Unlocking Property Wealth A Guide to Land Valuation

- Credence & Co

- Dec 11, 2025

- 17 min read

At its heart, land valuation is the rigorous, professional process of determining the economic worth of a plot of land. It’s not just about what a piece of ground is worth today; it’s about translating its future potential—its location, zoning, and highest and best use—into a credible, defensible monetary figure. This number is absolutely vital for making sound investment, financing, and development decisions.

The True Worth of Your Land

Think of a parcel of land not as an empty space, but as a canvas brimming with future possibilities. Land valuation is the art and science of translating that raw potential into a clear, reliable number. In this role, a professional valuer becomes a financial storyteller, someone who reads the subtle language of market trends, deciphers complex legal codes, and understands development possibilities to narrate a property's true value.

This guide is here to demystify the entire process. Whether you're an investor scouting your next project, a developer planning the next regional landmark, or a lender assessing risk in the fast-paced markets of the UAE and Oman, this journey will give you the confidence to navigate high-stakes real estate decisions.

Unlocking Potential and Possibilities

A land valuation brings clarity to a world filled with variables. It's a foundational tool that underpins a huge range of strategic activities. For instance, a clear understanding of a plot's value can unlock creative sales strategies, like exploring owner financing options, which can create win-win scenarios for both buyers and sellers.

A credible valuation is truly indispensable for:

Securing Financing: Banks and financial institutions depend on accurate land valuations to underwrite loans for both acquisitions and major development projects.

Informing Transactions: Buyers and sellers alike use valuations to anchor negotiations, ensuring fair pricing and allowing them to engage from a position of strength.

Strategic Development: It helps establish the baseline land cost, which is a critical first step in determining the financial feasibility of any proposed project.

Financial and Regulatory Compliance: Valuations are often a mandatory requirement for financial reporting, tax assessments, and various legal proceedings.

A land valuation is more than a number; it is a strategic forecast of a property's most profitable and legally permissible destiny. It provides the foundation upon which sound investment and development decisions are built.

The type of land also dramatically influences the valuation approach. To dive deeper into this, have a look at our guide comparing https://www.cnco.ae/post/greenfield-vs-brownfield-a-guide-to-property-valuation-for-real-estate-investors-credence-co.

Ultimately, we're going to explore everything from foundational principles to the specific valuation methods and legal frameworks that define this vibrant region. Our goal is to turn complexity into clarity, empowering you to see land not just for what it is, but for everything it can become.

Why We Value Land in the First Place

Before we dive into the technical side of things, let's start with the big question: why does a land valuation even matter? It’s about more than just stamping a price on a piece of dirt. A professional valuation answers the crucial question: what is this land truly worth, and what is its absolute best potential? That answer is a strategic key, unlocking opportunities, heading off risks, and giving you a rock-solid foundation for major financial moves.

Think of it like a specialised health check for a property. A doctor uses different tools for a routine check-up than they would for a major pre-surgical exam. In the same way, a valuer picks specific methods based on what you need to achieve. For a bank thinking about funding a new development, the valuation is their main risk assessment tool. For a buyer and seller working out a deal, it’s the impartial benchmark that ensures a fair price for everyone.

It's All About Smart Decisions

A credible, independent valuation is absolutely essential at every stage of a property's life. It plays a number of critical roles that shape the economic landscape here in the UAE and Oman.

Securing Project Finance: Banks and lenders lean heavily on solid valuations to approve loans. They need to know the land's value provides enough security for the money they're lending.

Fair Market Transactions: It gives both buyers and sellers an objective, defensible price point. This builds transparency and trust into the negotiation process.

Financial Reporting Compliance: For companies, valuations are a must for meeting accounting standards like IFRS. It’s about reflecting the true value of assets on the books.

Resolving Legal Disputes: When it comes to inheritance, dissolving a partnership, or other legal battles, a professional valuation provides an impartial basis for dividing assets and reaching a settlement.

This need is even more critical in fast-moving markets. Just look at the UAE's real estate sector, which saw transaction values hit a staggering AED 239 billion in the first quarter of this year alone. Dubai made up AED 142 billion of that figure, a 30% jump in transaction volume from the year before. This growth is fuelled by intense demand and rental yields that are leaving global hubs like New York and London in the dust. You can get the full story on the UAE's property boom from Arab News.

The Cornerstone Concept: Highest and Best Use

At the very heart of every professional land valuation is the principle of ‘Highest and Best Use’. This isn't just industry-speak; it's a deep-dive analysis to find the most profitable, legally allowable, and physically possible future for a plot of land. It forces us to ask: what use of this land will generate the greatest return over time?

Highest and Best Use analysis transforms a valuation from a simple statement of current worth into a forward-looking vision of a property's ultimate potential. It is the logic that justifies the final number.

For example, imagine a vacant plot right in the middle of a bustling city centre. Its Highest and Best Use is almost certainly a high-rise commercial tower, not a small single-family home. The valuation, therefore, is based on the land’s potential to become that tower. This is the logic that explains why a specific plot can be worth millions—it’s not about the empty sand, but about the incredible value that can be built upon it.

Understanding this core principle is the key that unlocks everything else we’re about to cover.

Selecting the Right Valuation Method

Picking the right valuation method isn’t about some magic formula. It’s more like a skilled craftsman choosing the perfect tool for the job. You wouldn't use a sledgehammer to fix a watch, and similarly, a valuer needs to select the right approach based on what the land is and what it’s for.

Here in the UAE and Oman, we rely on a toolkit of globally respected methods. Each one looks at the question of "what's it worth?" from a slightly different, but equally powerful, angle. Getting a handle on these core approaches will give you the confidence to understand any valuation report that lands on your desk. It’s not just theory; it’s a genuine advantage when you're negotiating a deal, analysing an investment, or applying for finance.

The Market Comparison Approach

Let’s start with the most straightforward and intuitive method: the Market Comparison Approach. Think about how you’d figure out the price of your car. You’d jump online and see what similar models with roughly the same mileage and in the same condition have sold for recently. It’s the exact same logic for land.

This approach works on a simple idea called the principle of substitution—why would a buyer pay more for your plot of land when they can get a nearly identical one down the road for less? It’s pure, real-world market evidence. We dive into recent sales of similar plots in the same area and make careful adjustments for key differences:

Location, Location, Location: A plot with prime road frontage is in a different league to one tucked away on a quiet side street.

Size and Shape: A big, easy-to-build-on rectangular plot will always be more desirable than a small, awkward, or irregularly shaped one.

Permissions and Zoning: Land that already has the green light for a high-rise tower is worlds away in value from a plot zoned only for a single villa.

Date of Sale: The market moves fast. A sale from last week is far more relevant than one from last year.

This is our go-to, the gold standard, for valuing empty plots or standard residential land where we have plenty of recent, comparable sales data to draw from.

The Income Approach

But what if the land is already making money, or is meant to? That’s when we pull out the Income Approach. This method doesn't just look at the land itself; it values the property based on the stream of revenue it can generate. It’s like valuing a company based on its future profits, not just the equipment in its factory.

This is the perfect tool for income-producing assets like leased land, agricultural farms, or sites with existing commercial buildings. We project the potential net income the property can deliver and then apply what’s called a “capitalisation rate.” This rate is essentially a measure of the return an investor would expect, factoring in the risk involved. A lower, more attractive cap rate means a higher valuation.

The Income Approach is all about shifting focus from what a property is to what it can earn. It’s a forward-looking perspective, absolutely essential for investors and commercial developers.

The Residual Method

For anyone with a developer’s mindset, the Residual Method is the most important calculation of all. Let's say you're looking at a plot and picturing a stunning new apartment complex on it. This method works backwards from that final vision to figure out what the land underneath is truly worth.

The concept is beautifully simple, even if the details can get complex:

First, we estimate the Gross Development Value (GDV). What will the finished, built-out project sell for in the current market?

Then, we subtract all the costs to get there. This means construction, architects, marketing, legal fees, bank financing, and, of course, the developer's profit.

What's left over? That’s the value of the land. It's the absolute maximum a developer can pay for the site and still have a viable, profitable project.

This method is vital for assessing any kind of development opportunity, from a single villa plot to a massive master-planned community. The value of the land is directly tied to the financial success of the project built upon it. The core ideas here are part of a wider understanding of market value; anyone dealing with residential property will find that learning about accurately pricing your home for sale offers some great parallel insights.

Choosing the Best Fit

The truth is, no single method is perfect for every single situation. An experienced valuer will often use two or even all three approaches as a way to sanity-check their conclusions. This process, called reconciliation, gives the final valuation a much stronger and more defensible foundation. Our in-depth guide to property valuation methods and their applications explores this in more detail.

To make it simple, we've put together a table that shows which method generally works best for common scenarios you’ll encounter here in the UAE and Oman.

Comparison of Land Valuation Methods

Valuation Method | Core Principle | Best Used For | Key Consideration |

|---|---|---|---|

Market Comparison | Value is set by what similar, nearby properties have recently sold for. | Vacant land, standard residential villas, apartments—anything with lots of market activity. | You absolutely need reliable, recent, and truly comparable sales data. |

Income Approach | Value is based on the property’s ability to generate a steady income stream. | Leased commercial land, hotels, shopping centres, agricultural plots, and tenanted buildings. | The accuracy of your income forecasts and choosing the right capitalisation rate are critical. |

Residual Method | Value is what's left after subtracting all development costs from the final project's value. | Any piece of land with development potential, from a single plot to a huge master plan. | Success depends entirely on the viability of the proposed project and the accuracy of cost estimates. |

Ultimately, having a clear picture of these valuation methods helps everyone involved—from investor to developer to lender—make smarter, more informed decisions with confidence.

Navigating Regional Laws and Regulations

A land valuation isn't just a numbers game; it's a legally robust document that has to hold up under a microscope. In the fast-paced markets of the UAE and Oman, a valuation is only as strong as its compliance with local laws. Getting this right is like navigating a complex channel—the laws are your markers, and a seasoned valuer is the captain who knows precisely how to read them.

And this isn't just for the experts. Whether you're an investor, a developer, or a landowner, grasping the legal framework is empowering. It helps you pull together the right documents, see potential hurdles before they appear, and truly understand the story behind your property's final appraised value. It turns the valuation from a simple figure into a defensible, legally sound conclusion.

Key Regulatory Bodies Shaping Valuations

Across the UAE and Oman, specific government bodies are the final word on property regulation. Their standards and circulars directly shape how a land valuation is performed and whether it gets the official stamp of approval. Any professional valuer worth their salt doesn't just know of these authorities; they live and breathe their guidelines.

The main players you'll encounter are:

Real Estate Regulatory Agency (RERA) in Dubai: As the regulatory arm of the Dubai Land Department, RERA's standards are the gold standard. For any valuation in Dubai meant for official use, like financial reporting or major transactions, RERA compliance is absolutely essential.

Department of Municipalities and Transport (DMT) in Abu Dhabi: In the capital, the DMT writes the rules. Valuers must be officially accredited by the DMT to issue reports for any property within Abu Dhabi.

Oman’s Ministry of Housing and Urban Planning: This ministry is the custodian of property registration and land use in Oman, setting the legal foundation that every Omani valuation is built upon.

Submitting a valuation that doesn't follow the rules of these bodies is a non-starter. For any official purpose, it's simply not worth the paper it's written on.

A valuation that ignores regional regulations is like a ship built without a rudder. It may look impressive, but it has no direction and cannot safely reach its destination in a legal or financial dispute.

The Impact of Free Zones and Special Jurisdictions

Just when you think you have it figured out, the region's many free zones add another layer of complexity. Economic hubs like the Dubai International Financial Centre (DIFC) or Abu Dhabi Global Market (ADGM) often operate under their own distinct legal systems, many based on English Common Law. This creates a parallel regulatory universe that valuers must navigate with expertise.

For instance, property registration and how disputes are handled inside the DIFC are completely different from how things work on the mainland under Dubai law. A valuation for a plot in a free zone must account for these unique rules, which can influence everything from property rights to transferability—all of which have a direct impact on market value. Spotting these nuances is the hallmark of a true expert.

Core Legal Documents Driving Value

At the end of the day, a valuation figure is directly tied to the land's legal standing, and that standing is proven through official paperwork. These documents aren't just administrative fluff; they are the bedrock of the entire assessment. Think of them as the foundational pillars holding up the property's worth.

Before a valuer can even begin their analysis, they will need a few key documents:

Title Deed (Mulkiya): This is the ultimate proof of ownership. It clearly states who owns the land, its exact size, and any mortgages or restrictions tied to it.

Affection Plan / Site Plan: Issued by the local municipality, this is a make-or-break document. It details the permitted land use (e.g., residential, commercial, industrial), height limits, and setback rules, defining the land's raw development potential—a primary driver of its value.

Planning Permissions and Approvals: If approvals for a specific project are already in place, they can add significant value to the land. Why? Because they remove a huge chunk of development risk and uncertainty for a potential buyer.

These documents are the first step in the legal due diligence that anchors any credible land valuation. It’s also important to remember how legal frameworks shape value beyond ownership, as we explore in our guide to Abu Dhabi tenancy law, which governs the income potential that underpins many property valuations.

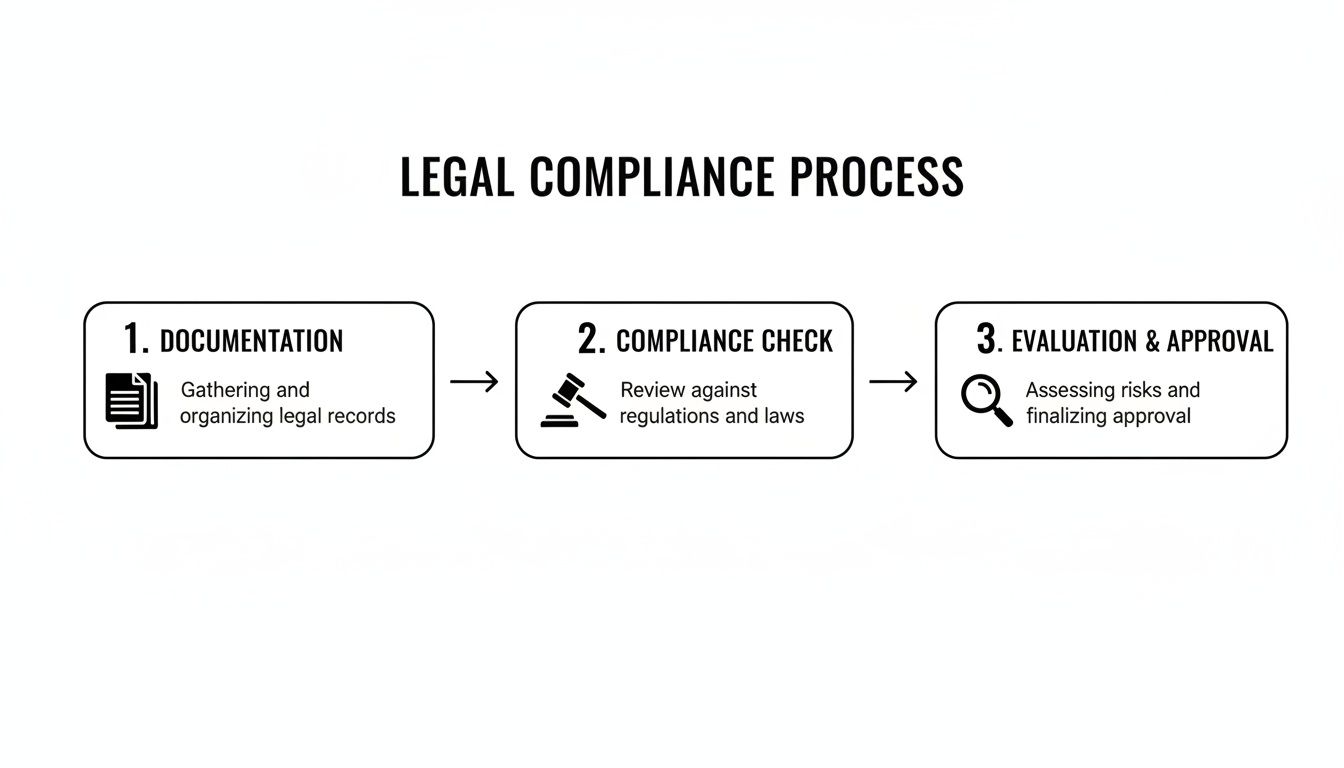

The Land Valuation Process Step-by-Step

A professional land valuation isn’t some dark art where a number is magically conjured out of thin air. It's a disciplined, methodical process, a lot like building a solid legal case. Each step is about gathering undeniable evidence, constructing a powerful argument, and arriving at a judgement of value that can stand up to scrutiny.

For you, the client, understanding this journey is empowering. It demystifies what we do, clarifies what we need from you, and shows you the difference between a quick guess and a truly professional valuation.

Stage 1: The Initial Brief and Scope Definition

Every great valuation starts with a simple, clear conversation. This is where we define the mission. We’ll sit down with you to get to the heart of why you need this valuation. Is it for securing a bank loan? Preparing for a sale? Maybe for financial reporting or settling a shareholder dispute?

The purpose is everything. It dictates the entire approach, from the basis of value (like Market Value versus Fair Value) to the specific valuation methods we’ll use. In this first meeting, we’ll agree on the scope of the work, the timeline, and the fees, making sure we’re all on the same page from the very beginning.

Stage 2: Inspection and Comprehensive Data Gathering

With our mission clear, the real detective work begins. We're now gathering the raw materials—the facts and evidence that will become the bedrock of our analysis. This always includes a physical inspection of the site, which is absolutely essential.

A seasoned valuer does more than just glance at a plot of land; they assess its unique DNA.

Physical DNA: We look at the plot's size, its shape, the lay of the land (topography), and how easy it is to access.

The Neighbourhood Vibe: We analyse the surrounding area, taking note of nearby developments, crucial infrastructure, and local amenities that add or detract from value.

The Paper Trail: We meticulously review key documents like the Title Deed and Affection Plan to confirm ownership and fully grasp any planning or zoning restrictions.

This hands-on approach is what separates a thorough valuation from a desktop estimate. For a deeper dive into what our inspectors look for on the ground, our expert guide on property inspections in Dubai offers some fantastic insights.

Alongside the site visit, we pull together a mountain of market data from official sources like the Dubai Land Department (DLD) and other regional authorities.

This process shows that a credible valuation is built on a foundation of verified documents and a thorough compliance check before a single calculation is even made.

Stage 3: Analysis and Value Reconciliation

This is where the magic happens. We take all that raw data and, drawing on years of experience, transform it into a logical, defensible opinion of value. We’ll apply the valuation methods we selected in Stage 1, almost always using more than one to cross-check our work and ensure the result is robust.

This is far from a simple copy-and-paste job. We analyse recent sales of comparable plots and then make precise, evidence-backed adjustments. Does your plot have a superior location? That might justify a 10% upward adjustment. Are there restrictive zoning rules? That could mean an adjustment downwards.

The real art of valuation is in the reconciliation. This is where we weigh the results from the different methods, explain any differences, and converge on a single, final figure of value that is both logical and fully supported by all the evidence we’ve gathered.

Stage 4: Reporting and Final Delivery

The last step is to document this entire journey in a comprehensive valuation report. This isn't just a letter with a final number. Think of it as the full story, a detailed narrative explaining exactly how we arrived at that value.

A professional report clearly lays out the scope, the methods we used, the data we analysed, and the thinking behind every key assumption. This transparency is what gives the valuation its power and credibility. It leaves you with a clear, defensible document you can confidently present to banks, auditors, courts, or potential buyers, bringing the entire process to a successful and empowering close.

Common Pitfalls and How to Avoid Them

Getting to a reliable land value is a journey, and like any journey, there are plenty of places to take a wrong turn. The valuation methods we've discussed provide a solid roadmap, but the real skill—the kind that comes from years in the field—is in navigating the subtleties and sidestepping the traps that can completely derail a valuation.

It's about more than just crunching numbers; it's about applying seasoned judgement. This is what separates a superficial estimate from a valuation you can confidently take to the bank.

One of the most common mistakes we see is relying on stale or irrelevant comparable sales. In markets that move as fast as those in the UAE and Oman, a transaction from six months ago might as well be from another era. A sharp valuer knows that to capture the true pulse of the market, you have to work with the most recent and genuinely comparable data available.

Another classic error? Overlooking the unique character of the land itself. You can’t treat all plots the same. The specific topography, the ease of access, even the very shape of the parcel—these things have a real and measurable impact on value.

The Art of Making Critical Adjustments

This is where experience really comes into play. A great valuer doesn't just present a list of similar sales. They meticulously adjust those sales, making precise, defensible calculations to account for every single difference between the comparable properties and the one being valued.

This detailed analysis is what creates a true "apples-to-apples" comparison.

Common adjustments often revolve around:

Location Premiums: How much more is a corner plot really worth? What's the value of having direct frontage on a main arterial road versus being tucked away on a side street?

Physical Characteristics: We might apply a discount for an oddly shaped plot that limits development potential or for land with steep slopes that would drive up construction costs.

Planning Status: The difference in value between a plot with full, approved planning permission and one where approvals are still a question mark can be absolutely massive.

Being able to not only make these adjustments but also to clearly articulate and defend them is the signature of a true professional. It’s what elevates a simple data exercise into a sophisticated analysis that genuinely reflects a property's unique position in the market.

Misreading the Regulatory Maze

Navigating the web of zoning laws and local regulations is another area fraught with peril. It's not enough to simply know what a piece of land is zoned for. You have to understand what that means in practice.

What are the specific setback requirements? What are the absolute limits on Gross Floor Area (GFA)? A small misinterpretation here can lead to a wildly optimistic—and completely wrong—assessment of the land’s ‘Highest and Best Use’.

This is especially challenging in booming markets where major projects constantly rewrite the rules of supply and demand. Just look at Saudi Arabia, where the property price index jumped by 4.3% in the first half of the year, fuelled by giga-projects like NEOM. In Riyadh, we saw luxury residential prices climb 15% year-on-year, with land values in some neighbourhoods soaring by almost 20%. This kind of rapid change shows just how vital it is to have your finger on the pulse of the market. Discover more insights about the GCC real estate outlook on Mada Properties.

Steering clear of these pitfalls demands diligence, local knowledge, and a healthy dose of professional scepticism. It also underscores why professional guidance is so important. To arm yourself with more knowledge, you can learn more about the eight typical pitfalls to dodge when seeking a property valuation service. By understanding where things can go wrong, you can ensure your land valuation provides the solid, accurate foundation you need to make your next big move.

Your Land Valuation Questions Answered

When you're dealing with land valuation, a few practical questions always come up. How long will it take? What paperwork do I need to dig up? What's the real difference between all these terms people throw around? Getting straight answers to these questions is the first step to feeling in control and making smart decisions.

Think of it like this: before you start any important journey, you want to see the map, pack the right gear, and understand a bit of the local language. Let's map out the valuation process for you.

How Long Does a Land Valuation Take?

Honestly, it depends. The timeline for a professional land valuation really hinges on what we're looking at. For a simple, empty plot of land, we can often turn around a full report in about 5-7 working days. But if we're assessing a massive site earmarked for a mixed-use development, that’s a different story and could take a few weeks to do properly.

The same goes for the fees. They’ll naturally vary based on the property’s value, how deep we need to go in our analysis, and what you’ll be using the report for. My best advice? Always ask for a detailed proposal from a RICS-certified firm. It should clearly lay out the timeline, fees, and exactly what we'll be doing before any work kicks off. No surprises that way.

What Documents Are Needed for a Valuation?

To get you the most accurate and reliable valuation, we need a bit of homework from your side. Pulling these key documents together early on makes everything run much more smoothly.

Title Deed (Mulkiya): This is the most important one. It's the official proof of who owns the land.

Affection Plan or Site Plan: This document, straight from the municipality, is critical. It tells us exactly what you can (and can't) do with the land – the zoning, building limits, and permitted uses.

Approvals and Permits: If you’ve already secured any planning permissions or development approvals, we absolutely need to see them as they can dramatically influence the land's value.

Think of these documents as the essential ingredients for a recipe. Without them, the final dish—your accurate valuation—is just guesswork. Your valuer needs this information to correctly figure out the land's 'Highest and Best Use'.

What Is the Difference Between Market Value and Fair Value?

People often use these terms as if they mean the same thing, but in the professional world, they have very distinct definitions.

Market Value is what most people think of: it’s the price we estimate a piece of land would sell for on the open market, assuming a knowledgeable buyer and a willing seller are involved, neither under any pressure. It’s a purely objective look at the market.

Fair Value, on the other hand, is a specific accounting term used for financial reporting (think IFRS standards). It’s the price that would be received to sell an asset in an orderly transaction between market participants. The difference is subtle, but for corporate accounting, it's a crucial one. A good valuer will know exactly which basis of value is right for your situation.

At Credence & Co., we provide accredited, technically robust valuation services across the UAE and Oman to de-risk your decisions and optimise outcomes. Contact us today for a consultation.

Comments