising the world—quick reports, low fees, you name it. But before you get dazzled by the sales pitch, there's a fundamental check you need to make. This isn't just about ticking a box; it's about protecting your investment and ensuring complete peace of mind.

The Dubai property market is built on a foundation of trust and strict regulations. Trying to navigate it without a properly certified guide isn't just risky; it's a financial gamble. The credentials a firm holds aren't just fancy logos for their website—they are your guarantee of ethical conduct, technical skill, and adherence to global standards.

The Gold Standard: RICS Regulation

In the property world, one name stands head and shoulders above the rest: RICS, the Royal Institution of Chartered Surveyors.

If a firm is "Regulated by RICS," you can stop your search right there. This is your most important filter. It means the company is committed to the highest international standards of practice, laid out in what's known as the Red Book Global Standards.

This isn't a one-time membership. RICS-regulated firms are under constant scrutiny, facing regular audits and a strict ethical code. This rigorous framework ensures every report they produce is impartial, backed by solid evidence, and created with total integrity. Think of it as a quality seal of approval recognised by major banks, legal teams, and serious investors across the globe.

Choosing a RICS-regulated valuer means you're protected. Their methods are sound, their work is transparent, and they are fully accountable for their advice. That’s what turns a simple valuation into a credible, bankable document you can rely on.

Understanding the Local Regulatory Landscape

While RICS sets the global benchmark, local accreditations are just as critical. A top-tier property valuation company in Dubai will always hold key local credentials, ensuring they're aligned with regional laws and market nuances.

RERA (Real Estate Regulatory Agency): As part of the Dubai Land Department (DLD), RERA is the chief regulator for the entire Dubai real estate sector. A RERA-certified company is officially licensed to operate, meaning its reports are legally recognised for everything from sales and inheritance to mortgage applications.

TAQEEM: This is the Dubai Real Estate Appraisal Centre, another vital DLD entity that specifically licenses and monitors valuation professionals. TAQEEM accreditation proves a valuer has met specific local competency standards and is approved to provide official valuations in Dubai.

Picture this: you’re about to finalise the mortgage on your dream villa in Arabian Ranches. The bank rejects it at the last minute. Why? The valuation came from a firm that wasn't properly accredited. All that time, effort, and excitement—gone. It’s a completely avoidable disaster.

Now, imagine the alternative. You hire a RICS-regulated and RERA-approved firm from day one. Their report is robust, detailed, and immediately accepted by your lender. The whole process glides forward without a hitch. That’s the real-world difference credentials make. They remove the risk from your transaction and pave the way for a successful outcome.

To get ahead of the game, it helps to understand what goes into a professional assessment. For a closer look, you can explore the key components of professional property valuation services and see how these credentials directly impact the quality of your report.

Ultimately, vetting a firm’s qualifications isn't just a preliminary step—it’s the cornerstone of a confident and secure real estate decision.

Understanding the Valuer's Toolkit: Core Property Valuation Methods

When you partner with a property valuation company in Dubai, you're not just paying for a number on a page. You're investing in the expertise behind that number. A huge part of that expertise lies in knowing how to value a property, because the methodology is everything.

Think of it this way: you wouldn't value a sleek Jumeirah villa the same way you'd assess a bustling warehouse in Jebel Ali. Each asset has a unique story, and the right valuation method is what allows a valuer to tell that story accurately. Getting this right from the start is the difference between a reliable figure and a shot in the dark.

The Sales Comparison Approach: What’s Happening in the Neighbourhood?

This is the bread and butter for most residential properties, whether it's an apartment overlooking the Dubai Marina or a family villa in Arabian Ranches. The logic is beautifully simple: a property is worth what people are currently paying for similar ones nearby.

A seasoned valuer dives deep into recent sales data, looking for "comps" – comparable properties that have sold in the last few months. But it's far from a copy-paste job. They meticulously adjust the value based on what makes your property unique:

Size and Layout: Is your two-bedroom apartment a spacious 1,200 sq. ft. while the one next door was only 1,000? That matters.

View and Floor Level: A penthouse with a full sea view will always command a premium over a ground-floor unit facing the car park.

Condition and Upgrades: That brand-new, German-engineered kitchen you installed? A good valuer will factor that in.

Building Amenities: Does your tower have a state-of-the-art gym and a resort-style pool that others in the area lack? That’s a value-add.

It’s a detailed, almost forensic, analysis. The goal is to synthesise all these micro-details to arrive at a value that reflects your property’s true place in today’s market.

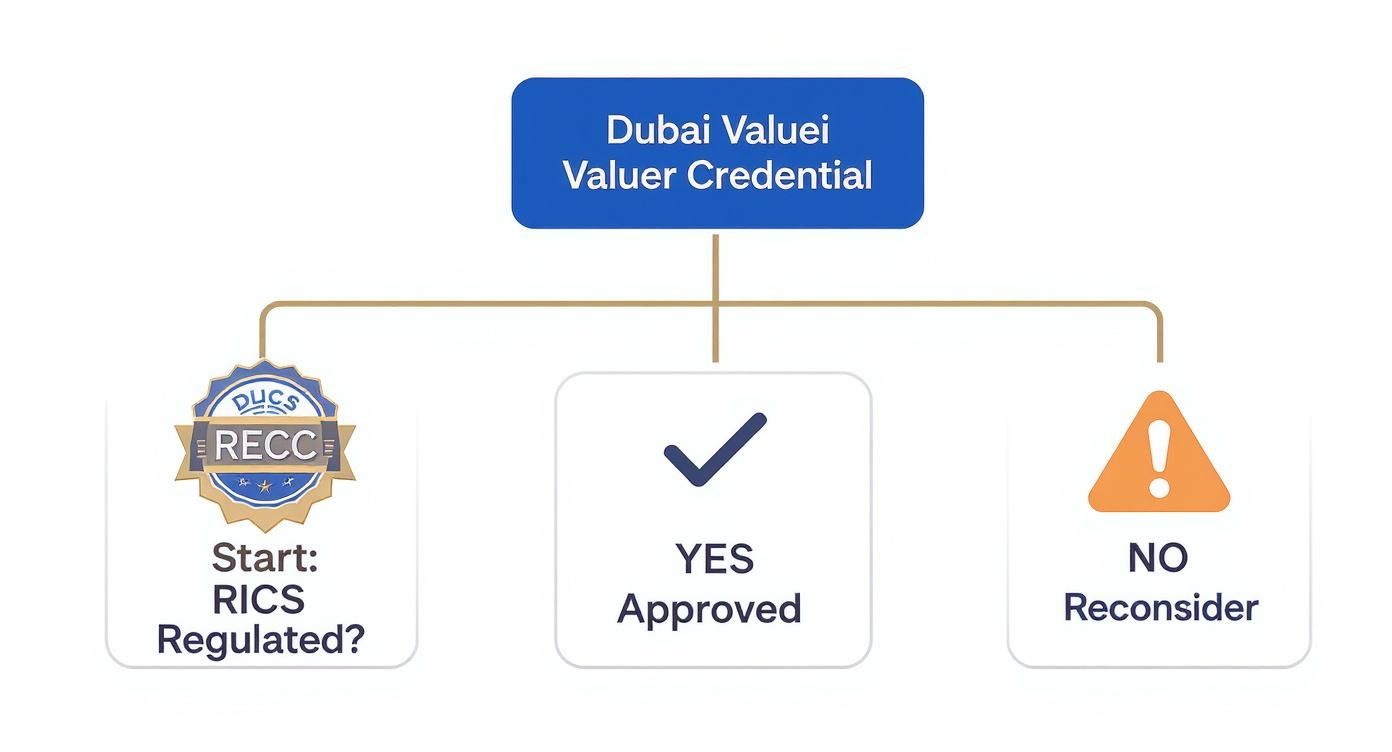

Before you even get to their methods, a quick check on a valuer's credentials can save you a world of trouble. This flowchart breaks it down.

As you can see, credentials like RICS regulation aren't just a nice-to-have; they are a fundamental starting point for finding a reliable partner.

The Income Approach: It's All About the Revenue

Let’s switch gears to commercial real estate—think of a gleaming office tower in DIFC or a portfolio of retail shops. For these assets, the narrative changes. It’s less about a beautiful view and more about the bottom line. How much income does it generate?

This is where the Income Approach shines. It’s all about the property's power to produce cash flow. Valuers will analyse the rental income, factor in potential vacancies, and subtract all operating expenses to arrive at the Net Operating Income (NOI).

From there, they apply what’s known as a "capitalisation rate" (or cap rate) to determine the property's current value. It’s a crucial metric in the world of investment real estate, and it pays to understand how to accurately calculate the capitalization rate and what it says about a property's performance.

When valuing an income-generating asset, you’re not just buying bricks and mortar; you are buying a future income stream. The property's value is a direct reflection of its profitability.

The Cost Approach: Valuing the Unique

So, what happens when there are no comparable sales and no rental income to analyse? Imagine a brand-new school, a custom-built factory, or a one-of-a-kind public building.

Enter the Cost Approach. This method asks a straightforward question: what would it cost to build this exact property from the ground up today? The calculation starts with the current value of the land, adds the total cost of construction (labour, materials, everything), and then subtracts depreciation for any wear and tear or obsolescence.

While less common for standard properties, this approach is indispensable for new developments, insurance valuations, and specialised assets. If you're keen to go deeper, exploring the purpose and applications of property valuation provides a fantastic overview of how these methods fit into the bigger financial picture.

Finding a True Specialist: How to Assess a Firm's Niche Expertise

Let's be clear: Dubai’s property market isn’t one big, uniform landscape. It's a vibrant mosaic of dozens of micro-markets, each with its own rhythm and rules.

The skills needed to value a sprawling villa on Palm Jumeirah are worlds away from what’s required for an off-plan apartment in Business Bay or an industrial plot in Jebel Ali. A generalist firm, one that claims to do it all, simply can’t master these nuances. A one-size-fits-all approach just doesn't work here.

You need a property valuation company in Dubai that not only understands your asset type but lives and breathes that specific segment of the market.

Beyond the Generalist Approach

Think of it this way: you wouldn't ask your family doctor to perform open-heart surgery. So why would you trust a generalist valuer with your most significant asset? You need a specialist who has a deep, proven track record in your property’s specific niche.

It’s about so much more than just plugging numbers into a spreadsheet. It’s about understanding the subtle, often unseen, forces that shape value.

Take a retail space in a major mall, for instance. A true commercial specialist won’t just look at the square footage. They’ll be digging into changing footfall patterns, analysing consumer spending trends, and even assessing the financial health of neighbouring tenants. These are critical details a residential-focused valuer might completely overlook, leading to a valuation that's way off the mark—a mistake that could cost you dearly.

This is where you need to get forensic in your vetting process.

Digging Deeper with the Right Questions

Don’t be shy about asking direct, pointed questions that reveal their real-world experience. You want to see evidence, not just hear claims.

Before you commit, it’s a good idea to create a checklist of key questions. This helps you compare different firms systematically and ensures you don't forget anything important during your conversations.

Key Questions to Ask a Property Valuation Company

Category | Question to Ask | What a Good Answer Looks Like |

|---|---|---|

Property Type Focus | "What percentage of your valuations in the last year were for properties similar to mine (e.g., luxury villas, commercial offices, industrial warehouses)?" | A specific percentage, backed by examples. "Around 40% of our work is in the high-end villa market, particularly in Emirates Hills and the Palm. We just completed three valuations there last month." |

Geographic Specialisation | "Can you share a recent case study or example of a property you’ve valued in my specific area, like Downtown Dubai or JVC?" | A confident, detailed response. "Certainly. We recently valued a three-bedroom apartment in the Burj Khalifa. We had to account for the service charge variations and the premium for higher floors, which is a key value driver there." |

Team Expertise | "Who on your team specialises in this asset class, and what is their background? Will they be the one handling my valuation?" | Naming a specific RICS-certified valuer and outlining their years of experience in that sector. "Our commercial lead, Sarah, will handle this. She has 15 years of experience focused solely on Dubai's office market." |

Complex Scenarios | "Have you ever handled a valuation for a distressed asset or a property with tenancy disputes in this sector?" | A "yes" with a non-confidential overview of the process, demonstrating they can handle complexity beyond a simple transaction. |

Strong answers will be specific and packed with tangible proof. This level of granular expertise is also why partnering with broader experts, like those detailed in our guide to the best real estate consulting companies, can offer a significant strategic edge.

A good firm won't just give you a number; they'll give you the story and the data behind it.

The Power of Market Nuances

Dubai's property market is in constant motion. We see huge price variations across different communities, with average prices fluctuating anywhere from AED 1,100 to AED 1,400 per square foot.

Right now, the villa segment is particularly hot, with median asking prices climbing by 8% year-on-year, fuelled by a post-pandemic demand for more space. This is precisely why a top-tier property valuation company in Dubai needs to be on the pulse of the market, armed with real-time data.

The best RICS-regulated firms don’t just follow the market; they contribute to its understanding by publishing their own proprietary data, like the highly respected ValuStrat Price Index (VPI). This data-first approach provides a solid, empirical foundation for every valuation they produce.

When you hire a specialist, you're not just getting a valuation. You're gaining access to a deep well of market intelligence that can inform your entire investment strategy.

Ultimately, matching your property with a firm that has a deep, proven history in that specific niche is the final, non-negotiable step. It’s the most important filter in your entire selection process.

This ensures the number you receive is not just accurate, but genuinely insightful. It's how you move from simply getting a valuation to making a truly empowered financial decision.

Getting to Grips with the Final Report and Client Experience

The valuation report is more than just a document; it’s the tangible outcome of all the expertise, research, and analysis you’ve invested in. This is the piece of paper that can make or break a negotiation, secure that crucial financing, or give you the confidence to move forward with a major investment. A flimsy, poorly justified report will crumble under pressure, whereas a robust, detailed one becomes your most powerful asset.

But here’s something many people overlook: the quality of the report is only half the story. The way a firm treats you—their responsiveness, clarity, and willingness to explain the nuts and bolts—is what separates a simple transaction from a genuine partnership. A top-tier property valuation company in Dubai excels at both, leaving you feeling empowered and informed, not just holding a document with a number on it.

What a High-Quality Report Actually Looks Like

When that PDF lands in your inbox, resist the urge to just scan for the final figure. A truly professional valuation report is a masterclass in transparency and evidence-based logic. It should be comprehensive enough to stand on its own, walking the reader through a clear, defensible journey to its conclusion.

So, what should you be looking for?

A Deep Dive into the Property: This needs to go way beyond basic square footage. It should cover the legal description, unique features, the property's current condition, and any recent upgrades or notable flaws.

Insightful Market Analysis: The report must paint a clear picture of the local market right now. Think trends, supply-and-demand dynamics, and the economic pulse of that specific Dubai neighbourhood.

The All-Important Comparables: For any residential property, this is non-negotiable. The report has to list the comparable properties used, complete with photos, sale dates, and a clear breakdown of adjustments made to account for any differences.

Transparent Valuation Method: It should state exactly which approach was used—like Sales Comparison or Income—and, crucially, why that was the best fit for your specific asset.

The real strength of a report is in the story it tells with data. It should leave no room for ambiguity and be ready to withstand scrutiny from banks, potential buyers, or legal advisors. Knowing what to watch out for is half the battle, and our guide on the eight typical pitfalls to dodge when pursuing a property valuation service can help you avoid common mistakes.

Why Great Communication is a Game-Changer

Picture this: you receive a complex financial report with a multi-million dirham figure, but there’s no one to help you make sense of it. A fantastic valuation experience isn't just about accuracy; it's about the human connection.

This is where the good firms are separated from the great ones. A truly professional property valuation company in Dubai knows their job isn't over when they hit 'send'. They should be accessible, ready to field your questions, and able to explain their reasoning in plain English, not impenetrable jargon.

A valuation report should provide clarity, not confusion. The firm's willingness to explain the 'why' behind the number is a powerful indicator of their professionalism and commitment to their clients.

This is especially vital in Dubai's buzzing mortgage market. In a recent quarter alone, the city saw 9,300 residential mortgage transactions, a staggering 24% jump from the previous year. The value of these deals soared to AED 20.4 billion, up 46.8%, which shows properties are securing much larger mortgages. This puts immense pressure on valuation reports, as lenders depend entirely on their accuracy to approve loans and manage risk.

Don't Forget Turnaround Times and Transparency

Finally, let's talk logistics. In a market as fast-paced as Dubai, timing is everything. A valuation that drags on for weeks can completely derail a time-sensitive deal.

Before you commit, get a clear promise on their turnaround time—from the day of the inspection to the moment you receive the final report. For most standard properties, the industry benchmark is around 3 to 7 working days. You should also ask about their process. A transparent firm will have no problem outlining their workflow, so you’re never left wondering what’s happening. It’s this powerful combination of a bulletproof report and stellar client service that marks a true industry leader.

Answering Your Top Valuation Questions

Even with a solid plan, it's natural to have questions pop up as you get closer to the valuation itself. Getting clear answers is what turns uncertainty into confidence, especially when making major real estate decisions. Let’s tackle some of the most common queries we hear from clients in Dubai, moving beyond the theory to get into the practical details that truly matter.

Think of this as your personal FAQ, designed to clear up those last-minute "what ifs" and "how-to's" that can make all the difference.

How Long Does a Property Valuation in Dubai Typically Take?

This is usually the first question on everyone's mind, especially when deadlines are looming. Generally, you can expect the entire process—from the initial site visit to having the final report in your hands—to take between 3 and 7 working days.

The on-site inspection itself is surprisingly quick, often wrapped up in just 30 to 60 minutes. The real heavy lifting happens back at the office. The valuer spends the next few days deep in market research, poring over comparable sales data, and carefully drafting the comprehensive report that you'll receive.

Of course, complexity matters. A standard apartment in a well-known tower will be a much quicker job than, say, a sprawling industrial warehouse or a unique commercial asset. If you’re working against the clock for a mortgage offer or a sales agreement, make sure you flag this upfront and get a firm timeline from your chosen company.

What Is the Difference Between a Bank Valuation and an Independent Valuation?

This is a crucial point that often trips people up, but getting it right puts you in a much stronger position. They might sound similar, but they serve two completely different masters.

Bank Valuation: This is ordered by the bank, for the bank. Its one and only purpose is to ensure the property is sufficient security for the loan they're about to issue. Because of this, the final figure often leans conservative to minimise the bank's risk. You don't own this report—the bank does.

Independent Valuation: This is a report you commission as a buyer, seller, or owner. It's designed to give you an unbiased, true-to-market value for all sorts of reasons—selling, negotiating a purchase price, accounting, or just strategic planning. You own this report, giving you an impartial and powerful tool for your next move.

An independent valuation equips you with objective knowledge. A bank valuation simply protects the lender. Knowing which one you need, and when, is a cornerstone of any smart real estate strategy.

Can I Challenge a Valuation if I Disagree with the Result?

Absolutely. If you review the report and feel the final figure is off the mark, you have every right to challenge it. Any professional, RICS-regulated firm will have a clear, formal process for handling these appeals.

Your first move should be to contact the property valuation company in Dubai and formally request a review. But here's the key: you can't just say you don't like the number. You need to back up your claim with solid evidence.

Come prepared with things like:

Recent Comparable Sales: Found a few similar properties in your building or community that sold for more, which weren't in the report? Bring the details.

Missed Upgrades: Did you complete a high-end kitchen renovation or install a smart home system that the valuer might have missed? Provide the invoices and photos.

Factual Errors: Sometimes, it’s a simple mistake. Is the square footage wrong? Is the number of bedrooms or bathrooms incorrect? Point it out.

A reputable firm will always take your evidence seriously. They'll either give you a well-reasoned explanation for their original figure or, if your evidence is compelling, they'll issue a revised valuation.

How Much Does a Property Valuation Cost in Dubai?

There's no one-size-fits-all answer here; the cost is always tailored to the property itself. The final fee will hinge on the asset's type, its size and complexity, and where it’s located.

That said, here are some general price ranges to help set your expectations:

Standard Apartments: Typically, you'll be looking at somewhere between AED 2,500 and AED 4,000.

Villas: The cost for most villas falls in the AED 3,500 to AED 6,000 range, though it can climb for exceptionally large or custom-built homes.

Commercial & Industrial Properties: These are far more intricate and are always priced on a case-by-case basis after an initial discussion.

It can be tempting to just go for the cheapest quote, but this is one area where you really do get what you pay for. Cutting corners on a valuation can end up costing you dearly down the line. What you're really investing in is accuracy, credibility, and a report that will stand up to scrutiny. A quality valuation is a small price for the financial clarity and peace of mind it provides.

Your real estate decisions deserve the highest level of certainty and expertise. Credence & Co. provides RICS-regulated, RERA-approved valuation reports that stand up to the highest scrutiny, giving you the confidence to act decisively. Learn more about our property valuation services at cnco.ae.

Comments