Real estate Consultancy in UAE: Your Strategic Guide

- Credence & Co

- Nov 17, 2025

- 13 min read

Updated: Dec 5, 2025

Think of a real estate consultancy as your strategic partner in the property world. They offer expert, data-driven advice to help you navigate tricky property decisions. This is quite different from a real estate agent, whose main job is to close a sale. A consultant provides impartial analysis to boost your investment's value and minimise risk, which is absolutely vital for high-stakes projects in the UAE market.

Why You Need a Real Estate Consultancy in the UAE

Jumping into the UAE's fast-paced property market without an expert guide is a bit like trying to build a skyscraper without a blueprint. You might have the best materials and a prime location, but without a solid strategy, the whole thing could come crashing down. This is exactly why a real estate consultancy service is your most valuable asset here.

A consultant is the architect of your property investment strategy. While an agent is focused on helping you buy or sell a specific property, a consultant tackles the bigger, more critical questions first. Is the project even viable? Where are the hidden opportunities? How can we structure a deal that perfectly aligns with your long-term financial goals?

The Strategic Blueprint for Success

Making your way through the markets in Dubai, Abu Dhabi, and the wider GCC takes more than just money—it requires real foresight. A consultancy gives you this by turning raw market data into smart, actionable intelligence. Their job is to make sure your decisions are proactive, not just a reaction to market noise.

This kind of strategic partnership is essential for a few key reasons:

Objective Analysis: They provide unbiased advice that puts your best interests first, without the pressure of earning a commission on a sale.

Risk Mitigation: By carrying out detailed due diligence and feasibility studies, they spot potential problems before you invest your capital, saving you from expensive mistakes down the road.

Opportunity Identification: Consultants have a bird's-eye view of the market, helping you find emerging trends and undervalued assets that others might easily overlook.

A consultant's real worth is in the clarity they provide. They cut through the hype and speculation to offer a clear, data-backed path forward, ensuring your investment is built on a rock-solid foundation of expertise.

Beyond the Transaction

Ultimately, the reason for hiring a real estate consultancy is to shift from just making a deal to thinking strategically. They don't simply help you with a purchase; they build the entire framework for your long-term growth and profitability.

For developers, investors, or family offices, this means having a partner on your side who truly understands the complex interplay of local regulations, market cycles, and economic forces. This deep expertise ensures your vision is not only brought to life but is fine-tuned for the best possible return in one of the world's most competitive real estate arenas.

What Does a Real Estate Consultant Actually Do?

A top-tier real estate consultancy does far more than just offer advice. They provide a full suite of specialised services built to boost your returns and shield you from risk, no matter where you are in your property journey. Think of their work as a set of core pillars, each one holding up a vital part of your investment strategy. Grasping these functions is the key to knowing exactly what kind of expert you need on your side.

This kind of strategic guidance is absolutely essential in a market as fast-paced as the Middle East. In 2024 alone, the regional real estate market pulled in roughly USD 217.3 billion in revenue, with the UAE as a massive contributor. And it’s not slowing down; projections point to a solid compound annual growth rate (CAGR) of 7.2% between 2025 and 2030. This highlights both the incredible opportunity and the critical need for an expert navigator.

Market Analysis and Feasibility Studies

Before a single dirham is invested, a consultant tackles the most fundamental question: "Is this a good idea?" This is the realm of market analysis and feasibility studies. It’s a deep-dive into everything from market trends and supply-demand dynamics to what the competition is doing and what kind of returns you can realistically expect. A crucial first step is a proper competitive analysis, which is often structured using a competitive analysis template for UAE businesses to map out the strategic landscape.

Let's say a developer is eyeing a bustling Dubai neighbourhood for a new luxury retail complex. A consultant's feasibility study would dig into the existing retail density, local consumer spending habits, and any future projects in the pipeline. If their research shows the area is already saturated with similar outlets, they’ll advise against it—potentially saving the developer from a multi-million-dollar misstep.

Investment Advisory and Due Diligence

Once an opportunity passes the initial test, the next phase is making sure it’s a solid, viable investment. This is where investment advisory services come in, guiding a client through the entire purchase, from identifying the right asset to structuring the final deal. A key part of this is due diligence—the forensic investigation of a property.

Picture an investor looking to buy a commercial tower in Abu Dhabi. A consultant would get to work on several fronts:

Verify the books to confirm the rental income is what the seller claims it is.

Conduct physical inspections to find any hidden structural defects or maintenance issues. We cover this in detail in our guide to property snagging and inspection in the UAE.

Scrutinise all legal paperwork to ensure the title is clean and there are no lingering liabilities.

This painstaking process is what protects a buyer from overpaying or, worse, inheriting a host of expensive problems down the line.

A consultant is essentially your private investigator, digging into every corner of a property so you can invest with absolute confidence. Their goal isn't just to close a deal; it's to make sure it's the right deal for you.

Development and Asset Management

For developers, a consultant can be the project lead from the drawing board to the ribbon-cutting. This involves handling everything from securing permits and managing contractors to keeping a close eye on budgets and timelines. It's about ensuring the project not only gets finished but also stays true to the original vision and financial goals.

For existing property owners, asset management services are all about maximising the long-term value of your portfolio. This means crafting strategies to boost occupancy, trim down operating costs, and spot opportunities for a refresh or total redevelopment. For example, a consultant might recommend modernising an older office building to attract premium tenants, a move that could significantly lift its annual returns and overall market worth.

From a Vague Idea to a Solid Investment

Every successful real estate venture starts as an idea. But turning a broad vision into a tangible, high-value asset doesn't happen by chance. It requires a structured journey, a clear path that ensures every decision is backed by hard data and perfectly aligned with your end goal. This is what a consultancy engagement provides: a logical progression from concept to profitable reality, safeguarding your capital and boosting your returns every step of the way.

Imagine an international investor looking to break into Dubai's notoriously competitive hospitality market. They've got the funds, but they lack the crucial on-the-ground knowledge to move forward with any real confidence. This is where a consultant's methodical process proves its worth.

Getting to the Heart of the "Why"

The journey always begins with a deep dive into the investor's vision. We’re not just talking about what they want to build, but uncovering the fundamental why behind it. A good consultant works to translate a fuzzy ambition into clear, measurable objectives.

Is the main driver long-term rental income, a quick capital gain, or perhaps establishing a flagship brand presence?

What's the investor's appetite for risk, and what is the ideal timeline for seeing a return?

Are there other factors at play, like sustainability goals or a desire to make a specific community impact?

For our investor, this initial phase crystallises their thinking. "A hotel in Dubai" becomes "a boutique luxury hotel in a high-growth, art-focused district, targeting affluent millennial tourists, with an expected ROI of 12% within seven years." Now we have a real target.

Pinpointing the Perfect Opportunity

With clear goals locked in, the heavy lifting begins. The consultant now shifts into an intensive analysis phase, hunting for viable opportunities that tick every box on the investor's list. This means meticulous market research, sophisticated financial modelling, and rigorous site selection.

The consultant might scout out up-and-coming districts like Alserkal Avenue or the Dubai Design District, digging into visitor demographics, checking out how competitors are performing, and looking at the government's future development plans for the area. They'll run feasibility studies on a shortlist of properties, projecting everything from construction costs and operational expenses to potential revenue streams. This data-first approach systematically weeds out the non-starters, leaving the investor with only the most promising, financially sound options.

This analytical rigour is what separates a calculated investment from a speculative gamble. The consultant's job is to replace guesswork with a clear, evidence-based business case for moving forward.

Crafting the Roadmap to Success

Finally, the consultant pulls all these findings together into a concrete, actionable strategy. This isn't some generic, off-the-shelf report; it’s a detailed roadmap built specifically for the client. For our hotel investor, this would include a recommendation for a specific plot of land, a complete financial breakdown, a proposed development timeline, and even introductions to trusted local architects and legal experts.

This comprehensive plan gives the investor the clarity and confidence to pull the trigger. The consultant has successfully transformed a vague ambition into a de-risked, data-backed investment strategy that's ready to execute. This is the core value of consultancy real estate—methodically turning a vision into measurable value.

Why the UAE Is a Prime Market for Real Estate Consulting

The huge demand for consultancy real estate services in the UAE isn't a coincidence. It's a direct result of the nation's incredible ambition and explosive growth. This is a country that thinks big. We see it in the mega-projects and visionary government blueprints like the Dubai 2040 Urban Master Plan, which are constantly reshaping city skylines.

This kind of environment is brimming with opportunity, but it’s also incredibly complex.

With such rapid development, the rules of the game are always changing. You’re dealing with intricate new property laws, the sophisticated demands of modern investors, and a sheer scale of development that can be daunting. Navigating this market successfully takes more than just money; it requires specialised, on-the-ground expertise. Consultants are the ones who make sense of it all, connecting the government’s grand vision with the developer's execution and the investor's need for confidence.

A Hub of Economic Ambition

The UAE has made a strategic push to move its economy beyond oil, and that has sparked a boom in tourism, logistics, technology, and more. Each of these growing sectors needs a place to operate, which in turn fuels the demand for all kinds of real estate infrastructure. This economic energy makes the region a magnet for global talent and investment, pouring even more fuel on the property market fire.

The consulting industry itself has seen phenomenal growth here. In 2023, the UAE's consulting market was valued at around $1.1 billion, expanding at a rate of 15.2%. That’s a pace that leaves many established Western markets in the dust. As you'd expect, this growth is heavily centred in Dubai and Abu Dhabi, where global connectivity attracts multinational clients looking for expert advice. They need help with everything from urban planning and commercial property investment to simply keeping up with local regulations. You can get a deeper look at these market dynamics from a recent industry analysis on consultingquest.com.

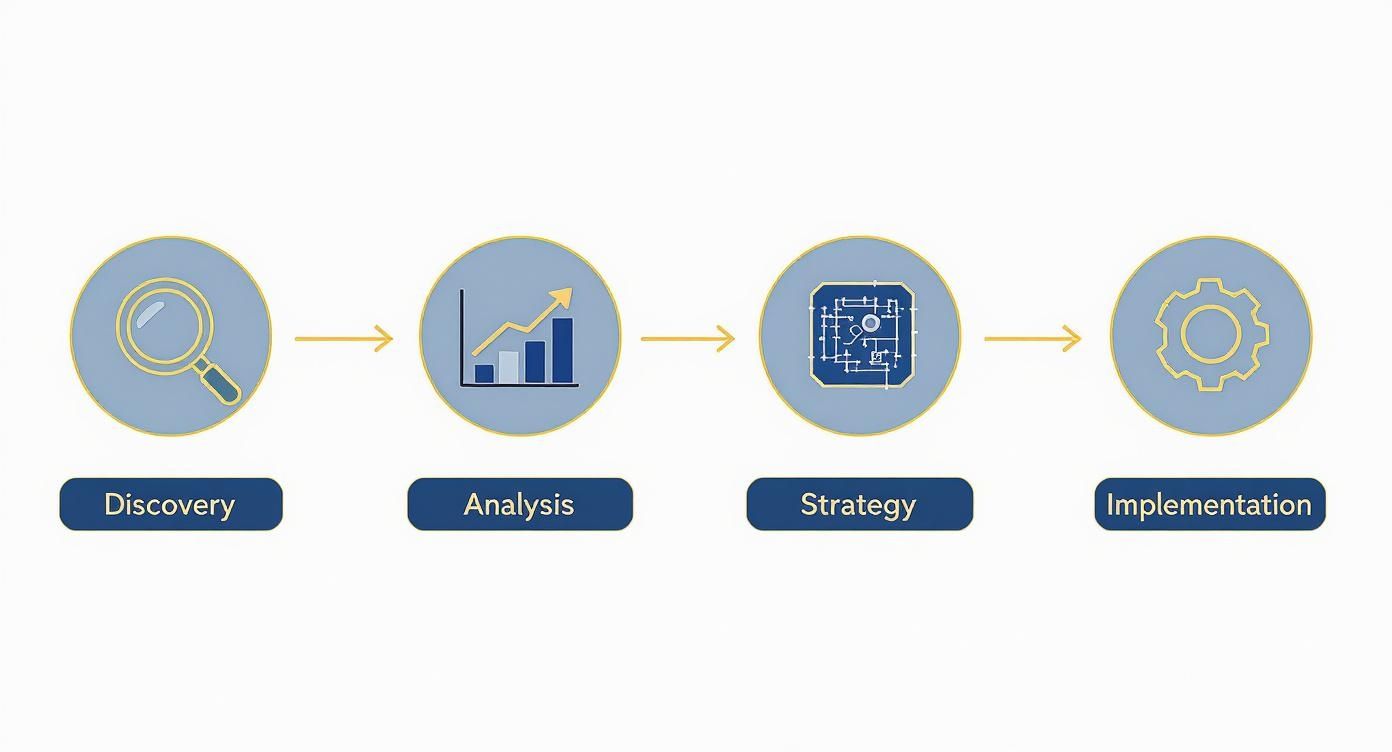

The infographic below shows the structured journey a consultant typically takes with a client, starting with the initial idea and moving all the way through to making it happen.

It’s this methodical approach that turns a broad concept into a well-defined, de-risked, and actionable strategy.

Navigating Sophisticated Investor Demands

Today’s investors, whether they're from the region or halfway across the world, are smarter and more cautious than ever. They won't just take your word for it; they demand detailed, data-driven business cases before they’re willing to commit their capital. On top of that, government initiatives like residency-by-investment programmes add another strategic layer for buyers to consider.

If that's something on your radar, we have a helpful guide on turning your property into a Golden Visa opportunity in the UAE.

In a high-stakes market like this, a real estate consultancy isn't a luxury; it's a fundamental requirement for success. They provide the strategic clarity needed to navigate regulatory hurdles, satisfy investor due diligence, and ultimately capitalise on the UAE's incredible growth story.

This need for strategic oversight is what ensures investments are not only profitable but also perfectly aligned with the long-term vision of one of the world's most dynamic property markets.

How to Select the Right Consultancy Partner

Choosing your real estate advisor is one of the most important decisions you'll make on your property journey. Think of it like picking a specialist surgeon for a complex operation—you wouldn't want a general practitioner. You need someone with proven, specific expertise.

The right consultancy real estate partner can be the difference between a runaway success and a costly mistake. It takes more than just a slick presentation to get this right. You need to dig deeper to find a firm whose experience lines up perfectly with your goals, whether that’s developing a massive logistics hub or investing in a boutique hotel.

Ultimately, their track record should do the talking. Look for real, verifiable case studies and client testimonials that show they know how to deliver results here in the UAE and across the GCC.

Key Criteria for Your Checklist

When you're sizing up potential partners, the core principles of due diligence are universal. For a broader perspective on how to choose a trusted professional partner, many of the same rules apply.

To make a confident choice, focus on these essential criteria:

Deep Regional Expertise: Do they genuinely understand the local regulations, market nuances, and key players in Dubai, Abu Dhabi, and the wider region? Or are they just applying a global template?

Specialised Asset Class Knowledge: Have they actually delivered successful projects in your specific sector—be it commercial, residential, retail, or industrial property?

Verifiable Track Record: Ask for concrete examples of projects similar to yours. Can they clearly show where they added significant, measurable value?

Transparent Fee Structure: Is their pricing model clear and fair? It should be directly linked to the value they provide, with absolutely no hidden costs or surprise fees down the line.

Questions to Ask Potential Partners

To really understand who you're dealing with, you need to ask sharp questions that go beyond the surface. This is your chance to test their strategic thinking and see if their team’s culture is a good match for yours.

A great consultant doesn't just answer your questions; they ask better ones. They should challenge your assumptions and bring fresh perspectives to the table from the very first conversation.

Try asking these during your initial meetings:

Based on what you know, how would you approach our specific challenge, and what are the biggest risks you foresee?

Who from your team will be our main point of contact, and what is their direct, hands-on experience?

Can you walk us through a past project where you hit unexpected roadblocks? How did you navigate them?

The demand for high-calibre consulting reflects the region's incredible growth. The broader Middle East and Africa consulting market was estimated at USD 10.75 billion in 2025 and is projected to hit USD 13.30 billion by 2030.

Countries like the UAE are major drivers of this demand, particularly for strategic real estate advice. To understand how the best https://www.cnco.ae/post/real-estate-consulting-companies-your-growth-partner, it all starts with making the right choice.

Got Questions About Real Estate Consultancy? We've Got Answers.

The world of real estate consultancy can feel a bit murky if you're not in it every day. It's natural to have questions, especially when you're trying to figure out if bringing in a strategic advisor is the right move for you.

Let's clear things up and tackle some of the most common questions we hear, giving you the clarity needed to make smart decisions in the UAE's dynamic property market.

What's the Real Difference Between a Consultant and an Agent?

This is easily the most common point of confusion, and it’s a crucial one to understand. While both consultants and agents work with property, their roles, motivations, and how they get paid are fundamentally different. Knowing which one you need starts here.

A real estate agent is a deal-maker. Their job is to get a transaction over the line – a sale, a purchase, or a lease. They're skilled at marketing properties and negotiating terms, and their income is almost always a commission tied to that single transaction. Their focus is on the deal itself.

A consultant, on the other hand, is your strategic partner. Their role is to provide objective, data-backed advice tailored to your long-term goals. You pay them a fee for their expertise, which means their guidance is completely impartial. They're not focused on closing a specific deal, but on ensuring your overall strategy is sound, whether a transaction happens now, later, or not at all.

Here's a simple way to think about it: An agent is the skilled salesperson showing you the best car on the lot today. A consultant is the automotive engineer who analyses your lifestyle, budget, and long-term needs to help you design the perfect vehicle from scratch.

So, When Should I Actually Hire a Consultant?

Knowing the right moment to bring in a consultant is the key to unlocking their true value. You don’t need one for a simple apartment rental, but when the stakes get higher and the decisions more complex, their expertise becomes invaluable.

Think about engaging a consultancy real estate firm for situations like these:

Major Development Projects: Before you even think about breaking ground, you need rock-solid feasibility studies, market analysis, and financial models to make sure the project is viable. This is a consultant's bread and butter.

Entering a New Market: Thinking of expanding into the UAE or wider GCC? A consultant provides the on-the-ground due diligence, regulatory know-how, and local market intelligence you can't get from a distance.

Optimising a Property Portfolio: If you own several assets, a consultant can perform a deep dive on your entire portfolio. They’ll find ways to boost returns, cut costs, and make sure your properties are aligned with your bigger financial picture.

Navigating Complex Deals: For anything tricky – like joint ventures, creative financing, or tangled zoning laws – a consultant provides the strategic oversight needed to manage risk and keep things on track.

Put simply, if a decision involves serious capital and has long-term consequences, a consultant isn't a luxury; they're a core part of your risk management strategy.

How Do I Know If It's a Good Investment?

It's a fair question: how do you measure the ROI on advice? With a real estate consultant, the return comes in two powerful forms: value creation and risk mitigation. Both deliver real, tangible financial benefits that should far outweigh their fees.

Value creation is about their guidance leading to a more profitable outcome. Maybe they identify an undervalued asset everyone else has overlooked, or structure a deal that gives you much better terms. For instance, a consultant might recommend a strategic refurbishment for an old commercial building that leads to a 20% jump in its market value. That’s direct, measurable value.

But honestly, risk mitigation is often where a consultant delivers the most powerful ROI. Their meticulous due diligence can uncover a deal-breaking flaw that saves you from a disastrous investment. By preventing you from sinking millions of dirhams into a project with hidden legal troubles or structural nightmares, they've provided an immediate and massive return by helping you avoid a catastrophic loss.

The real value is in the outcome: making smarter, safer, and ultimately more profitable decisions.

At Credence & Co., we provide the strategic clarity and data-driven insights you need to navigate the complexities of the UAE and GCC real estate markets. Our RICS-qualified experts deliver unbiased, technically robust advice to de-risk your decisions and maximise your returns.

Comments