How to buy property in sharjah: A comprehensive guide

- Credence & Co

- Nov 9, 2025

- 15 min read

Thinking of buying property in Sharjah? It’s a smart move, but you need to know the lay of the land first. The market here is unique—it’s more affordable and has a distinctly family-friendly vibe compared to its neighbours. For expats, ownership is generally limited to specific freehold zones, while UAE and GCC nationals have more freedom to buy anywhere. The journey typically involves finding a good real estate agent, signing a Memorandum of Understanding (MoU), and then making it all official at the Sharjah Real Estate Registration Department (SRERD).

Why You Should Consider Buying Property in Sharjah

Before you even start scrolling through listings, let's talk about what makes Sharjah a standout choice for property investment. It's often called the UAE's cultural capital, and for good reason. The emirate offers a refreshing blend of rich heritage, modern conveniences, and a pace of life that feels more relaxed. This unique combination pulls in families and savvy investors looking for both solid value and a great quality of life.

Sharjah’s appeal isn't rooted in the fast-paced glitz you see elsewhere. Instead, it’s all about its community-first, family-oriented atmosphere. You can see this reflected in the real estate itself, which often prioritises spacious layouts, green parks, and close proximity to top-notch schools and cultural hubs.

Let’s not forget the financial side. The market here is known for its affordability. For many people, the decision to buy property in Sharjah simply means getting more bang for their buck—whether that’s a bigger apartment, a villa with a proper garden, or just a lower entry point for a first-time investment. And this accessibility doesn’t mean you’re sacrificing returns; Sharjah consistently delivers some very attractive rental yields.

Thriving Residential Areas and Property Types

Once you start your search, you'll quickly find that a few key areas keep popping up. Each neighbourhood has its own personality, catering to different lifestyles and investment strategies. Getting to know them is your first real step.

Al Majaz: If you love the idea of waking up to waterfront views of the Khalid Lagoon, this is your spot. Al Majaz is perfect for anyone who enjoys vibrant city life with a scenic backdrop. It’s packed with modern apartment buildings, lovely parks, great restaurants, and the famous Al Majaz Waterfront promenade.

Muwailih Commercial: This area has become a massive hotspot, especially for families. Why? Its location is fantastic, right next to the top-tier schools and universities in University City. You'll find a lot of new residential buildings here offering spacious, modern apartments at really competitive prices.

Al Khan: This is where beachfront living meets city convenience. Al Khan offers a mix of established buildings and shiny new towers. Its strategic location near Sharjah's corniche and the Dubai border makes it a brilliant choice for commuters.

The types of properties are just as varied. You can find everything from a compact studio perfect for a young professional to a sprawling multi-bedroom villa in a gated community designed for a growing family.

Sharjah’s real estate market strikes a great balance between affordability and strong rental demand. It's a strategic move for investors focused on stable, long-term growth over quick speculative wins, with rental yields often hitting between 6% to 8.5%.

Understanding Current Market Dynamics

The property market in Sharjah isn't just holding steady; it's on an impressive upward swing. The latest data shows a real surge in investor confidence and a huge jump in the number of deals being closed. In just the first nine months of the year, the total value of property transactions hit an incredible AED 44.3 billion—that’s a 58% increase compared to the previous year.

This growth was fuelled by 80,320 transactions, with buyers coming from 121 different countries, proving the emirate's wide-reaching international appeal. This kind of momentum suggests that now is a fantastic time to buy property in Sharjah, as the market is showing both strength and a strong potential for your property's value to grow.

Of course, a crucial part of making a smart investment is accurately assessing a property's worth. To get a better handle on this, it's worth exploring different real estate valuation methods to make sure you're paying the right price. Having this insight into the market trends and popular spots will give you the confidence to make a well-informed decision in Sharjah's dynamic real estate scene.

Understanding Who Can Buy Property in Sharjah

So, who can actually buy property in Sharjah? It’s one of the first questions any potential investor asks, and the answer is refreshingly clear, but it absolutely depends on your nationality. The emirate has really opened its doors to foreign investment over the years, creating a structured, secure environment for everyone involved.

Not too long ago, the rules were much tighter. Today, however, the legal landscape is quite different. Getting to grips with where you fit in from day one is the key to a smooth and successful purchase.

This forward-thinking approach has fuelled incredible growth. In the first half of the year alone, Sharjah's real estate transactions rocketed to AED 27 billion—a massive 48.1% jump from the previous year. What's driving this? Families and investors are flocking to the market, with residential sales making up 58% of these deals. The appeal of stable rental yields and a family-friendly atmosphere is undeniable. You can get a better sense of the market by exploring Sharjah's real estate market trends and what to expect.

Ownership Rights Based on Nationality

Your passport is the deciding factor in what and where you can buy in Sharjah. The regulations neatly segment buyers into three categories, each with its own set of rules.

To give you a clearer picture, here’s how property ownership rights are structured for different buyers in Sharjah.

Property Ownership Rights in Sharjah by Nationality

Buyer Category | Ownership Rights in Freehold Areas | Ownership Rights in Non-Freehold Areas | Key Considerations |

|---|---|---|---|

UAE Nationals | Full and unrestricted ownership. | Full and unrestricted ownership. | Can buy any type of property anywhere in Sharjah without limitations. |

GCC Nationals | Full and unrestricted ownership. | Full and unrestricted ownership. | Enjoy the same property rights as UAE citizens across the entire emirate. |

Other Expats | Permitted to buy in designated projects on a leasehold basis (up to 100 years). | Ownership is not permitted. | Must verify the property is in a government-approved investment zone. |

As you can see, the rules are straightforward. For Emirati and GCC citizens, the entire emirate is open for investment. For everyone else, the opportunities are concentrated in specific, high-quality developments designed for international investors.

The Crucial Difference: Leasehold vs. Freehold

It's easy to get bogged down in jargon, but understanding the difference between "leasehold" and "freehold" is absolutely essential. They sound similar, but legally and financially, they are worlds apart.

A leasehold agreement means you’re buying the right to use a property for a very long, fixed period—in Sharjah, this is typically up to 100 years. Critically, you own the apartment or villa itself, but not the land it sits on. At the end of the lease, the property ownership technically reverts to the landowner (the freeholder), though renewals are often possible.

For non-GCC expats, this is the most common form of ownership. You'll find that most new master-planned communities catering to international buyers operate on this basis. These designated zones are precisely where most expats choose to buy property in Sharjah.

An investment here can be more than just a financial asset; it can also be a stepping stone to long-term residency. Many investors are exploring how to turn your property into a Golden Visa opportunity.

Overseeing all of this is the Sharjah Real Estate Registration Department (SRERD). This is the government body that registers titles, protects your rights as an owner, and ensures every transaction is done by the book. Their oversight provides a crucial layer of security, giving you peace of mind that your investment is officially and legally protected.

From Property Hunt to Handover: Your Purchase Journey

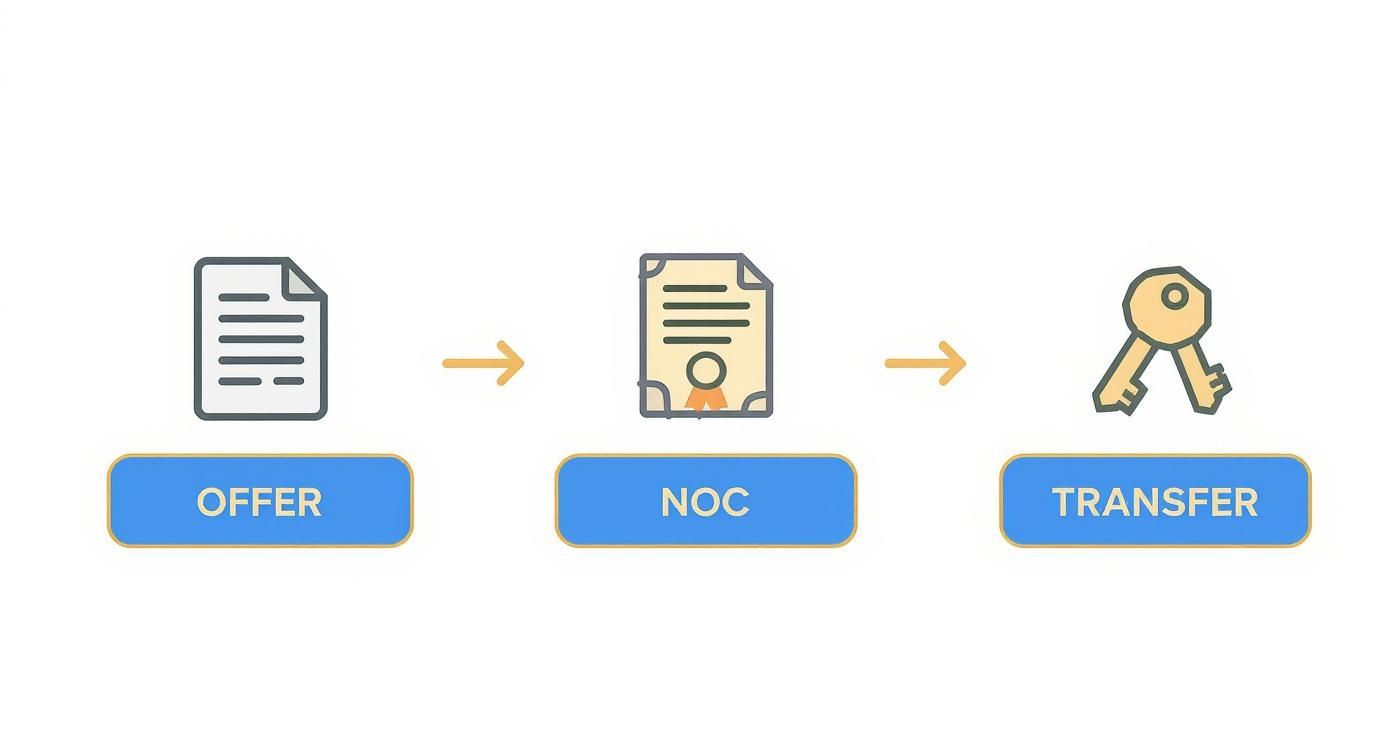

So, you've done your homework on Sharjah's property scene and got a handle on the legal side of things. Now comes the exciting part: actually buying your place. Think of it as a clear-cut path, starting with the search and ending with those brand-new keys in your hand. Getting through it without a hitch means knowing what to expect at each stage, from picking the right professional to help you out to signing on the dotted line.

The process of buying property in Sharjah isn't rocket science, but every step is built on the one before it. A small oversight at the start can snowball into a real headache later on. This roadmap will walk you through the key milestones to make sure your purchase goes off as smoothly as possible.

Finding a Real Estate Agent You Can Trust

First things first, you need a good real estate agent in your corner. This is about more than just getting a list of available properties. A solid agent is your guide, your negotiator, and your expert on all things local. They know the market inside out and can point you toward properties that actually fit what you're looking for, whether it’s a flat in Al Majaz or a villa in Muwailih.

Don't just go with the first agent you find. Look for someone with a proven track record in the areas you’re eyeing. Ask for references and double-check their registration. A true professional will listen to your needs instead of just trying to offload whatever they have on their books.

A great real estate agent does more than unlock doors. They'll give you a real market analysis, handle the tricky negotiations, and make sure your interests are protected from the first viewing to the final signature. They are easily the most important partner you'll have in this process.

Making an Offer and Signing the Agreement

Once your agent has helped you pinpoint the right property, it's time to make your move. A formal offer is more than just a number; your agent will help you put together a competitive bid based on what similar properties have recently sold for. This initial negotiation is where a seasoned expert really proves their worth.

When the seller agrees to your price, the next step is to make it official with a Memorandum of Understanding (MoU). This is a preliminary but legally binding contract that spells out all the details of the sale. It’s the rulebook for the transaction.

It will cover things like:

The final agreed-upon price.

The payment timeline, including your deposit.

What's expected from both you and the seller.

A clear timeline for completing the purchase.

Any special conditions, like the deal being dependent on you getting a mortgage.

At this point, you'll usually put down a security deposit, typically 10% of the property's value. This is held securely and shows the seller you’re serious about the deal.

Getting the Go-Ahead: The No Objection Certificate (NOC)

If you're buying a property in a master-planned community (which covers a lot of Sharjah's newer developments), you'll need a No Objection Certificate (NOC) from the developer. This isn't optional—it's a critical step that’s there to protect you.

The NOC is the developer's official stamp of approval. It confirms two key things: first, that they’re fine with the property being sold to you, and second, that the current owner has paid off all their service charges and fees.

Without an NOC, the transfer can't happen. It’s what stops you from accidentally inheriting the previous owner’s debts. The seller handles the application and pays the NOC fee, which can be anywhere from AED 500 to AED 5,000. Your agent will manage this to make sure it’s all done correctly. Depending on the developer, this can take a few days or a couple of weeks.

The Final Step: Transfer and Keys in Hand

With the MoU signed and the NOC in your file, you're in the home stretch. The last stop is the official property transfer at the Sharjah Real Estate Registration Department (SRERD). You (or your legal representative) and the seller both need to be there.

Here’s what happens at the SRERD:

You'll hand over the remaining balance for the property, usually in the form of a manager's cheque.

You'll pay the SRERD transfer fees.

All the documents—MoU, NOC, passports, and Emirates IDs—are submitted for final review.

Once the payments are confirmed and the paperwork is checked, the SRERD issues a new title deed with your name on it. This is your definitive proof of ownership.

And then comes the best part: the key handover. With that title deed in your possession, you are officially the owner. Congratulations! The journey is complete, and your new life or investment in Sharjah can begin.

Financing Your Purchase and Managing Costs

Figuring out the money side of things—securing the right financing and truly understanding what you'll spend—is where your dream of owning property in Sharjah becomes a reality. The price on the listing is just the starting point. A smart purchase depends on having a clear-eyed view of every dirham you’ll need, from the down payment to those recurring annual fees.

This doesn't have to be a daunting task. With a bit of prep work, you can build a realistic budget that prevents any nasty financial surprises down the line. Let’s walk through how to fund your purchase and map out all the costs involved.

Securing a Mortgage in Sharjah

For most people, a mortgage is the main route to getting on the property ladder. The good news is that UAE banks offer financing to both residents and non-resident investors, but the terms and what you'll need to qualify can be quite different.

If you’re a UAE resident, you'll find the process much smoother. Banks will typically finance up to 80-85% of a property's value for a first-time Emirati buyer. For an expatriate resident, that figure is usually around 75-80%. This means you need to have a down payment of at least 15-25% ready to go.

Non-residents can get a mortgage too, but the conditions are tighter. Banks see this as a higher-risk loan, so you should expect to put down a much larger deposit—often between 40-50% of the property’s value.

To get pre-approved for a loan, you'll need to gather a standard set of documents:

Passport and Visa Copy: To confirm your identity and residency status.

Emirates ID: An absolute must-have for any resident.

Salary Certificate: A formal letter from your employer outlining your income.

Bank Statements: Usually the last six months to show your financial history.

Proof of Address: Something like a recent utility bill works perfectly.

A bit of insider advice: get your mortgage pre-approval sorted before you even start house hunting. It gives you a solid, bank-verified budget, which instantly makes you a more serious and credible buyer when you find the right place and are ready to make an offer.

Beyond the Purchase Price: A Full Cost Breakdown

The sale price is the biggest number, but it's certainly not the only one. A safe rule of thumb is to budget an extra 5-7% of the property value to cover all the upfront costs. Forgetting to account for these fees can really throw your finances off track.

This infographic gives a simple overview of the transaction stages where different costs will come up.

As you can see, from the moment you make an offer to getting the developer’s NOC and finally transferring the title, different fees pop up at each key milestone.

Here’s a more detailed table breaking down what you should be saving for.

Estimated Costs When Buying Property in Sharjah

The table below outlines the typical fees you'll encounter. It's a handy checklist to make sure you've covered all your bases financially.

Fee or Cost | Typical Percentage of Property Value | Payable To | Notes |

|---|---|---|---|

SRERD Transfer Fee | 2% for expats, 1% for GCC nationals | SRERD | This is the main government fee for registering the property in your name. |

Real Estate Agent Commission | 2% | Real Estate Agency | This is the standard commission for the agent who helped you find and secure the deal. |

Mortgage Registration Fee | 0.25% of the loan amount | SRERD | You'll only pay this if you're taking out a mortgage to finance the purchase. |

Bank Processing & Valuation Fees | Varies (AED 3,000 - 7,000) | The Bank | This covers the bank's admin work and the cost of a professional property valuation. |

Developer NOC Fee | Varies (AED 500 - 5,000) | The Developer | This is a fixed fee for issuing the No Objection Certificate, required for resale properties. |

Keep in mind that these percentages are based on the official property value, which is why a proper valuation is so important.

Getting an accurate market value for the property is crucial, as it affects both the loan amount you can get and the transfer fees you'll pay. To get a better handle on this, you can learn more about how property valuation is demystified in our detailed guide.

Finally, don't forget about what comes after you get the keys. As a homeowner, you'll be responsible for annual service charges that cover the upkeep of common areas, security, and amenities. These fees can vary a lot from one building or community to another, so always make sure to ask for the current rate before you sign on the dotted line.

Performing Due Diligence and What Comes After the Sale

So, you've signed on the dotted line and the title deed is in your name. Congratulations! But the journey to successfully buy property in Sharjah isn't quite over. The final stretch is all about crucial checks and practical setups that will protect your investment and make the transition into ownership a smooth one.

I've seen plenty of buyers make the mistake of overlooking these final steps, only to face unexpected costs and administrative headaches later. Think of this phase as securing your foundation—it’s about triple-checking every detail before the ink is truly dry and knowing exactly what to do the moment you get the keys.

Essential Pre-Purchase Verifications

Before the final transfer happens, a few checks are absolutely non-negotiable. While your real estate agent should be guiding you, it’s vital to be actively involved yourself to ensure nothing gets missed. This is your final safety net.

Your due diligence checklist should definitely include these items:

Title Deed Verification: First things first, confirm the title deed is authentic and properly registered with the Sharjah Real Estate Registration Department (SRERD). It must be completely free from any liens or legal claims.

Service Charge Clearance: You need a formal statement from the developer or building management confirming the previous owner has settled all outstanding service charges. The last thing you want is to inherit someone else's debts.

Developer Registration: Make sure the developer is officially registered and in good standing. This is especially important for off-plan properties, as it can help protect you from potential project delays or even cancellations.

A thorough physical inspection of the property is also critical. Finding any defects before the final handover can save you a small fortune in future repair costs. For a deep dive into this, you can learn more about professional property snagging and inspection services in the UAE.

Pro Tip: Always request the final, updated service charge statement directly from the building management on the day of the transfer. This simple action prevents any last-minute surprises and ensures you start with a completely clean financial slate.

Your First Steps as a New Property Owner

With the keys officially in hand, a new set of tasks begins. These are the practical steps that turn a legal asset into a functional home or a ready-to-rent investment. Prioritising these will make for a much smoother start.

Your immediate to-do list should focus on getting the utilities sorted and getting acquainted with your new community. The top priority is setting up your account with the Sharjah Electricity, Water and Gas Authority (SEWA). The process is pretty straightforward and can often be started online. You'll typically need your new title deed, a copy of your passport, and your Emirates ID to get connected.

Next up, get familiar with the community or building rules. Every development has its own regulations covering everything from parking spots to renovation guidelines. Grabbing a copy of the community handbook early on will help you avoid any accidental missteps.

Managing Your Investment for the Long Haul

Once you're all settled, your focus naturally shifts to long-term management and financial planning. A key part of this is budgeting for the annual service charges. These fees aren't optional; they cover the upkeep of common areas, security, and amenities that ultimately maintain the value of your property.

If you've bought the property as an investment, efficient management is the name of the game for maximising returns. This means marketing the property, screening tenants, collecting rent, and handling any maintenance requests. To make this much easier, you can explore resources like this guide to the best property management apps to help you stay organised.

Taking these final steps seriously solidifies your decision to buy property in Sharjah, turning a major purchase into a successful, long-term asset.

Common Questions About Buying Property in Sharjah

Jumping into the Sharjah property market naturally brings up a lot of questions. Getting straight answers is key to feeling confident about your decisions, so let's tackle some of the most common queries we hear from buyers.

Think of this as a quick Q&A to clear up the practicalities and sticking points, from who can buy where to the costs you'll face after you get the keys.

Can Foreigners Buy Freehold Property Anywhere in Sharjah?

This is probably the most important question for any expat buyer, and the short answer is no. Non-GCC nationals can't just buy a freehold property anywhere they like in Sharjah. Your options are limited to specific investment areas and master-planned communities that have been officially designated by the government.

In most other parts of the emirate, ownership for expats is on a leasehold basis. This means you buy the right to use the property for a very long time—often up to 100 years—but you don't own the land itself.

Expert Tip: Before you fall in love with a property, your very first step should be to confirm its status with the Sharjah Real Estate Registration Department (SRERD). A quick check ensures you're buying in an approved zone and protects your investment from day one.

What Are the Typical Rental Yields in Sharjah?

For investors, this is what it all comes down to. The great news is that Sharjah is known for its stable and very healthy rental yields, typically sitting somewhere between 6% and 8.5%. Of course, the exact return you get will hinge on the type of property and its location.

Areas that are always in high demand with families, like Al Majaz or Muwailih Commercial, are known for delivering consistent returns. As a general rule, apartments tend to offer slightly higher percentage yields than villas, making them a go-to choice for investors who are focused on cash flow.

What is a No Objection Certificate (NOC)?

A No Objection Certificate (NOC) is a crucial legal document you'll need when buying a resale property in a master community. It’s issued by the original developer, and it essentially gives their official green light for the sale to go ahead.

More than just a permission slip, the NOC confirms that the seller has settled all their outstanding service charges and fees with the developer. The SRERD won't let you transfer the ownership without it. It's a vital safeguard that protects you, the buyer, from accidentally inheriting the previous owner's debts.

Are There Ongoing Costs After I Buy the Property?

Absolutely. The purchase price is the biggest hurdle, but it's not the last one. Owning a property in Sharjah comes with ongoing financial responsibilities you need to budget for.

The main recurring cost will be the annual service charges. These fees pay for the upkeep of the building or community—things like security, cleaning of common areas, landscaping, and maintaining facilities like pools and gyms. On top of that, you'll have your own utility bills from the Sharjah Electricity, Water and Gas Authority (SEWA). Factoring these expenses in from the start gives you a much more realistic picture of what owning the property will truly cost.

At Credence & Co., we provide RICS-qualified, RERA-accredited valuation services to ensure you have a precise and unbiased understanding of your property's market value. Contact us for a robust valuation that de-risks your investment decisions.

Comments